[ad_1]

Set to release Q3 earnings on November 16, shares of Lowe’s LOW are gaining momentum after fellow home improvement retailer Home Depot HD posted better-than-expected earnings and sales today. Strong third quarter results from Lowe’s would be a good sign that consumer spending is holding up and that costs are finally coming down.

Pro-Growth

Lowe’s and Home Depot’s Building Products-Retail Industry is currently in the top 21% of over 250 Zacks Industries. LOW stock has slightly outperformed the broader market and has beaten its peer Home Depot’s performance as well.

LOW shares have moved with the inflationary concerns of the broader market and with mortgage rates hitting 7% during the third quarter it is significant to see this won’t have a monumental effect on the company’s business. Homeowners are core customers for Lowe’s as a home improvement and hardwood store operator with renters and commercial business customers serviced as well.

Lowe’s has strived to enhance the experience of its professional customers by upgrading pro-focused brands and its pro-service business website. This could certainly play a role in keeping its business strong by attracting professional remodeling and repair customers that service a variety of clients of their own including commercial businesses.

Image Source: Zacks Investment Research

Last quarter, Lowe’s CEO Marvin Ellison attributed double-digit Pro segment growth (for the ninth consecutive quarter) in driving operating margin improvement, along with effectively managing inventory despite lower-than-expected sales.

Pro customer sales were up 13% despite the company’s revenue of $27.46 billion missing expectations by 2%. LOW was still able to beat Q2 EPS expectations by 1% with earnings of $4.67 per share. Investors hope this continues and that Lowe’s was able to beat top-line expectations as well during Q3 as Home Depot did.

Q3 Outlook

The Zacks Consensus Estimate for LOW’s Q3 earnings is $3.11, which would represent a 14% increase from Q3 2021. Earnings estimates for the period have slightly gone up from $3.01 at the beginning of the quarter. Sales for Q3 are expected to be up 1% at $23.10 billion. Lowe’s appears to be effectively managing its operating cost and benefiting from a top business industry.

Year over year, LOW earnings are expected to jump 12% in fiscal 2023 and rise another 6% in FY24 at $14.44 per share. Sales are projected to be up roughly 1% in FY23 and FY24 at $97.71 billion. This is on top of huge growth during the pandemic era as FY24 revenue would represent a 42% increase from 2018 sales of $68.61 billion.

Performance & Valuation

LOW is down -19% YTD, near the S&P 500’s decline. The stock has underperformed its peer group’s -12%, with other notable competitors including Builders FirstSource BLDR outside of Home Depot. HD, in comparison, is down -25% YTD.

Image Source: Zacks Investment Research

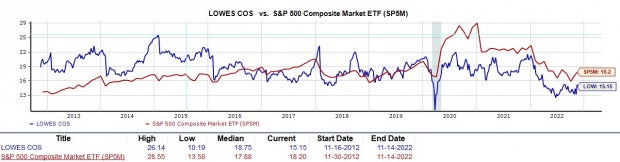

Lowe’s has been the industry leader over the last decade, up an impressive +554% to beat the benchmark and HD’s strong performance. LOW also outperformed its peer group’s +167%. Investors are hoping that this year’s decline in LOW stock will turn out to be a long-term buying opportunity.

Trading around $208 per share, LOW shares currently trade at a 15.1X forward earnings multiple. This is higher than the industry average P/E of 8.1X but Lowe’s has become a leader in its space. And LOW trades well below its decade-high of 26.1X and the median of 18.7X.

Image Source: Zacks Investment Research

Bottom Line

At the moment, Lowe’s lands a Zacks Rank #3 (Hold). The current economic environment is strenuous for most companies but Lowe’s appears to be headed in the right direction with slight sales growth forecasted for FY23 and FY24. The solid growth expected in the company’s bottom line is a great sign for investors as well.

Wall Street will want to see the company’s Q3 earnings and guidance start to reaffirm this optimistic outlook. Patient investors could be rewarded for holding the stock as Lowe’s is in a top industry and offers a solid 2.05% annual dividend yield at $4.20 per share. The Average Zacks Price Target also suggests 17% upside from current levels.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe’s Companies, Inc. (LOW): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.