[ad_1]

This month, a new term surfaced on LinkedIn, Twitter and other professional networking tools called “Quiet Quitting.”

Quiet quitting refers to employees quietly doing less work for their employers, sticking to only their core responsibilities. Arguments have been made for and against quiet quitters, as employees are seeking a work-life balance and many feel that they should only be completing work for which they are paid to do. K

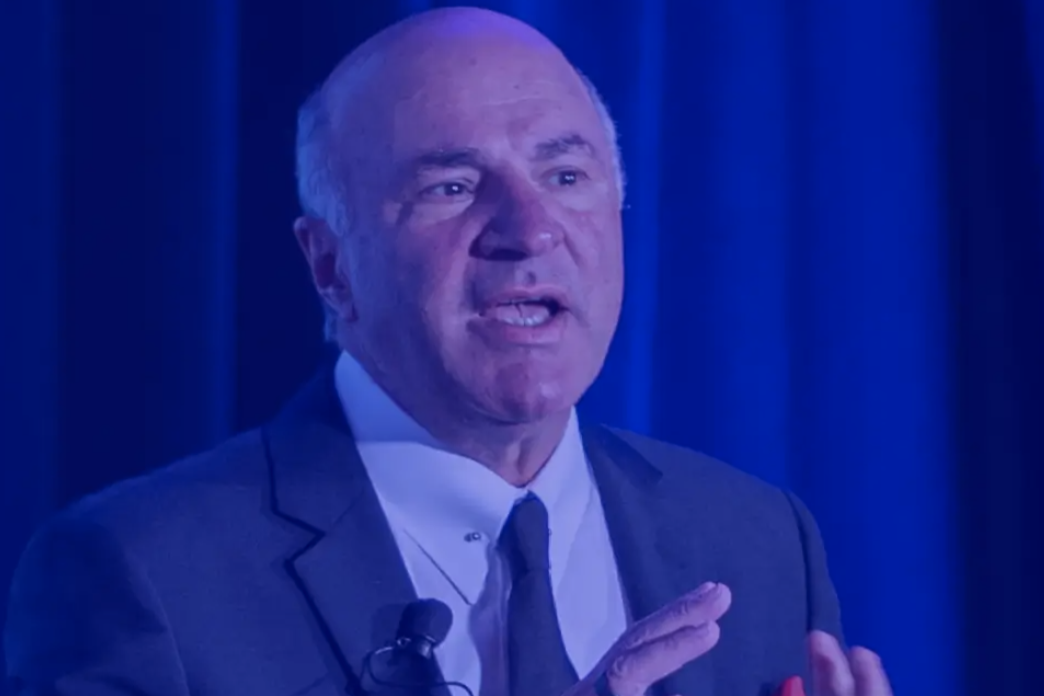

“Shark Tank” judge Kevin O’Leary is taking a strong position against quiet quitting, asserting that quiet quitters are “losers” and “un-American.”

In an interview with CNBC, O’Leary told the network, “The economy is changing, we’re going into a whole new metric where people are working from home and the office. You’re hired and trusted to finish things off. Some ideas are bad ideas, and some ideas are stupid ideas, but very rarely can you combine both, and this is what we have here.”

O’Leary continued, “What I’m hoping to do, and I told the recruiters, is to identify these employees early and help them get jobs with our competitors? Because this is the most competitive weapon I’ve ever seen. If you’re a quiet quitter, you’re a loser, you’re Un-American — that’s what I think.”

The shark and venture capitalist often voices his opinions on the future of work, cryptocurrencies and high-growth industries on his Twitter account. O’Leary is joining Benzinga in December in New York City to speak at the Future of Crypto Conference.

Unlike fair-weather fans, O’Leary has voiced his support for digital assets through the cryptocurrency bear market. Time and time again, cryptocurrency bear markets have presented opportunities to capitalize on the fastest growing industry across the globe, making investors outsized returns in the bull markets that follow.

Early bird tickets for Benzinga’s Future of Crypto Conference just launched, and you can reserve a seat today for just $97!

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.