[ad_1]

Former head of precious metals at J.P. Morgan, Michael Nowak, is currently on trial with colleagues Gregg Smith and Jeffrey Ruffo in Chicago regarding whether or not they conspired to manipulate gold and silver markets.

While that may not be news to many Zero Hedge readers, some of the inner workings of J.P. Morgan’s metals desk, as detailed in a new Bloomberg report, may be.

It was revealed in court that the bank’s annual profits from its metals desk, which aren’t usually broken out in the bank’s earnings reports, made astonishingly consistent “annual profits between $109 million and $234 million a year between 2008 and 2018.”

Those profits came mostly from trading in financial markets, Bloomberg noted, but trading and transporting metals also made the bank about $30 million, per year, on average.

In 2020, amidst the Covid panic, the bank made $1 billion from precious metals due to “unprecedented arbitrage opportunities”.

The bank holds tens of billions of dollars worth of gold in various vaults it has in places like New York and London, Bloomberg writes. It is the biggest player of several “bullion banks”, the report notes, with about 40% of all transactions in the gold market in 2010 clearing through J.P. Morgan.

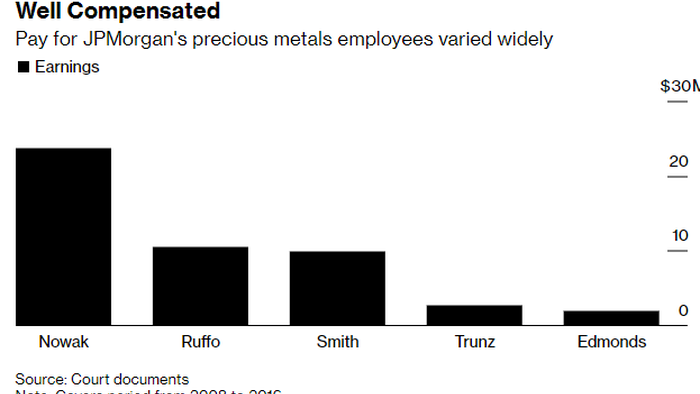

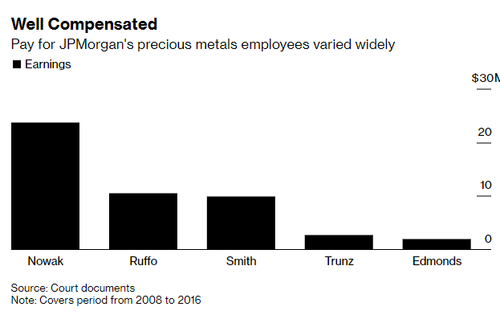

The bank’s metals traders were “remunerated handsomely”, the report notes. In fact, they made so much money that the jury audibly gasped when it learned how much they made. Ruffo made $10.5 million between 2008 to 2016 and Smith received $9.9 million. Nowak cleared $23.7 million over the same period of time.

Ruffo made the bank $70.3 million in profit between 2008 to 2016, while Smith generated $117 million and Nowak made $186 million.

Perhaps this is why the bank is often brought up anytime there are rumors and unconfirmed discussions about large short positions in the gold and silver markets. The bank has also been in the spotlight for spoofing being “open strategy” on its trading desk.

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.