[ad_1]

AT A GLANCE

- Over the past several decades, the gold-silver ratio has ranged widely

- Although gold and silver are both classified as precious metals, investors often treat silver as a hybrid precious-industrial metal

Gold and silver prices tend to move together, but what causes them to move relative to one another?

Over the past half century, gold and silver prices have shown a strong positive correlation. This has been especially true during the past 20 years when the correlation between the prices of the two metals has been consistently higher than positive 0.7.

While gold and silver have a strong positive correlation, the ratio of the prices has ranged widely – from one ounce of gold buying as few as 30 ounces of silver in 2011 to as many as 120 ounces of silver in 2020.

Scan the above QR code for more expert analysis of market events and trends driving opportunities today!

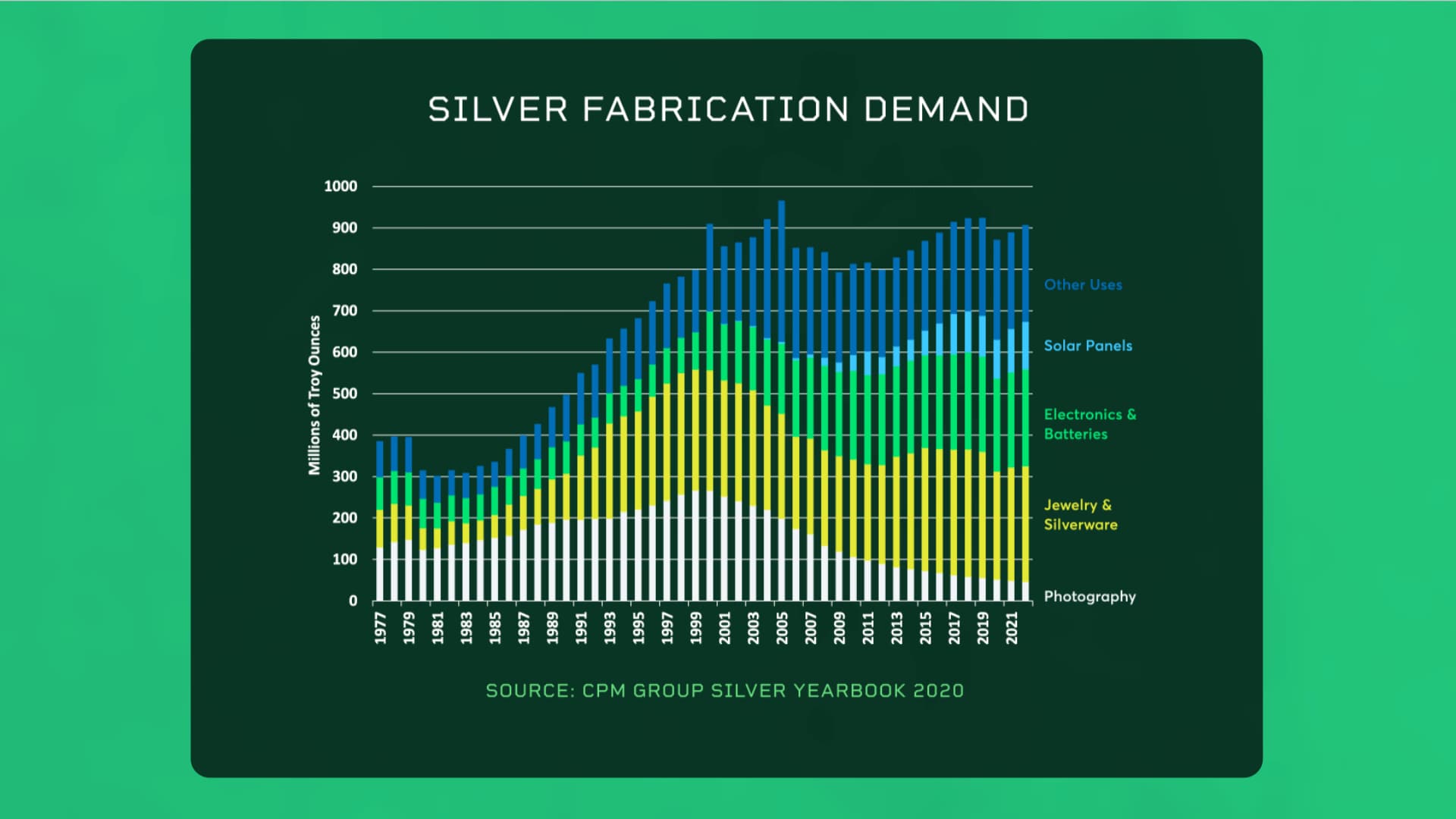

What explains the large relative moves in the prices of the two metals? In part, silver tends to outperform during periods of strong expansion, like during the 1990s, whereas gold tends to do better during downturns. The reason can be found in their end uses. Gold is mostly used as an investment and in jewelry. Silver, meanwhile, has a wider range of uses, although one of its biggest uses has just about disappeared. Before the advent of digital cameras, more than 250 million ounces of silver were used per year to develop photographs. However, the rise of digital cameras has reduced this source of silver demand by over 80%, tarnishing silver’s value relative to gold.

The good news for silver is that it is finding new uses in the energy transition. Silver usage in batteries and electronics nearly doubled in 1999, and silver has also found a new use in solar panels. Together, batteries and solar panels have now nearly replaced the lost demand for silver stemming from photography, and that might put silver on a better foot going forward.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.