[ad_1]

Dogan Kutukcu/iStock via Getty Images

There are lots of opportunities in today’s markets. We go over two popular ETFs that are very similar to each other except in their leverage profile. VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) is designed to invest in junior gold and silver mining companies.

VanEck Vectors Junior Gold Miners ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Junior Gold Miners Index (MVGDXJTR), which is intended to track the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver.

Source: VanEck GDXJ

Direxion Daily Junior Gold Miners Index Bull 2x Shares ETF (NYSEARCA:JNUG) is an ETF designed for those who feel the volatility inherent in junior mining companies is not sufficient for their tastes.

The Direxion Daily Junior Gold Miners Index Bull and Bear 2x Shares seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite), of the performance of the MVIS Global Junior Gold Miners Index. There is no guarantee these funds will meet their stated investment objectives.

Source: Direxion

When we last covered these two, we gave a good deal of the thesis away in the title and concluded with the following.

At this point, the risk-reward is better than the last time we wrote on GDXJ and we would wager the next swoon is a buyable opportunity. JNUG remains a far harder beast to tame thanks to the inherent decay.

Source: When USD Is Rocking, Don’t Come Knocking

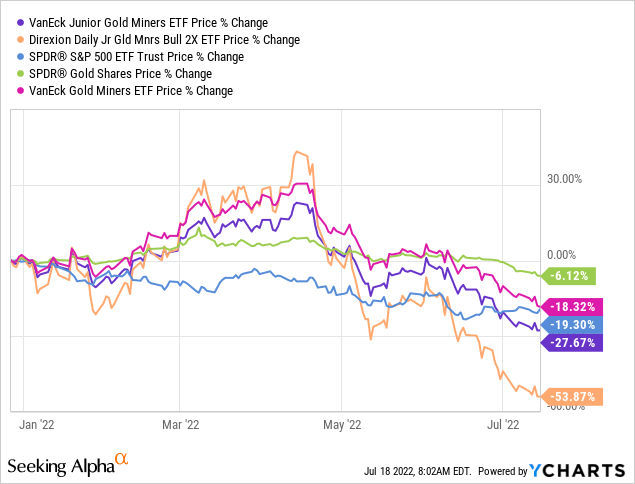

Our decision not to buy was a resounding success. GDXJ dropped 27.67%, far more than the broader market (SPY) and underperformed SPDR Gold Shares (GLD) by 21.5%.

JNUG, of course, amplified that and dropped 53.87% giving investors a “half-off” sale.

The Fundamentals

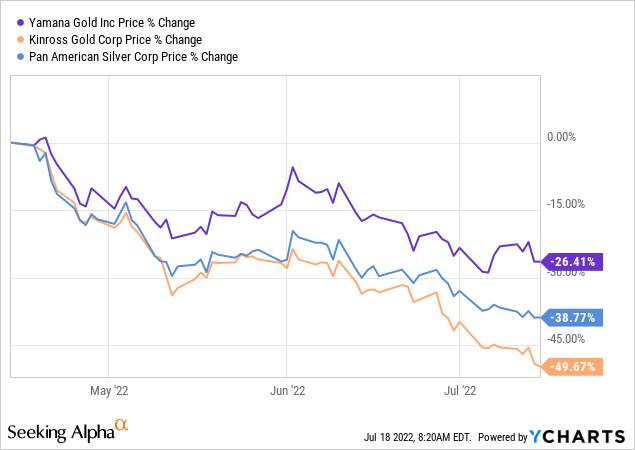

Mining stocks faced the perfect hurricane over the last few months that caused the top components of these ETFs like Yamana Gold (AUY), Pan American Silver (PAAS) and Kinross Gold (KGC) to drop over 35% on average.

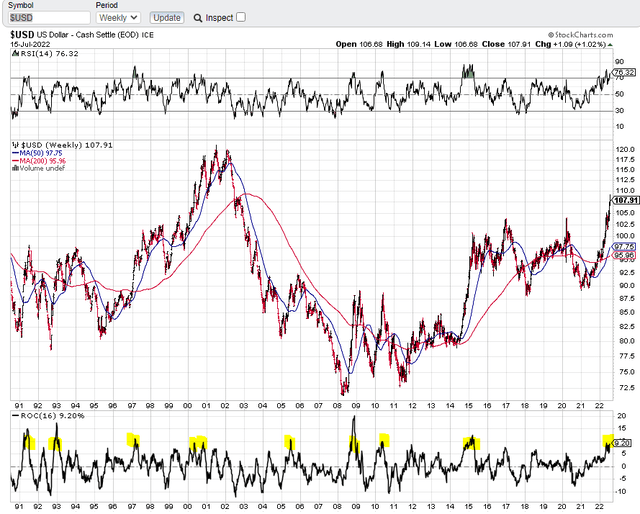

The first factor was the direct strength of the US Dollar. Gold stocks can rally when the US Dollar is strong, but it is a rare feat. Eventually, they succumb to the pressure, and the US Dollar had one of its strongest periods in decades this past quarter. A 9% rate of change over 16 weeks has only been matched or exceeded less than 10 times over the last 32 years.

Alongside that, Gold shares obviously felt the pressure from falling Gold prices. During the initial part of the invasion, Gold shares held up as Gold resisted the USD strength. But once that support broke, the floodgates opened.

Finally, Gold shares got a huge hit from higher oil and other commodity prices. As large consumers of energy, gold stocks tend to do poorly when oil rises faster than gold. We identified this risk in 2021 (see Why Gold Miners Make Poor Inflation Hedges), and obviously, the war pushing oil to over $130/barrel made things intolerable.

Outlook & Verdict

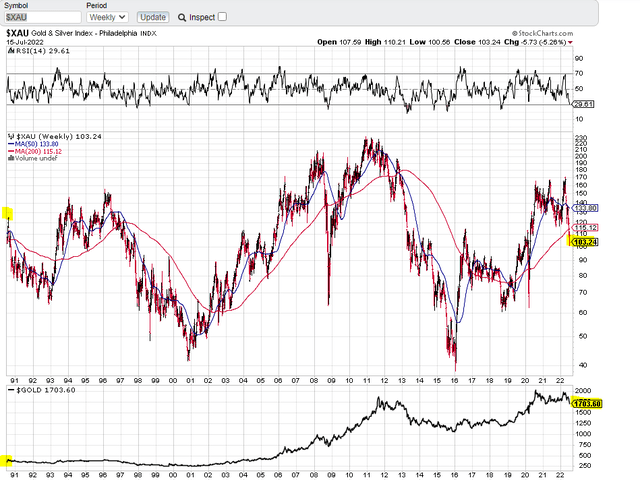

We see Gold shares as one of the poorest asset classes for the long term as they require a perpetually rising gold price to stay flat. We are not kidding about that. Just examine the chart of the $XAU (Gold and Silver index) from 1990, with the price of Gold in the lower panel.

Proudly Delivering Zero Returns Since 1990 (XAU)

The main reasons for this are depletion and dilution. Depletion is easy to understand. Gold mines deplete and production drops over time. Unlike other commodities, overall drop in production barely moves the dial for Gold prices. The reason for that is that virtually all mined Gold since the beginning of time still exists.

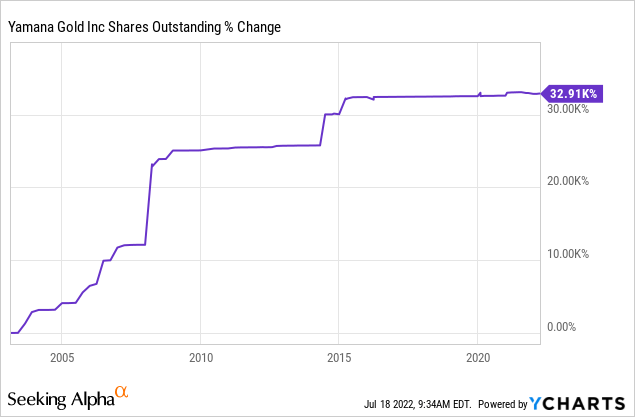

Dilution is even easier to understand. Here is one prime example.

So, in the long run, we expect Gold stocks to make collectively less than treasury bills, even assuming Gold moves up gently over time. If Gold accelerates upwards, then yes, you will have periods where Gold stocks will suck in a few more investors that will eventually be introduced to the wealth destroying power of this asset class. Now, we expect Gold to accelerate upwards, so that puts us in the position where we believe that, yes, you can make money on them. You just have to pick your entry points responsibly. The current selloff and sentiment Gold stocks is one such point. That is why we are stamping a “Buy” rating on GDXJ.

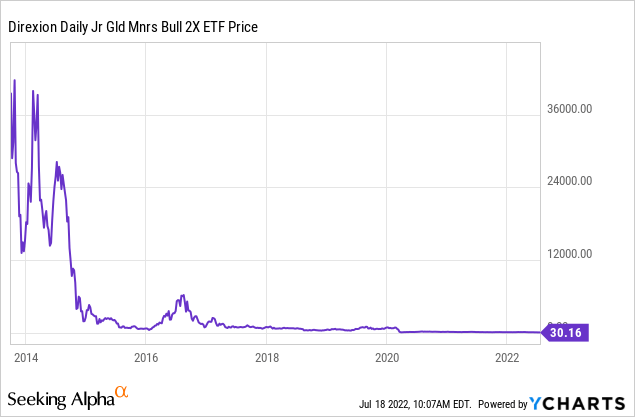

JNUG is a different beast, and the longer-term chart should help with what we are saying. Split adjusted, this was at $40,000 at one point.

Now, JNUG runs 2X leverage rather than the 3X it did at one point. Nonetheless, junior mining companies are bad enough without leverage. So we are maintaining a “hold” on JNUG as we just don’t have the capacity to go long this. That said, if speculators want to play this, we suggest a covered call approach as we did last time. The very high implied volatility compensates to some extent for the decay and gives you a better risk-adjusted bet.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.