[ad_1]

Gold, XAU/USD, Fed, GDP, PCE, Technical Analysis, IG Client Sentiment – Briefing:

- Gold prices soared as US GDP drop boosts Fed pivot bets

- Softer PCE data Friday could compound XAU/USD’s rise

- Retail trader positioning data is also offering a bullish bias

Gold prices soared on Thursday, extending a recovery in the yellow metal since last week. So far, this week is shaping up to be a positive one, perhaps opening the door to the best 5-day period since the middle of May. So, why did gold rally overnight?

The United States economy unexpectedly contracted 0.9% in the second quarter after shrinking 1.6% in the first. Two consecutive months of GDP shrinking does not bode well for recession fears and the markets continued focusing on a pivot from the Federal Reserve.

Front-end Treasury yields weakened, signaling fading hawkish expectations. Next year, the markets are already pricing in rate cuts. Thursday’s GDP print further amplified bets of a dovish Fed pivot, weakening the US Dollar. This allowed gold to capitalize handsomely.

Heading into the weekend, all eyes are on PCE data, which is the Fed’s preferred inflation gauge. The core reading is seen holding at 4.7% y/y. A softer print could underscore fading inflation bets, further underlying dovish market expectations. That may hurt the Greenback, and thus boost gold prices.

That said, the labor market arguably remains tight. Down the road, this could be a problem for the Fed, which would face a tradeoff between trying to tame inflation or boost growth. Such uncertainty could bring volatility back into financial markets.

Gold Technical Analysis

On the daily chart, gold shot past the 20-day Simple Moving Average (SMA), exposing the falling trendline from March. That has opened the door to near-term gains. Still, the trendline may hold as resistance, reinstating the downside focus. Such an outcome would likely place the focus on the July low at 1681.

XAU/USD Daily Chart

Chart Created Using TradingView

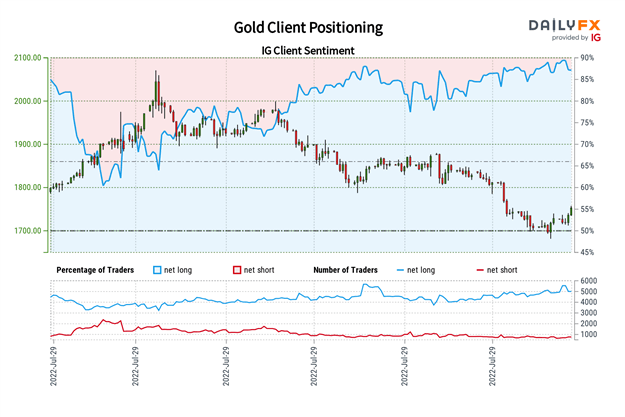

Gold Sentiment Outlook – Bullish

The IG Client Sentiment (IGCS) gauge shows that roughly 85% of retail traders are net-long gold. Since IGCS tends to function as a contrarian indicator, and most traders are still bullish, this hints prices may continue falling. But, short exposure has increased by 17.20% and 14.50% compared to yesterday and last week respectively. With that in mind, the data is offering a bullish-contrarian trading bias.

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.