By Graham Summers, MBA

Stocks soared higher on Friday because a Fed official suggested they might not have to tighten rates as rapidly as before.

Yes, you read that correctly… the Fed will still have to tighten (and tighten a lot), but it might not need to do so as rapidly…

And this ignited a massive rally!

Let’s cut through the BS here.

The Fed is arguably one of the worst forecasters in the world. All throughout 2021, Fed officials repeatedly told us that inflation was either non-existent or “transitory.”

How’d that work out?

Inflation is at 40+ year highs. Americans have never spent more of their paychecks on gas and food. And if not for various gimmicks with the inflation numbers, the official inflation metric would be in the double digits.

And we’re supposed to believe that somehow the Fed is now able to correctly assess this situation?

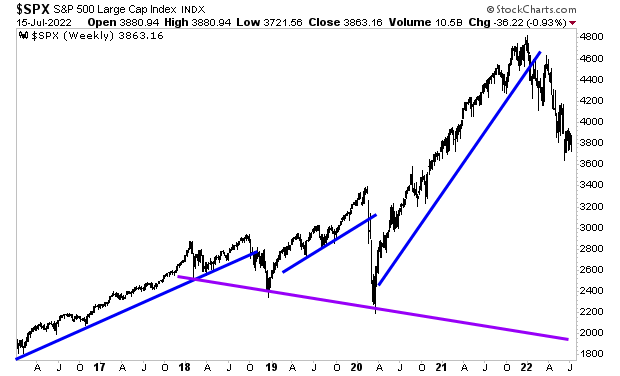

The below chart tells you all you need to know. And you don’t need to suffer through some Fed official’s nonsense to get a clear picture of what’s coming.

The market is where you get the best information… not some Fed official whose job is verbally intervene whenever stocks are close to breaking down. Ignore the Fed, and focus on the market and you’ll come out of this mess intact.

For more detailed information on how to prepare and profit from this mess, you should check out our Stock Market Crash Survival Guide.

Within its 21

pages we outline which investments will perform best during a market meltdown

as well as how to take out “Crash

insurance” on your portfolio (these

instruments returned TRIPLE digit gains during 2008).

To pick up

your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html