[ad_1]

The Zacks Computer and Technology sector has tumbled in 2022 amid a hawkish pivot from the Federal Reserve, down more than 30% and widely lagging behind the S&P 500.

A widely-recognized name in the realm, Intuit INTU, is on deck to unveil Q1 earnings on November 29th, after the market close.

Intuit is a business and financial software company that develops and sells financial, accounting, and tax preparation software and related services for small businesses, consumers, and accounting professionals globally.

Currently, the company carries a Zacks Rank #4 (Sell) paired with an overall VGM Score of a C.

How does everything else stack up heading into the release? Let’s take a deeper dive and find out.

Share Performance & Valuation

INTU shares have sailed through rough waters in 2022, down nearly 40% and underperforming the S&P 500 by a wide margin.

Image Source: Zacks Investment Research

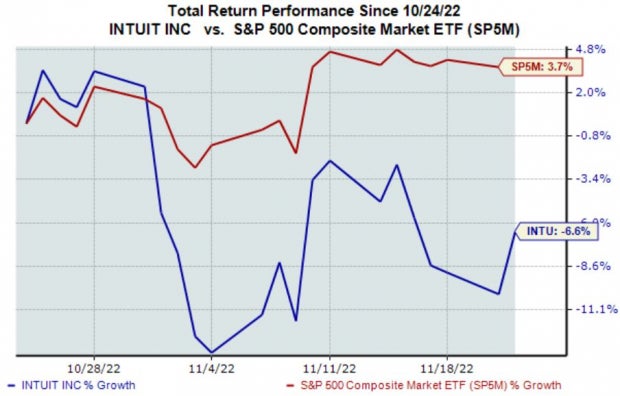

Over the last month, INTU shares have continued to lag behind the general market, losing 6.6% in value vs. the S&P 500’s roughly 4% gain.

Image Source: Zacks Investment Research

The company’s forward earnings multiple currently sits at 41.3X, above its 46.9X five-year median and reflecting an 86% premium relative to its Zacks Computer and Technology sector average.

The company sports a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has upped their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $1.17 indicating a 23.5% Y/Y decrease in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line is in better health; the Zacks Consensus Sales Estimate of $2.5 billion suggests an improvement of more than 20% from year-ago quarterly sales of $2 billion.

Quarterly Performance

INTU has consistently exceeded quarterly estimates, penciling in nine EPS beats across its last ten releases. In its latest print, the company registered a 12.2% bottom-line beat.

Top-line results have been even more robust; INTU has exceeded the Zacks Consensus Sales Estimate in 22 consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

INTU shares have sailed through rough waters in 2022, underperforming the general market across several timeframes.

Shares currently trade at a 41.3X forward earnings multiple, undoubtedly on the higher end of the spectrum and above its five-year median value.

One analyst has upped their earnings outlook for the quarter, with estimates suggesting a Y/Y decrease in earnings but an uptick in revenue.

The company has been the definition of consistency within its quarterly results, exceeding estimates regularly.

Heading into the release, Intuit INTU carries a Zacks Rank #4 (Sell) paired with an Earnings ESP Score of 3.2%.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuit Inc. (INTU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.