[ad_1]

Euro, EUR/USD, EUR/GBP & Gas News and Analysis

- Germany announces third relief package to ease energy costs and Q3 off to a rough start after July’s balance of trade data drops

- Russia turns off gas taps in tit-for-tat response to G7 oil price cap

- EUR/USD trades below 99c while EUR/GBP at possible inflection ahead of the announcement of the UK’s new Prime Minister

Germany’s Third Relief Package & Trade Data Starts Q3 on the Backfoot

The German government announced its third relief package in an attempt to soften the blow of increasing energy costs. The list includes once off fiscal support for pensioners and students, extending housing allowances to 2 million recipients, cutting social security contributions and reducing VAT at restaurants and bars among other measures. Critics of the package argue that the €65 billion package represents only 2% of GDP, compared to the fiscal support during the pandemic which equated roughly to 15% of GDP. Other concerns include the absence of price caps on electricity and gas consumption and wider support for businesses.

Unfortunately for the euro, the bad news continues. The Eurozone’s major industrial economy revealed that Q3 has gotten off to a challenging start, as Germany’s trade surplus for the month of July dropped to €5.4 billion from a previously revised €6.2 billion in June. Somewhat predictably, imports and exports involving Russia dropped more than 17% and 15% month-on-month. Trade has typically been a growth driver in Germany – a situation that no longer appears to be the case.

German Trade Balance (up to July 2020) Continues Downward Trajectory to Start Q3

Source: TradingView, prepared by Richard Snow

Oil Price Cap and Indefinite Delay to Nord Stream Resumption

There have been plenty developments since Friday as the G7 nations confirmed a price cap on Russian oil, which looks to have resulted in a tit-for-tat response from Russia. Not long after the price cap was announced, Gazprom identified an oil leak as the reason why flows would not resume. Siemens Energy issued a statement that the oil leak was not a technical reason for stopping operations but flows continue to be placed on hold until the issue is fixed. European gas prices gapped higher, as expected, with the October futures contract up around 25%.

EUR/USD, EUR/GBP Both at Decision Points but for Different Reasons

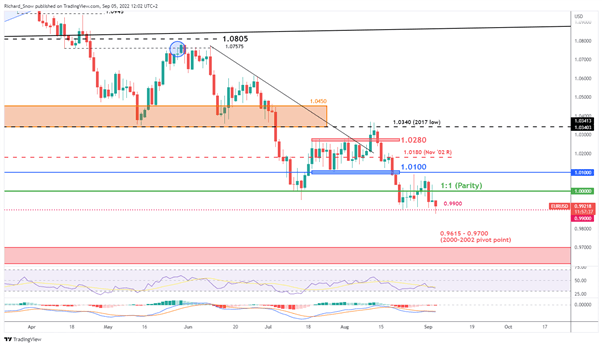

EUR/USD

EUR/USD broke below the 99 cents mark this morning as the US dollar continues to surge past 110. Although, as we approach midday in London, the pair has pulled back somewhat and trades above 0.9900. EUR/USD continues to be suppressed even markets anticipate 70 basis points worth of hiking on Thursday, suggesting a preference for 75bps instead of 50 bps.

From a technical point of view, a break below 0.9900 with momentum would be concerning for EU policymakers as there is little to get in the way of a continued decline towards 0.9700. The pair is likely to react to further Fed hawkishness and worsening electricity and gas pressures across Europe. In addition, the risk of a flare up in periphery bonds hangs on the balance however the ECB is confident they have enough fire power to deal with restrictions to the transmission of monetary policy via existing programs and the newly introduced Transmission Protection Instrument (TPI). Nevertheless, bond market volatility is likely to rise.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

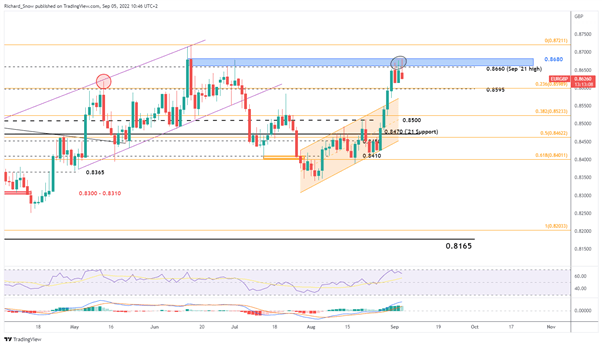

EUR/GBP

EUR/GBP throws up an interesting proposition this week as the UK will announce the new leader of the governing Conservative Party who will ultimately take over as Prime Minister from Boris Johnson. Liz Truss is odds on favorite to be announced and according to a BBC interview over the weekend, promises to reveal a support package within a week – something that could provide the pound with a much-needed boost.

Technically, a cluster of upper wicks around the zone of resistance of 0.8660-0.8680 hints at a potential pullback. Support appears at 0.8595 before the 38.2 Fibonacci retracement (0.8523) comes into focus. A bullish continuation remains possible if the pair breaches 0.8680.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

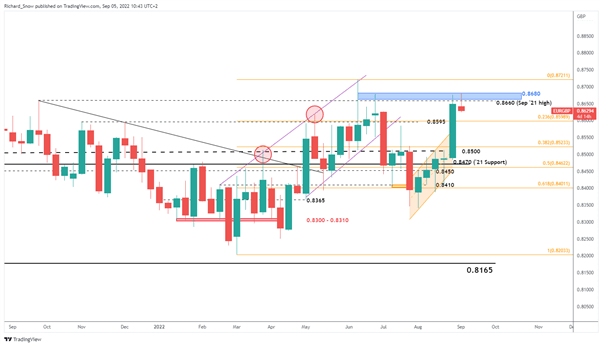

The weekly EUR/GBP chart helps define the major zone of resistance and subsequent support.

EUR/GBP Weekly Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.