[ad_1]

POUND STERLING TALKING POINTS

- Goldman forecasts Q4 recession for UK.

- Increase in GBP/USD downside risk.

GBP/USD FUNDAMENTAL BACKDROP

Pound sterling extended its fall this Monday after last week’s hawkish Fed Chair Powell speech at the Jackson Hole Economic Symposium. Although this outcome was largely expected by markets, confirmation turned out to highlight the disparities between the UK and U.S. economies respectively. The decline in UK economic data was relayed by Goldman Sachs this morning, echoing the sentiment of the Bank of England (BoE) a few weeks ago that a UK recession in the fourth quarter is expected – a marked revision from their previous outlook.

This being said, money markets remain ardent on a 50bps interest rate hike in the September meeting (see table below) but with the fundamental UK backdrop deteriorating as energy prices weigh on the consumer, I am not sure how much further these hikes will go considering winter is around the corner. It may be prudent to adopt a ‘wait and see’ approach during these winter months for a proper evaluation.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

On the political side, Foreign Secretary Liz Truss has put forward the possibility of a 5% cut on VAT to ease the strain on the UK consumer as well as a reduction in the fuel duty. Regardless, the UK faces tough times ahead and should translate through to the pound keeping a lid on significant GBP price appreciation against the U.S. dollar.

GBP/USD ECONOMIC CALENDAR

The economic calendar is extremely light this Monday with the Fed’s Brainard occupying the sole GBP/USD event later this evening. Brainard a known hawk may well reiterate the comments shared by Mr. Powell on Friday thus adding to downside potential for cable.

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

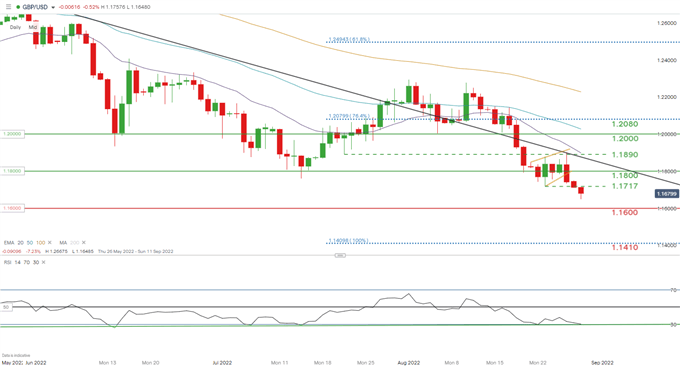

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The psychological 1.1800 resistance zone now seems a long way away after breaking below the rising wedge type formation (yellow). The Relative Strength Index (RSI) suggests possible bullish divergence – slowing bearish momentum on RSI coupled with falling GBP/USD price action. Traditionally, bullish divergence points to impending upside/reversal in the asset but with such a bleak fundamental outlook for the UK it may be ill-advised to look for a reversal at this point.

Key resistance levels:

Key support levels:

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 82% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.