[ad_1]

EURUSD, European Central Bank (ECB) – Talking Points

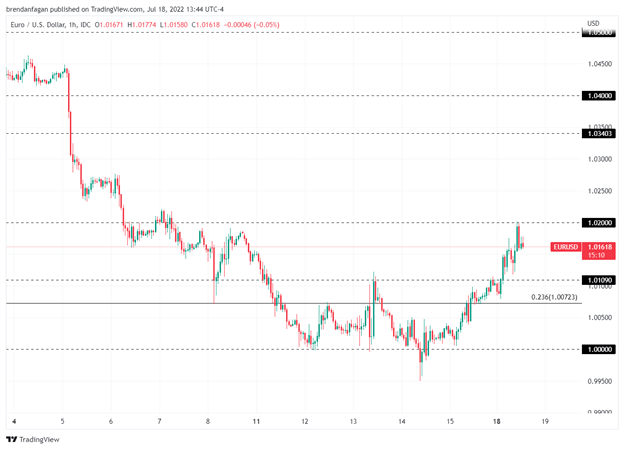

- EURUSD rally stalls short of 1.02 amid USD weakness

- ECB slated for first rate hike in 11 years on Thursday

- EU inflation data set to release Tuesday morning

EURUSD continued to push higher on Monday as traders brace for an action packed week. Having entered the blackout period for the FOMC, catalysts for EURUSD now shift to Europe. This week sees inflation and consumer confidence data come out, as well as the long-awaited July ECB policy meeting. Traders will also need to pay attention to the Nord Stream 1 pipeline this week, with flows set to resume following the completion of maintenance work. Should flows from Russia diminish or even cease, Euro weakness could return in a swift manner.

Tuesday sees June inflation data for the Eurozone drop, with headline expected to come in at 8.6%. Core inflation however, is forecasted to decline from May with a print of 3.7% expected. Declining core inflation would paint a similar picture to that of the United States, where inflation remains driven by soaring energy and food prices. A hot print on Tuesday may do little to deter the ECB from a 25 basis point rate hike, as Christine Lagarde and company balance inflationary pressures with growth concerns.

EU Economic Calendar

Courtesy of the DailyFX Economic Calendar

As mentioned, the ECB is widely expected to raise rates by 25 basis points at the July meeting, the central bank’s first rate hike in 11 years. The camp in Frankfurt appears split, with some members of the ECB’s Governing Council dissenting publicly by calling for more aggressive rate hikes. President Christine Lagarde has remained adamant that the ECB move at a gradual pace, in an effort to minimize the fallout(s) of tighter monetary conditions. Europe has already experienced a blowout of sovereign yields, with a spike in the BTP-Bund spread causing the ECB to meet to create a new “anti-fragmentation” tool. Traders will likely look to this week’s meeting for more information on the new tool coming to the ECB’s war chest.

EURUSD 1 Hour Chart

Chart created with TradingView

Following a significant break below parity last week, EURUSD bulls defended the area well enough to spur a rally into the weekend. Monday saw a continuation of that trend higher, but the rally stalled on the test of 1.02. The pair came under further pressure late in the NY session as headlines pertaining to Apple dented sentiment. EURUSD will be in focus this week with the major event risk that dominates the near-term calendar. While this week’s rate hike may provide a short-term boost for the beaten down Euro, sellers may reengage on any significant as growth concerns hang over the continent.

A mix of short covering and a boost in sentiment following the ECB’s first rate hike in 11 years could see the cross pop through resistance around 1.02. Any disappointment this week (which cannot be ruled out), could bring parity back under the microscope. For now, EURUSD remains driven by widening rate differentials and recessionary concerns.

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.