[ad_1]

EU Sentix Investor Confidence Reveals Much of the Same Despite Improved Figure

-25.2 vs -29.1 (Prior -26.4)

The Sentix Investor Confidence Survey of about 2,800 investors and analysts asks respondents to rate the relative 6-month economic outlook for the Eurozone. The overall figure for Europe appears positive on the face of it but when you dig a bit deeper, major concerns are showing up in the data.

Source: Refinitiv, Sentix

Customize and filter live economic data via our DaliyFX economic calendar

Germany’s overall index at -24.4 is the lowest since May 2020 and the assessment of the current situation at -14.8 is the lowest since Feb 2021, indicating that Europe’s largest economy is headed for recession.

The report cites consumer sentiment as the greatest economic burden at present, as they are more aware of the reduction in purchasing power due to soaring energy costs.

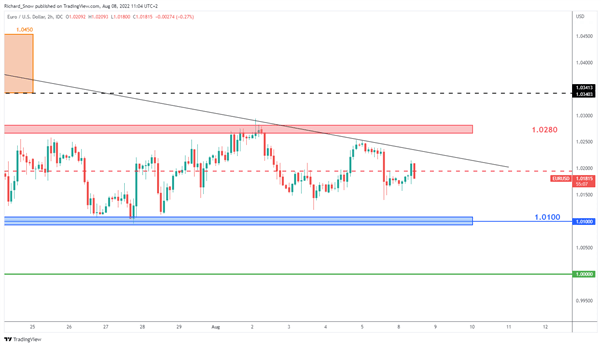

The EUR/USD chart continues to show the pair trading within the developing range, respecting the descending trendline. Recent dollar weakness lifted the euro but a heavily negative backdrop in Europe is unlikely to result in significant follow through. Spillover from Friday’s bumper NFP print could very well extend into Monday’s trading sessions, which may weigh on EUR/USD at the start of the week.

EUR/USD 2-Hour Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.