[ad_1]

jetcityimage

At the Cato Institute’s Monetary Policy conference this month we got yet another signal of what’s to come at the next Fed meeting. Rates will continue to hike strongly, likely another 75 bps. Whether equity markets are aware of this with its latest rise is unclear, as they’ve gotten carried away on multiple occasions in these last several months of rate hikes. In any case, duration continues to be your enemy, so we identify another ETF, the BlackRock Ultra Short-Term Bond ETF (BATS:ICSH), to use as an intermediate sink of funds while you await another reversal in equity markets, or keep looking for that next high conviction idea that can withstand the current swirl of market forces. It offers reference rates at minute fees, and stands in a market with certain liquidity.

Key ICSH Characteristics

The durations really are short. They average on being 0.4 years long in effective maturity thanks to a large representation of commercial papers in the mix, and the YTMs match almost exactly with the reference rates at around 3.26%. The fees are low on the ETF at around 0.08%, that don’t eat away at the yield.

The issuers are actually all corporations. Credit quality is decent, but not fantastic, mostly rated about A. Indeed, this is consistent with the yield curve shape. A 3.26% YTM incorporates some credit risk premium, as it shouldn’t normally be the same rate as 10-Y treasuries which carry more duration risk in a rate-volatile environment. All of the corporations are US and all denominations are in USD, so there are no FX risks to speak of, and it’s debatable whether there should be much of a credit risk premium as a lot of the issuers are financial companies, with 20% of the ETF being financial commercial papers.

Most importantly, the liquidity of the ETF is ample.

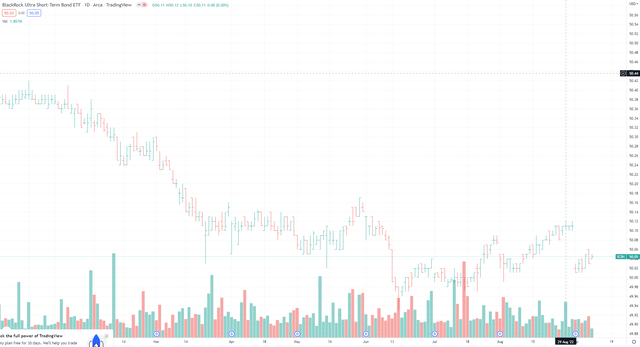

Price and Liquidity ICSH (Tradingview.com)

Millions of units of the ETF trade daily, so the market value of exchange is well into the tens of millions of USD. Functionally the ICSH can act as a money market exposure for your portfolio, and is a great way for conservative investors to respond to the current rate environment. Core inflation continues to lie at relevant numbers as of last month. The headline figure has declined, but high long-term core inflation rates still pose a problem, as inflation will propagate through the economy by the wage-price mechanism. To be properly tackled demand and employment must cool. Indeed, Powell’s comments are consistent with the employment reports as well. Unemployment rises but only due to greater participation in the workforce. Jobs continue to be created.

Conclusions

Investors need to react to duration risk, especially as more money enters fixed income ETFs as a catalyst for re-rating. Consider that preferred shares are also duration exposed, and might be part of your typical income portfolio. Duration enhances your portfolio’s sensitivity to rate hikes, and rate hikes will continue until inflation is fully squashed. There is a reason why in Europe it is the ONLY mandate of the ECB, it propagates and is dangerous, and the fact that the economy somehow still looks healthy in the US despite the current rate hikes just means the Fed has all the more latitude to raise rates without risking contagion, or sudden jolts to income. One of the reasons conditions support more rate hikes before economic hurt than normal is to do with the housing market which is pretty equity-rich right now. Certainly, the years of revised regulation following the financial crisis are partially responsible for that. Reference rates could still double from here before inflation is taken care of. Duration is your enemy, and ICSH has no duration exposure. A good intermediate sink for funds in the current environment.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.