[ad_1]

EUR/USD Price, Chart, and Analysis

- German inflation hits double-figures in September.

- Hawkish ECB speakers eye a 75 basis point hike in October.

Recommended by Nick Cawley

Get Your Free EUR Forecast

German inflation jumped in September to 10%, beating market expectations and last month’s print with ease. Energy costs continue to rise, while the German government’s three months of rail subsidies ran out this month driving transport costs higher.

Earlier today the final Euro Area consumer confidence figures showed economic sentiment weakening further, while the headline consumer confidence reading was confirmed at -28.8, the lowest reading since the series began.

For all market-moving economic releases and events, see the DailyFX Calendar

Hawkish ECB Talk

The latest round of speeches from ECB members now suggests that a 75 basis point rate hike is likely next month, with multiple rate hikes also expected over the next several meetings. ECB vice president Luis de Guindos today reiterated that inflation in the Euro Zone remains very high – and that growth is slowing – and channeling his inner Mario Draghi said the central bank had to do whatever it takes to lower inflation. ECB council member Georg Muller today called for a significant rate hike, while board member Gediminas Simkus said his preference was for a 75 basis point hike at the October meeting.

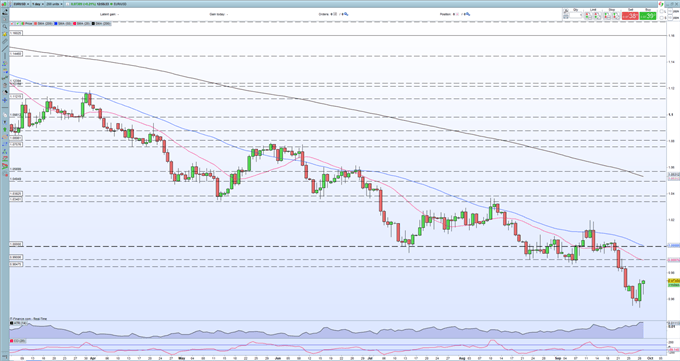

EUR/USD is pressing against yesterday’s high print, buoyed in part by the regional German inflation releases out earlier today. While the single currency may push higher, there remains a cluster of old prints on either side of parity that will likely stall any move higher.

EUR/USD Daily Price Chart September 29, 2022

Retail trader data show 68.85% of traders are net-long with the ratio of traders long to short at 2.21 to 1. The number of traders net-long is 15.83% lower than yesterday and 20.54% lower from last week, while the number of traders net-short is 13.23% higher than yesterday and 12.90% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | -4% | 2% | -2% |

| Weekly | -27% | 52% | -10% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.