[ad_1]

Rampant inflation is really hurting American households (even Fed Chair Powell admitted as much yesterday), but because of inflation, The Fed’s counter-punch has resulted in 1) declining equity prices, declining bond prices and increase mortgage rates. In fact, over the past 12 months, the 2-year US Treasury yield is up over 15 times (0.262% to 4.226%), Bankrate’s 30-year mortgage survey rate up 116.2%.

The S&P 500 index has been generally falling as The Fed tightens their monetary policy.

Another day, another bad day on Wall Street. The NASDAQ is down 2%.

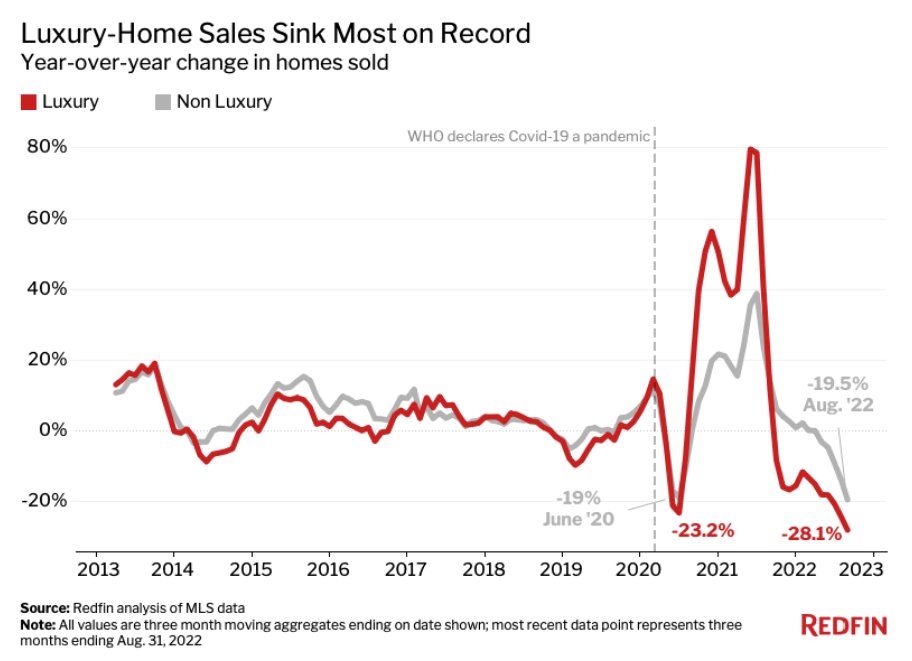

And here is a chart from Redfin. Luxury home sales sink most on record.

[ad_2]

Image and article originally from confoundedinterest.net. Read the original article here.