[ad_1]

piranka

Investment Thesis

In my last article on the Invesco NASDAQ Internet ETF (NASDAQ:PNQI), I pointed out some of the risks associated with investing in high-multiple stocks at a moment in the cycle when monetary policy turns restrictive. As a result of my previous analysis, I expressed some concerns about the duration of the previous rally and indicated that we were still far from the bottom. It turns out that monetary policy is now more restrictive compared to June 2022 and the Fed has clearly dismissed any pivot scenarios in the near future. Since the Fed’s goal is to remove liquidity from markets, I believe it will be difficult for PNQI to hit a new all-time high in the near future, unless there is a sudden dovish change in monetary policy. Until then, I find the risk-reward profile of this investment unappealing, and I believe the odds of retaking the June lows are very high.

What Has Happened Since My Last Article

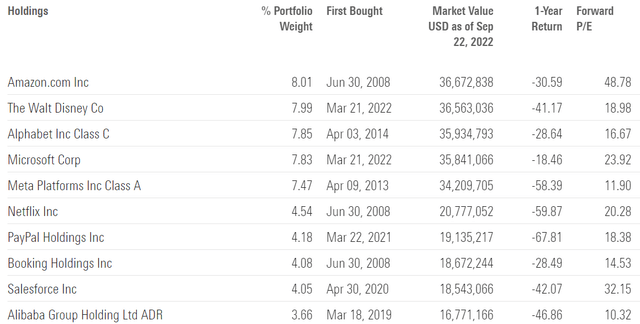

PNQI provides exposure to companies engaged in Internet-related businesses that are listed in the US. You will find below a recent breakdown of the top 10 holdings.

I concluded my previous article with the following statement:

PNQI is now much cheaper than it was a few months ago, and many investors have bought the recent dips in the hopes of getting a good deal. Personally, I believe we are now in a bear market rally and the bottom in tech/internet stocks has yet to be reached. As liquidity dries up, a weakening economy combined with a large number of unprofitable tech stocks facing refinancing risk will be a drag on the sector in the coming months, even for the best players out there.

The subsequent price action turned out to be a bull trap since we are now heading back to the June 2022 lows on both the SPDR S&P 500 Trust ETF (SPY) and the Invesco QQQ ETF (QQQ). On top of that, the odds of overtaking the previous bottom are increasing every day as the macro outlook continues to deteriorate. PNQI performed worse than the market once again during the downturn, highlighting the strategy’s excess drawdown. All in all, PNQI returned -13.8% since my previous article vs -10.91% and -10.34% for QQQ and SPY, respectively.

Year-to-date returns are also illustrative of the risks involved when purchasing PNQI. The fund is down over 45% since January 2022, and the return spread relative to QQQ and SPY has been widening during this last leg down. High-multiple tech stocks continue to show weakness in the face of higher rates for longer and lower liquidity in the system.

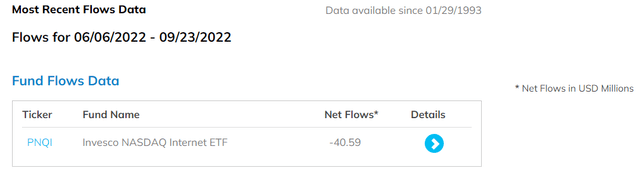

PNQI registered ~$41 million in outflows since early June 2022, which is slightly over 10% of the latest market value of the fund. Recent flow data breaks the pattern when compared to my previous article on PNQI and we are now starting to see bearish market positioning.

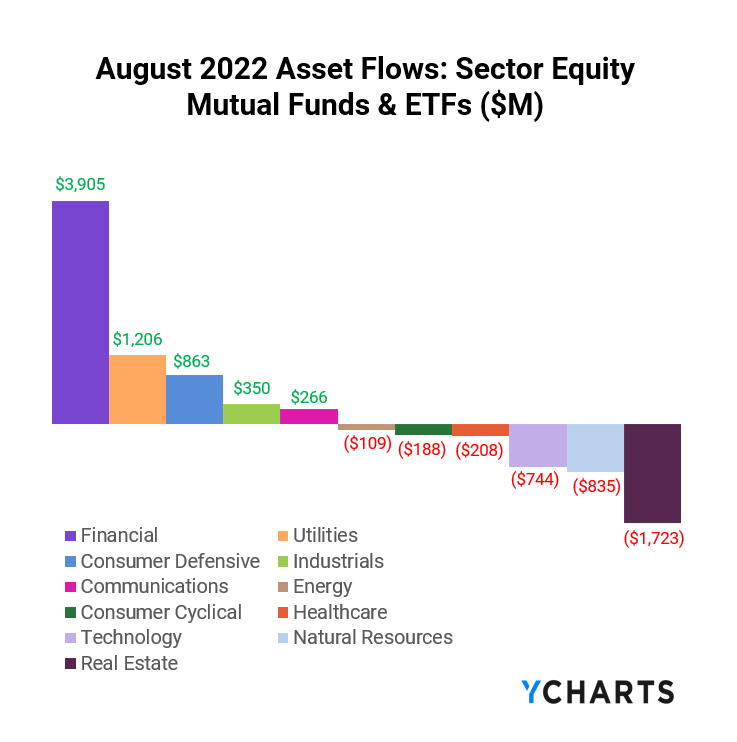

Prolonged outflows are another indication of the fact that we are already in a bear market, but I believe that the bottom is still ahead of us. Outflows remain modest compared to inflows, especially in sectors that have witnessed large drawdowns such as Technology and Real Estate. Larger outflows in these sectors would be a good indication of a nearing bottom.

YCharts

Higher Rates, A Risk For Internet Stocks

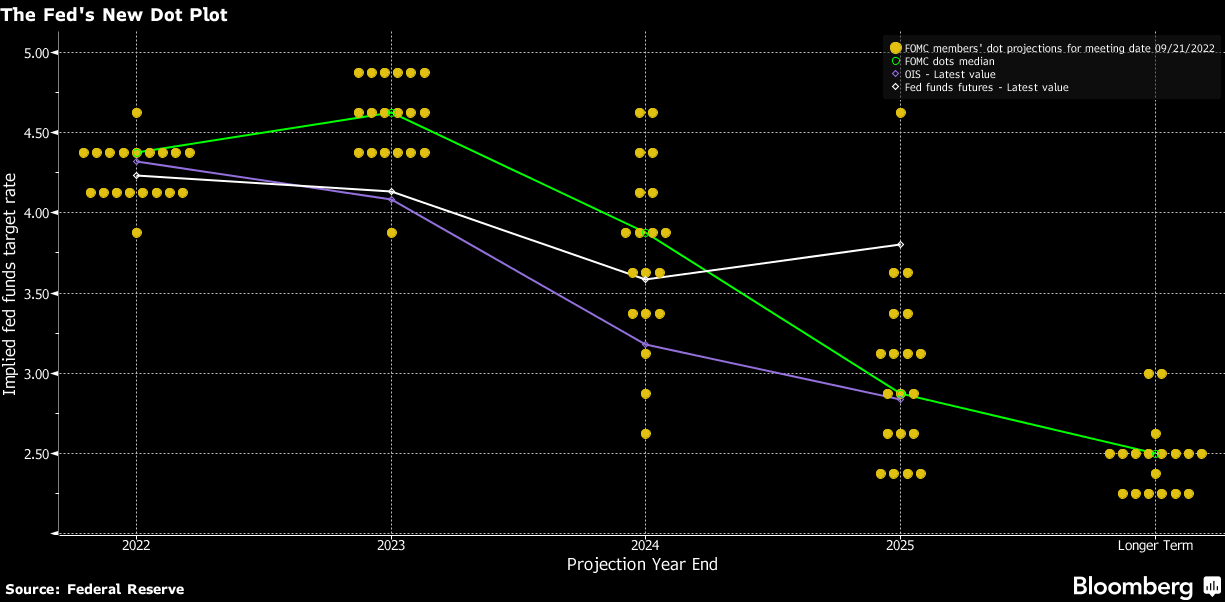

Higher rates for longer is the main takeaway from the last FOMC meeting. The message is illustrated in the newly released dot plots, that confirm rates will stay above the previous neutral target for longer. The ripple effects of this updated guidance are crucial for equity markets, particularly high-multiple stocks. I expect liquidity to continue to be drawn from markets, exposing a weak performance in securities trading at lofty valuations.

Bloomberg

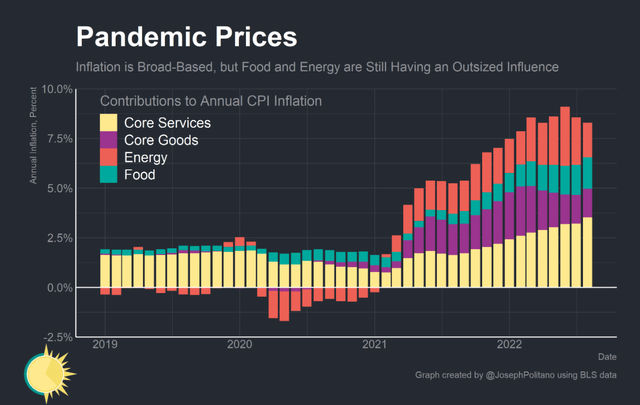

The Federal Reserve made it clear over the last couple of months that it would not back down in its fight against inflation. In fact, in the face of higher than expected CPI prints, the Fed now has a single commitment: reducing inflation. While commodity prices are catching a break, inflation continues to feed in through wages and rental costs, which more than offset the predicted decline in fuel prices. Still, the CPI is way above the long-term target of the Fed and that justifies higher rates for longer.

This brings us to what I believe is the main short-term risk for Internet stocks, and to a larger degree, high-multiple securities: with higher rates, a new alternative emerges to park your money in the form of Treasuries. The difference between earnings in risky assets (typically stocks) and earnings in 0% volatility liquid cash is reaching a 25-year low. The US 1-year Treasury yield is now a little over 4%, which incentivizes investors to wait for brighter days by offering a competitive return from risk-free cash. As a result, funds are being diverted away from the last decade’s beneficiaries, mainly Tech stocks, into other investments. I find it hard for PNQI to reach a new all-time high with lower liquidity, which leads me to conclude that a pivot is likely the key catalyst that will make this fund a buy once again. Until then, the risk-reward profile of this investment is unappealing to me and I wouldn’t exclude the possibility to see new lows in the coming months.

Key Takeaways

In my last piece on PNQI, I discussed some of the dangers of investing in high-multiple stocks during a time when monetary policy is tightening. Monetary policy is currently more restrictive than it was in June 2022, and the Fed has plainly eliminated any pivot scenarios in the near future. Since policymakers are clearly indicating that they want to see lower equity prices, I believe it will be difficult for PNQI to reach a new all-time high in the near future unless monetary policy changes abruptly. Until then, I find PNQI’s risk-reward profile unattractive, and I feel the prospects of retaking the June lows are quite high.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.