[ad_1]

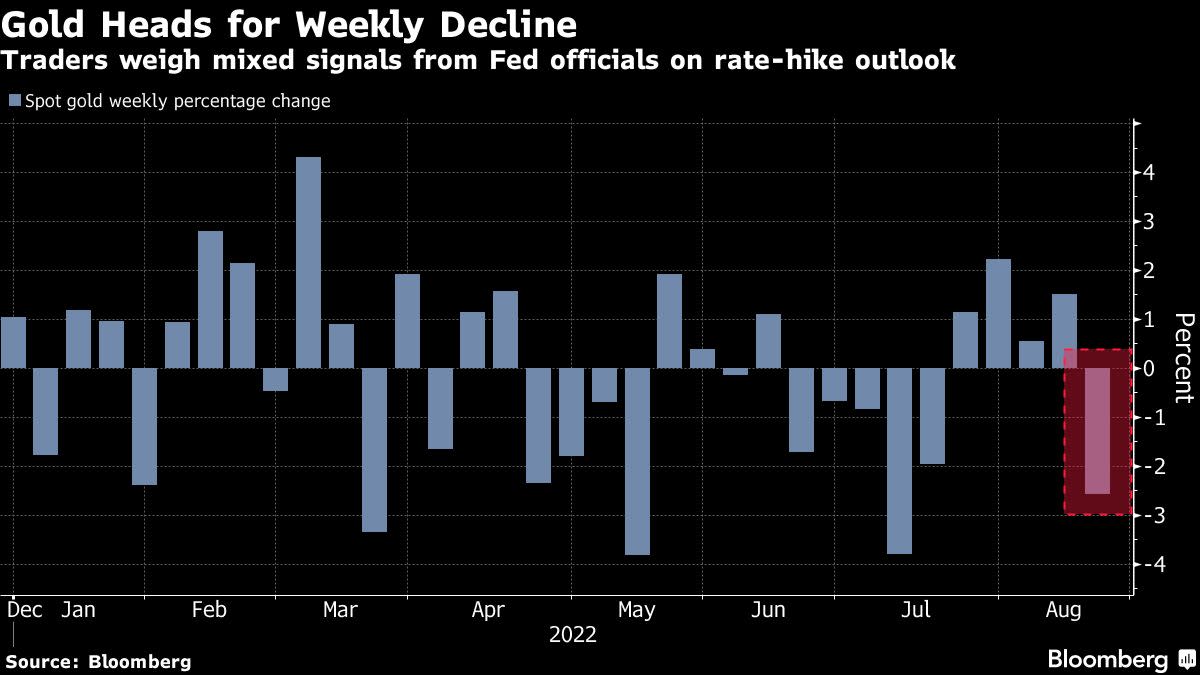

(Bloomberg) — Gold headed for the first weekly decline in five as traders weighed mixed signals from Federal Reserve officials on the size of the next interest-rate increase and the dollar strengthened.

Most Read from Bloomberg

Bullion dropped to a three-week low amid an ongoing discussion on whether the Fed will shift to less aggressive rate hikes. Policy makers offered divergent views, with St. Louis’s James Bullard urging another 75 basis-point move while Kansas City’s Esther George struck a more cautious tone, saying the case for rate rises remains strong but the pace is up for debate.

Higher interest rates typically curb the appeal of non-interest-bearing gold, though bullion has recovered from a near 16-month low in July on bets the Fed will be less aggressive with hikes as the US economy faces headwinds. The minutes from the central bank’s July meeting released Wednesday showed officials agreed on the need to dial back the pace of rate increases at some point.

The resurgence in the dollar has weighed heavily on the precious metal, which was already seeing profit-taking after recently reaching $1,800 an ounce, according to Craig Erlam, a senior market analyst at Oanda Corp.

“It may just be more difficult if the dollar continues to drive higher and yields don’t ease further,” Erlam said in a note.

The latest data pointed to a still-healthy US labor market, with jobless claims falling for the first time in three weeks. This potentially leaves the door open for the Fed to continue hiking aggressively, although fresh monthly readings on inflation and employment before the September meeting could influence the decision.

“The prospect of further tightening of monetary policy and a firmer US dollar until at least the end of the year continues to weigh on the gold price trend,” Commerzbank AG analysts said in a note. “The Fed’s conference in Jackson Hole at the end of next week could send out new signals in this respect.”

Spot gold fell 0.4% to $1,752.08 an ounce by 1:04 p.m. in London. Prices are down 2.8% this week. The Bloomberg Dollar Spot Index jumped 0.6%. Silver, platinum and palladium all declined.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Image and article originally from finance.yahoo.com. Read the original article here.