[ad_1]

porcorex

High dividend ETFs are a good way to help fight against inflation. However, I’m not a fan of leveraged ETFs that promise higher yields in exchanged for far higher risk. That’s why it’s a better idea for investors to stick with bread and butter ETFs that provide broad diversification across durable names in different segments.

This brings me to the iShares Core High Dividend ETF (NYSEARCA:HDV), which appears to be one such name. In this article, I highlight HDV a potential buy for long-term investors who prize income and growth, so let’s get started.

Why HDV?

As the name suggests, HDV is an ETF that seeks to track the investment results of the Morningstar Dividend Yield Focus Index, and is comprised of relatively high dividend paying U.S. equities. The fund generally invests 80% of its assets in the component securities of this index and in other securities that have similar economic characteristics of the index.

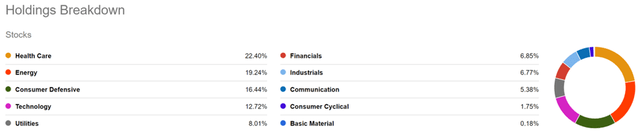

Unlike the S&P 500 (SPY), which is heavily tilted towards non-dividend paying technology stocks, HDV is tilted towards those sectors that are relatively more mature that do pay a dividend. As shown below, healthcare, energy, and consumer defensive comprise HDV’s top 3 segments, representing 58% of the portfolio value.

HDV Portfolio Mix (Seeking Alpha)

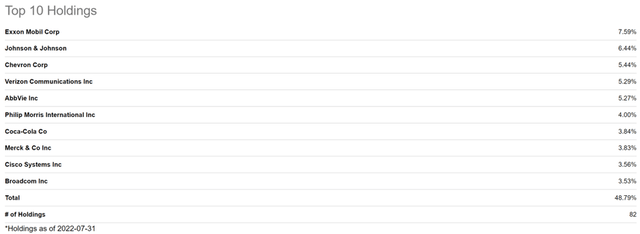

Moreover, it’s not as if HDV has little exposure to technology, as there are some mature and still growing tech companies that do pay a solid dividend yield. This includes companies like Cisco Systems (CSCO) and Broadcom (AVGO) that make up the #9 and #10 holdings of HDV, respectively.

As shown below, the other top names of HDV include well-recognized oil majors Exxon Mobil (XOM), Chevron (CVX), telecom giant Verizon (VZ), healthcare giants Johnson & Johnson (JNJ), AbbVie (ABBV) and Merck (MRK) and the consumer staples Philip Morris Int’l (PM) and Coca-Cola (KO).

HDV Top Holdings (Seeking Alpha)

Risks to HDV include its heavy weighting towards energy, with oil majors currently enjoying a bull run due to higher oil prices. This outsized exposure could be a double-edged sword should energy prices come crashing down. Moreover, drug-pricing reform could negatively impact healthcare companies. However, the specialty drugs of the large pharmaceutical companies provides a level of insulation from price controls.

HDV’s heavy focus on mature companies also means that it misses out on outsized gains of tech companies that don’t pay a dividend, like Amazon (AMZN) and Google (GOOG). As shown below, HDV’s total return of 149% over the past 10 years trails the 264% return of the S&P 500 (SPY).

HDV Total Return (Seeking Alpha)

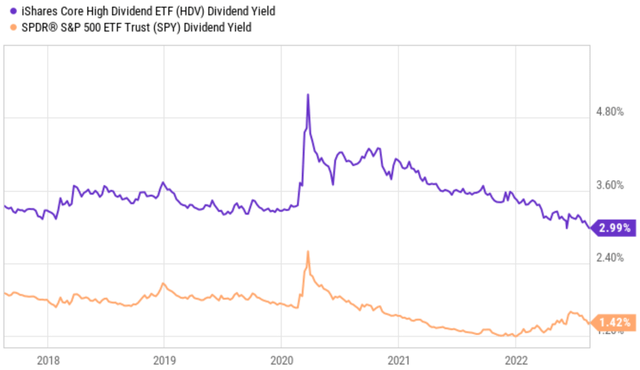

However, income is the primary objective of investors who buy HDV, and is dividend yield excels at beating that of the overall index. As shown below, HDV’s 3% dividend yield gives it a comfortable spread compared to the 1.4% yield of the S&P 500.

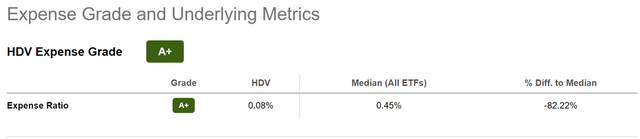

Moreover, investors don’t have to worry about expenses eating into their gains. As shown below, iShares charges a low 0.08% expense ratio, which sits well below the 0.45% median for all ETFs, helping HDV to score an A+ expense grade.

HDV Expense Grade (Seeking Alpha)

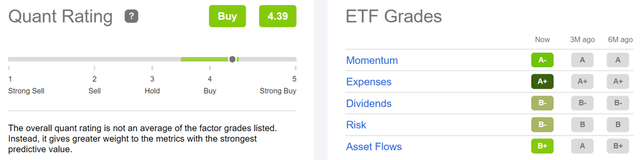

Lastly, HDV scores a Buy rating from Seeking Alpha’s Quant system. As shown below, HDV scores A and B grades for momentum, expenses, dividends, risk, and asset flows.

HDV Quant Rating (Seeking Alpha)

Investor Takeaway

HDV is a high dividend ETF that provides an attractive yield while diversifying across different sectors. This makes it a potential buy for long-term investors who are looking for both income and growth. However, investors should be aware of the risks associated with energy and healthcare stocks before making a decision.

Nonetheless, I find HDV’s holdings to be appealing, as it holds a number of stocks that I would recommend for a safe dividend portfolio anyways, and while giving investors the benefit of automatic diversification. As such, I find HDV to be a buy for long-term income investors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.