[ad_1]

CHUNYIP WONG

Published on the Value Lab 3/9/22

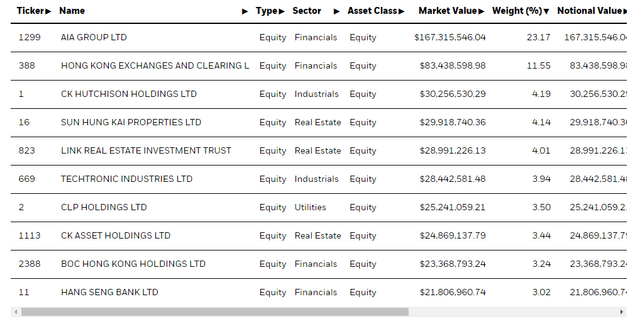

The iShares MSCI Hong Kong ETF (NYSEARCA:EWH) is unsurprisingly a little turbulent. Hong Kong markets are heavily shorted around the uncertainty of China’s growing involvement in their governance and the HK market’s exposure to delisting risks of many dual-listed entities in the US. While some EWH exposures look decent, there are concerns around real estate to which EWH is heavily exposed, which is also a politically sensitive area. Also, its financial exposures have limited catalysts as rates hike. We’d pass on this ETF despite the possibility of an eventual squeeze, especially on delisting outcomes.

EWH Breakdown

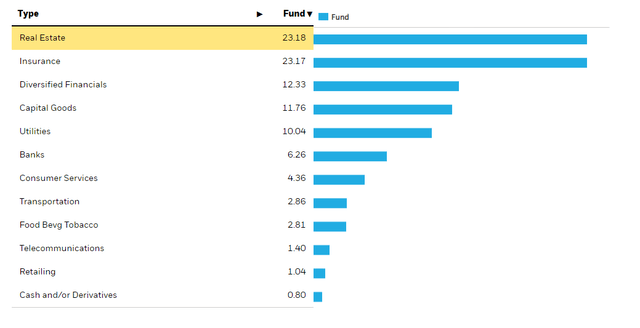

There are some major skews in this ETF.

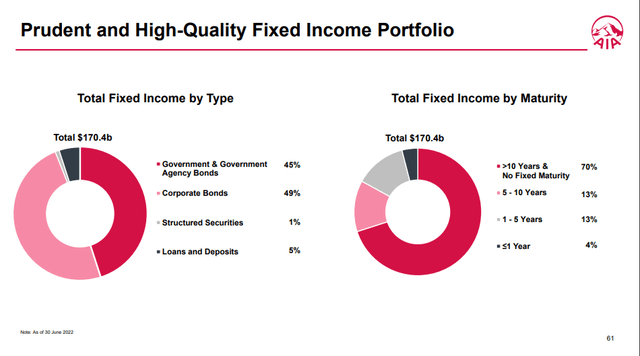

23% of the portfolio is AIA Group (OTCPK:AAGIY) which is a major life and health insurer in HK. While generally an insurance exposure would do well while Hibor, Libor and Fed Rate hikes grow reference rates in HK as well, the fixed income portfolio is very long duration.

Fixed Income Portfolio Duration (iShares.com)

Previously, this would have been great because they had locked in duration at a 4% rate, which would be excellent in our low inflation low rate environment pre-COVID. Now, it eliminates much of the rate upside in their investment operations. Besides that, it is a solid company, but there’s nothing catalyzing this major part of the portfolio, and it gelds an otherwise attractive exposure to insurance.

Besides insurance, there is substantial exposure to real estate. Here the exposures are more fragmented and heterogenous. But there is a risk here too. Development of property in HK depends on land auctions, and as the rich got richer those land auctions had increasingly smaller buying pools to the detriment of property tycoons. Many of these real estate exposures are beneficiaries of this, and the CCP is already signaling clearly that these outsized benefits to the wealthy will have to stop, especially with the HK property market being one of the least affordable in the world. China would want to make this process more competitive to create more housing development and ease shortages. With government clampdown, concerns around the financial institutions like HSBC (HSBC) which is in CCP sights, and COVID-19 restrictions, the outlook on property markets is not good from the demand side either.

Capital goods look more interesting. This exposure is covered by HKEX (OTCPK:HKXCF), which is the Hong Kong exchange. Declines are mainly from strong comps and lessened capital markets activity with recession concerns. But we think that delisting plays into potential activity on the HKEX. If managers want to bottom feed on Chinese equities if they no longer trade on US markets, HKEX should gain share or at least have some backstops. However, it seems some preliminary moves are being made towards agreement between the US and China over auditing of Chinese firms. While HKEX might not get a special mitigant there, it is good for HK markets in general, which do host major Chinese listings for international investors. This news should make you more bullish on HK markets, and apparently by December, it will be more clear whether compliance will be sufficient. Otherwise, HKEX is still exposed to the downside on capital market, especially ECM activity, that would be happening in an increasingly hostile HK market.

Conclusions

Agreements that avoid delisting would be a major upset to short sellers. That could spring markets. But we are still concerned more long-term over the real estate exposures and don’t love the financial exposures. With these exogenous political risks hanging over the market, we still think that trading around a 20% discount from pre-COVID levels is quite fair. With the added fact around the potential clampdown on HSBC which could affect the labor market and the potential increase in hostility in policy towards western actors, the market may become wholly less attractive. We won’t speculate here, not with squeezes either, best to pass at a 15x PE which isn’t even that low.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.