[ad_1]

When BofA’s top Rates strategist, and former NY Fed analyst, Marc Cabana speaks, investors, the Fed – and even his former Fed co-worker and repo guru, Zoltan Pozsar – listen. And what Cabana has to say now is extremely important.

On Thursday morning, roughly around the time BofA’s chief equity strategist Ssavita Subramanian slashed her S&P year-end price target by a whopping 25% from 4,500 to 3,600, Cabana’s rates team published a must read note (which is also available to pro subs in the usual place), in which he wrote that the bank’s rates team “is making substantial downward revisions to our rate forecasts following our US economics team’s new call for a mild 2022 recession and lower Fed funds rate path.”

What revisions?

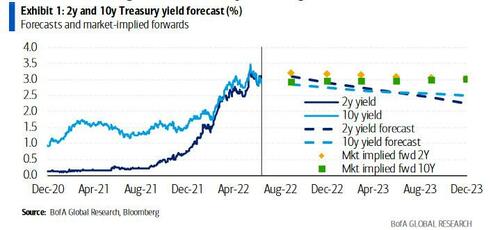

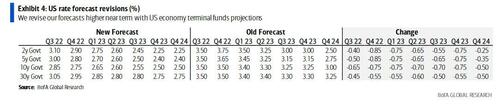

Well, as of today, in addition to sharply lowering its stock targets, BofA is also slashing its 10y Treasury end ’22 forecast from 3.50% to 2.75% and end ’23 forecast from 3.25% to 2.50%. The cuts come as BofA’s economics team yesterday also slashed its forecast to reflect a US recession in 2022 and materially lowered the Fed funds rate path with the terminal Fed funds rate lowered from 4.00-4.25% to 3.25-3.50%, as the BofA economics team now expects 100bp of Fed rate cuts between Sep ’23 and Jun ’24.

Needless to say, the new forecasts are “very bullish” vs the forwards given the market’s expectation for Fed rate cuts in 2H23 and 1H24.

Some more details from Cabana:

The lower Fed rate path and rate cuts in ’23-’24 are the most relevant aspects of our US economics team changes for the US rate path. We are lowering our 10yT end ’22 forecast from 3.50% to 2.75% and end ’23 forecast from 3.25% to 2.50%. Our new forecasts are very bullish vs the forwards given the expectation for Fed rate cuts in 2H23 and 1H24 (Exhibit 4). Our prior rate forecasts initially reflected a bullish rate bias vs the forwards but these revisions make us more constructive vs the current market.

All of the above is not really Cabana’s insight as he had no choice but to cut his rates forecast in a recession, which of course is not his call, and when the continued selloff in stocks will push investors into bonds.

What was, however, unique in Cabana’s take is that the former Fed staffer, whose monetary forecasts always pan out correctly (he correctly predicted that the Fed would purchase corporate bonds just days before the Fed did just that), is that in his new base case for Fed cuts in 2H23 is expected to occur with an end to QT. To wit:

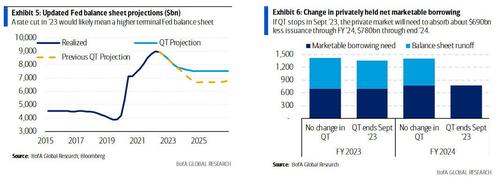

We expect the Fed will stop QT with rate cuts due to the contradictory signal it sends on monetary policy and to simplify policy communications; the Fed will likely not want to be easing with rate cuts but tightening with QT.

Cabana reminds us that the Fed has established a playbook for such an action in 2019 when the Fed cut started cutting rates in July ’19 and simultaneously announced a cessation of QT. Back then, the “QT cessation resulted in the Fed shifting MBS reinvestments up to the monthly redemption cap into USTs purchased in the secondary market.”

To be sure, it is possible that the Fed will choose not to follow the ’19 cut and QT end playbook, but that is unlikely according to Cabana, who just in case adds a few potential arguments for not ending QT with a 2H23 rate cut:

- the Fed will only be “normalizing” front-end rates after a period of elevated inflation,

- the Fed balance sheet will likely still be far from reserve scarcity. We see the logic of each argument but believe it will be difficult to prove ex-ante. We also expect the Fed to opt for the simplest communication: stop QT when cutting rates.

Cabana then notes that an earlier QT end would have several UST implications:

- reduced front-end UST cheapening pressure with more cash / less collateral in financial system,

- potentially more UST coupon cuts due to lower financing needs, and

- fewer secondary market UST dislocations due to a re-start of Fed purchases from MBS => UST reinvestment.

Each of these would tend to bias UST-SOFR spreads wider across the curve.

As for what happens to the Fed’s balance sheet, Cabana predicts that “Fed QT that is stopped in Sept ’23 will result in $1tn less balance sheet reduction vs our prior estimates through end ’24. Over a similar period, early QT end would result in $780b less UST financing need + $350b of additional Fed UST demand (from Fed MBS paydowns reinvested into USTs).”

Such a large UST financing shock would result in less bill supply and eventual additional coupon cuts. The risk of early Fed QT end may also encourage the UST to continue with its current slate of coupon reductions and even larger 20yT cuts.

Finally, while Cabana will not say it just yet, we will: or rather, we will repeat what we have been saying for a long time: after all, we called a premature end to QT several months ago. As for what happens after QT ends, well… there’s a playbook for that too, as we discussed yesterday.

ding ding ding: One Full Rate Cut priced in For Q1.

Time to start pricing in QE pic.twitter.com/xYAfd9Ngm6

— zerohedge (@zerohedge) July 13, 2022

Expect the market to take a few days (or weeks) to digest the full implications of this critical Fed pivot, but once markets realize that Cabana is once again right, high beta risk assets, currency debasement hedges like gold and bitcoin, and of course commodities will soar limit up as there will be no U-turn from this particular final Fed capitulation.

Much more in the full must read note from Cabana, available only to professional subscribers.

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.