[ad_1]

piranka

In general, when you hear anyone touting AI in their business, you should be skeptical. Obviously there are plenty of businesses that use algorithms and statistics, which is all machine learning really is, AI is often a major reach. With so many companies attaching themselves to AI, there are lots of disparate exposures in an ETF like iShares Robotics and Artificial Intelligence Multisector ETF (NYSEARCA:IRBO). Even telecoms make it into the ETF. Mostly, it is a broad IT exposure, although not particularly value-weighted. With a lot of more traditional IT crossover, Chinese exposures and things like telecoms making it into the mix, the PE ends up being low. But China exposure isn’t that great right now, and we don’t see these companies being particularly levered towards revolution in AI. Overall, we don’t see the special appeal of this EFT as an AI portfolio factor.

Breakdown IRBO

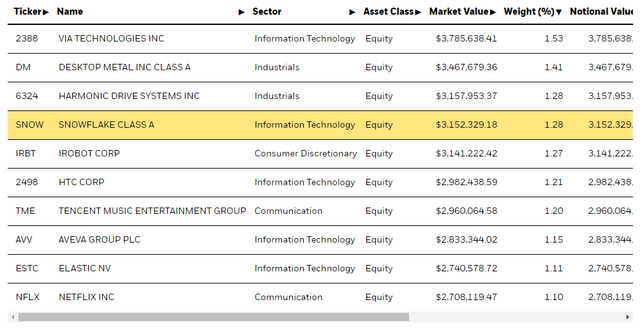

The list of holdings is pretty extensive, and not value-weighted.

Netflix (NFLX) sits pretty low compared to relatively small cap companies like Via Technologies which trades at only a $1.2 billion valuation. The portfolio is diversified though and has 114 holdings.

But you can see rather immediately that the AI link is pretty limited. HTC Corp (OTC:HTCKF) makes laptops and phones. Tencent (OTCPK:TCEHY) is a consumer products company mostly, still tech but consumer products. Cloud computing isn’t really AI, it’s more infrastructure or software for infrastructure. We see a fee cloud computing companies on the list. Even Disney (DIS) features in this portfolio, probably because Disney+ would employ some ML-based recommendation algorithms. Again, Amazon (AMZN) and JD (JD) are ecommerce. Yes, they’d have recommendation algorithms, and in the case of Amazon, there is AWS, but besides incremental improvement on the search and recommendation functions, we don’t see this incredibly high-tech link to these companies. There are some veritable robotics companies like Fanuc (OTCPK:FANUY), as are there AI companies, and because of the number of holdings they do end up adding up, but the point is there’s a lot of stuff that doesn’t necessarily fit. Disney is more heavily allocated than Fanuc by the way.

Conclusions

There are even companies like Lumen Technologies (LUMN), which is legacy telecoms, and lots of Chinese exposures. The telecom exposures are not even a problem, although not sensible as far as the mandate goes, but the Chinese exposures are more uncertain. The issue of delisting still looms, and while there has been a technical agreement to do with oversight of Chinese companies to satisfy listing requirements, whether compliance will hold is uncertain still. Furthermore, there are already regulatory risks in native China on these profitable, growing tech companies that have attracted a lot of US investment. These exposures, as well as the out of place industrial ones that have little to do with AI or robotics, have brought down the IRBO PE to a pretty low level of around 12.5x. The yield isn’t bad either at 3.1% net of fees, although it’s mostly coming from companies in telecoms or industry where yields are higher. However, we don’t feel strongly at all that these companies capture an AI and robotics factor in markets. If they do, it is in applications that are already so entrenched that the scope for extraordinary evolution is limited, certainly relative to where AI can go overall. We just don’t see the coherence in this ETF.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.