[ad_1]

Investing in India with ETFs

The International Monetary Fund (IMF) has just released data that shows India has overtaken the UK to become the world’s fifth largest economy.

India has a stable political system and is the world’s fastest-growing economy and while the world battles with inflation India’s battle is not half as bad. July inflation in India was 6.71% with the target set by the Reserve Bank of India (RBI) being 2% – 6%. So slightly above the target range and in their August meeting, the RBI increased rates 0.5% to 5.4%, still the lowest since the financial crisis of 2008/9.

The JSE has a few Exchange Traded Funds (ETFs) with exposure to India but most are emerging markets and that exposure is very small.

However in February this year, Satrix listed an Indian ETF (JSE code: STXNDA) and it is up some 19% since listing. The TER is higher than average at 0.82% but that’s manageable and it’s a pure play in the Indian economy. Important is no distributions as dividends will be reinvested.

More recently 1nvest listed an Asian ETF (JSE code: ETFEMA). This ETF covers all of Asia and has just over 40% exposure to China, almost 19% to Taiwan with India coming in third at almost 18%. Here the targeted TER is 0.405% and is also a total return fund, so dividends are reinvested.

The holdings are naturally different as the Satrix is a pure India investment while the broader Asian 1nvest ETF has other markets included.

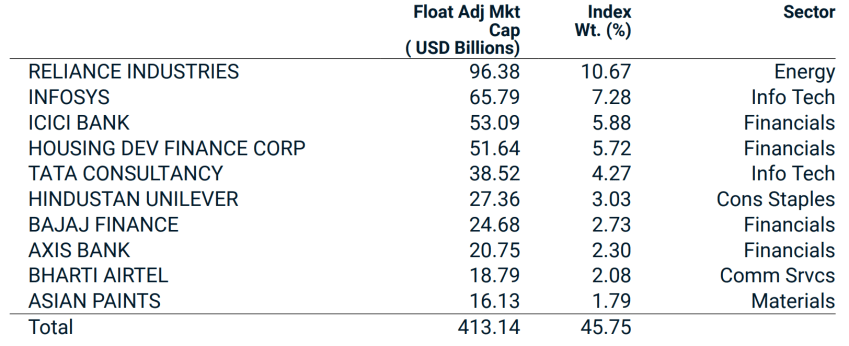

STXNDA Top 10 holdings

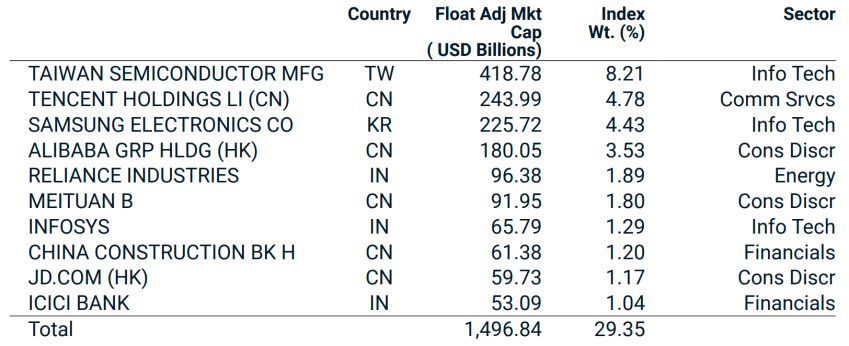

ETFEMA Top 10 holdings

For those looking for tactical exposure to a fast-growing emerging market, India has lots to offer.

ETF blog

At Just One Lap, we are big fans of passive investment using ETFs. In this weekly blog, we discuss ETFs on the local market and the factors you need to consider when choosing an ETF. If you have wondered how one ETF differs from another, this is where you can find out. We explain which index each ETF tracks, what type of portfolio could benefit from holding each ETF, and how the costs will affect your bottom line.

[ad_2]

Image and article originally from justonelap.com. Read the original article here.