[ad_1]

EUR/USD Price, Chart, and Analysis

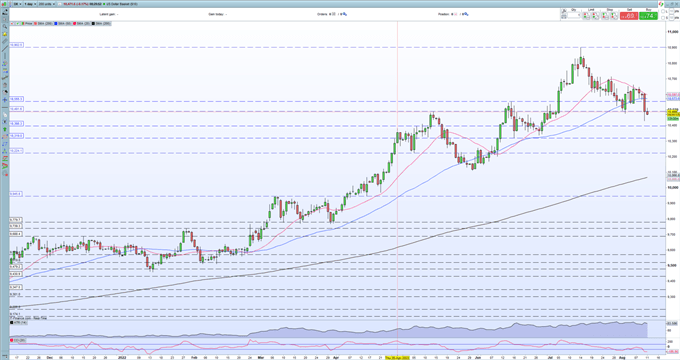

- The US dollar chart is bullish for now.

- US Treasury yields are flat to marginally lower.

The US dollar has lost a bit of its attraction in the last month as Treasury yields continue to slide lower. After touching a multi-year peak of just under 3.50% last month, the US 10-year benchmark now changes hands with a yield of 2.77%, as rates markets price in a slowdown in interest rate hikes. Yesterday’s inflation figure pushed expectations of a 75bp rate hike at the September FOMC meeting below 40% after having been in excess of 70% before the release.

For all market-moving economic releases and events, see the DailyFX Calendar

The US dollar may be down but it is not out and is currently looking for a base. The daily chart shows that the uptrend remains firmly in place with a block of old highs and lows between 104.92 and 103.20 expected to provide support in the event of any further greenback weakness.

US Dollar Daily Price Chart – August 11, 2022

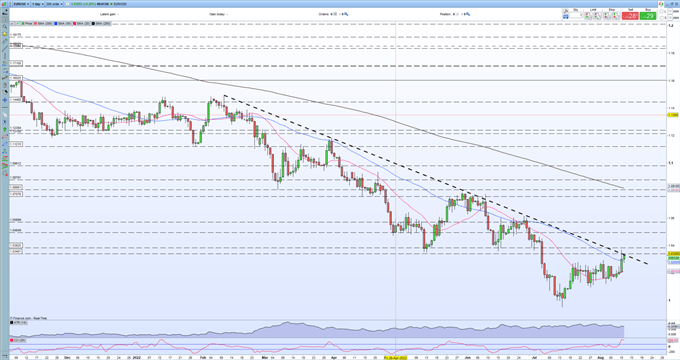

The single currency is pushing higher against the US dollar but there remains no real fundamental reason/s to buy the Euro at present. Inflation is rife, growth is weakening, food prices are soaring, and the energy crisis shows no signs of abating. In addition, water levels in Germany’s Rhine river are running extremely low, making it nearly impossible for barges carrying energy supplies and goods to get to their intended factories.

Euro Latest: German Food Prices Soar Despite Moderate HICP Print, EUR/USD & EUR/GBP

The Euro continues to push higher against the US dollar, after having traded below parity on July 14, and is now closing in on old support turned resistance between 1.0340 and 1.0382. If this level is broken with conviction, then there is little in the way of resistance before 1.0500 comes into play.

EUR/USD Daily Price Chart August 11, 2022

Retail trader data show52.38% of traders are net-long with the ratio of traders long to short at 1.10 to 1. The number of traders net-long is 12.31% lower than yesterday and 20.26% lower from last week, while the number of traders net-short is 6.13% higher than yesterday and 17.89% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.