[ad_1]

jetcityimage

The iShares Long-Term Corporate Bond ETF (NYSEARCA:IGLB) has traded down meaningfully and deservedly so. While buying bond ETFs makes a lot of sense, especially as it is expensive to buy bonds directly from the broker-dealer networks that trade them, you have to be careful about what you’re doing. Yes, there is a constant cash flow and that can be appealing, but duration matters a lot for capital appreciation and the intensity of erosion of economic return from a coupon. IGLB has really high duration bonds. While credit risk is not a factor, and YTMs are quite nice, we just don’t see the reason to invest now with more rate hikes coming in and the economic environment being so uncertain.

IGLB Breakdown

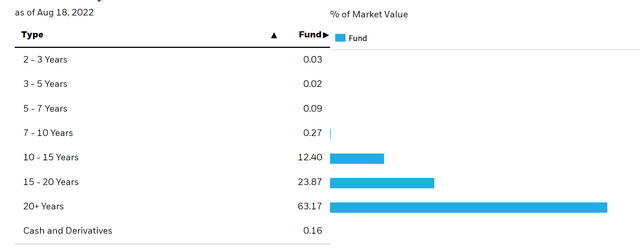

The IGLB certainly earns its name because durations are really long.

Looking at the detailed holdings data, the weighted average duration of the portfolio is 13.4 years. Indicatively that means that for every 1% increase in rates, the price should decline by 13.4%. Again, this is indicative, but it shows the potential sensitivity.

Credit qualities are technically rather good, certainly investment grade, but in our opinion as equity investors, the stocks that have issued debt that this ETF holds are all extraordinarily safe. The riskiest might be AT&T (T) but even they we would consider very robust. Other issuers include Apple (AAPL), other telco companies, well capitalised financial institutions, and Oracle (ORCL) and Microsoft (MSFT).

Conclusions

Currently, the weighted average YTM on the bonds is almost 5%. That might feel appealing, but unlike the dividend on a well selected equity, this will not grow. The average price is 94, meaning they are on average trading below par and coupons are becoming increasingly dwarfed. Due to the high duration, if rates continue to rise, which is likely given that unemployment remains extraordinarily low and core inflation remains high, further price declines are likely, and a weak spread between the coupons between 4 and 5% and the reference rate, rapidly approaching 3%, demonstrates the anti-economy in the investment. Higher rates are potentially the new normal with capacity crimps and supply chain problems likely to partially persist due to growing economic disintegration. So it is both a long-term and immediate concern with higher rates also likely to add to the already substantial 20% YTD decline.

If investors want to consider bonds as a means of parking money during the current uncertainty, low maturity corporate bonds might be the way to assure some income, while also having coherence between the potential horizon of a downturn and the maturity of the bond portfolio. A duration of maximum 2 years, which would represent a bear market on the longer side, makes sense, given the uncertainty around the current economic environment, including latent declines in corporate spending reflecting already observable declines in consumer spending.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.