[ad_1]

EUR/USD Price, Chart, and Analysis

- German retail sales slump – the largest drop in three decades.

- Eurozone manufacturing PMI falls deeper into contraction.

German retail turnover in June was down 1.6% on the previous month and was 8.8% lower compared to June 2021, the largest decline in year-on-year turnover since the series began in 1994, according to the German Federal Statistics Office, Destatis. Also released today, the final S&P Global German Manufacturing PMI confirmed that Europe’s largest economy was in contraction territory for the first time in over two years with sharp falls in new orders weighing on factory production. According to Phil Smith, economics associate director at S&P Global Market Intelligence,

‘The potential for a shortage in gas supplies has German manufacturers seriously worried about the outlook for production in the coming year. Goods producers’ expectations turned negative back in March, and have deteriorated in almost every month since then as downside risks to the sector’s outlook continue to build.’

For all market-moving economic releases and events, see the DailyFX Calendar

The Eurozone economic calendar is fairly light this week leaving the EUR/USD likely to be steered by the US dollar. The greenback has drifted lower since mid-July after the US dollar basket (DXY) printed a 109.02 high. US Treasury yields have fallen over the last couple of weeks as investors look through the current round of sharp US rate hikes and begin to price-in US rate cuts in Q2 2023. US dollar weakness however will be tempered in the short-term by the yield differential against a range of other G7 countries but with other major central banks playing catch-up and hiking rates sharply, this differential will narrow over the coming weeks and months, weakening a range of USD-pairs.

US Dollar Basket (DXY) Daily Price Chart – August 1, 2022

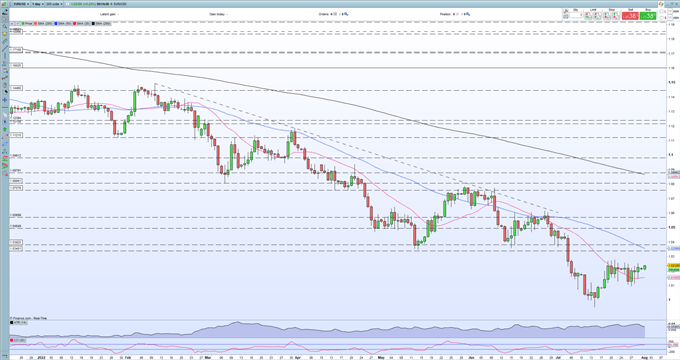

The single currency remains in a longer-term downtrend against the US dollar but is currently trying to form a short-term zone of support. The pair are currently pressing against a cluster of recent highs that go all the way up to the 1.0280 area, and if these are broken convincingly, then a re-test of 1.0340 is likely. Above here, 1.0380 is the next, important, area of resistance. Support is seen between 1.0080 and 1.0100.

EUR/USD Daily Price Chart August 1, 2022

Retail trader data show 58.00% of traders are net-long with the ratio of traders long to short at 1.38 to 1. The number of traders net-long is 1.94% higher than yesterday and 2.84% lower from last week, while the number of traders net-short is 5.43% higher than yesterday and 4.65% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.