[ad_1]

I sometimes like to take a somewhat contrarian view of a certain type of news. When a corporation announces cutbacks, for example, it is not always a bad thing. Sometimes it is prudent management that allows a company to get through tough times and emerge the other side leaner and stronger. Depending on the timing, it can actually be a good thing. That is how I feel this morning about the news that Micron Technologies (MU) is cutting around 10% of its workforce and suspending bonus payments, along with other cuts.

My optimistic take on that news, however, is not one that the market seems to share right now as MU is trading in this morning’s premarket at about 4% below yesterday’s close.

That is a drop that began when Micron released earnings after the close yesterday, and it is hard to know how much of it is attributable to the miss those earnings represented and how much to the news of the cutbacks. Last quarter certainly wasn’t pretty for the company, which posted a bigger loss than analysts were expecting on weak revenue and, more importantly, forecast bigger losses going forward.

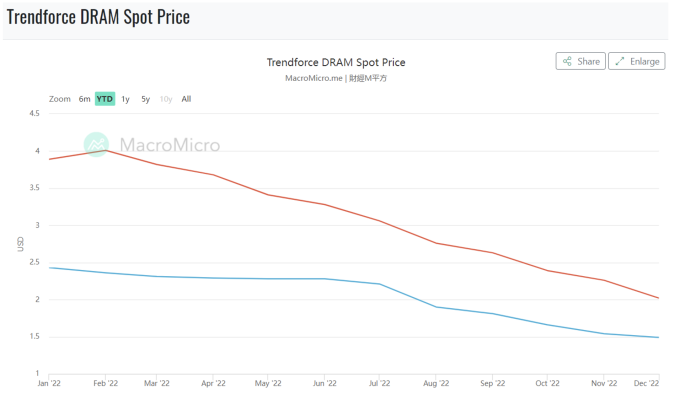

A drop in the stock is not a surprise, but then, the weak quarter itself wasn’t really a surprise either. Micron makes and sells semiconductors, and that is an industry that has been hit hard by what is going on in the world. The supply problems that are hitting companies like Apple (AAPL) at the moment are due mainly to disruptions in China; if companies like Apple aren’t making products, then they aren’t ordering chips. That lack of demand can clearly be seen in a chart for the price of DRAM memory so far this year:

If weak sales, weak commodity prices, and a weak bottom line were no surprise, why is the stock reacting so badly? Obviously, the principal reason for that is because they were worse than expected, but also, the cutbacks will have hit the mood of traders as well. There is always a tendency to see that as bad news piled on bad. It shows that a company is resigned to weaker sales for some time, but in some ways, that may not turn out to be all bad.

Markets look forward, but in the immediate aftermath of an announcement like this, they often punish companies that do the same.

For me, I would rather own stock in a company where management is realistic, maybe even a bit pessimistic, about what the future holds, versus, say, AMC Entertainment (AMC), which tends towards the opposite approach. Management at AMC has been painting quite a rosy picture for a while, talking about a strong return to movie theaters and the like while updating and renovating properties. Still, AMC has continued to struggle, as evidenced by the announcement this morning of another capital raise.

The actions of Micron are in stark contrast to that. Management there is proactively preparing for a downturn; the irony is that their actions and those of others in the industry may actually improve market conditions next year. As mentioned, semiconductor prices have been under pressure this year, but that isn’t all about demand. There is a supply component too, as there is with any commoditized product, and the general cutbacks from MU included a big reduction in proposed capex over the next couple of years. If that is mirrored by others in the industry, which it probably will be, then the supply outlook for chips changes and that will be reflected in price early next year.

One word of warning. I am not jumping in to buy MU quite yet. The pessimism around the stock isn’t going away in a hurry, and we could see it trade lower into the year’s end, particularly if the market as a whole closes out the year with a bearish tone, but it is definitely one to keep an eye on in the new year. Management did what it had to do in light of current conditions, but this is an industry with a history of volatility. History tells us they will bounce back strongly before too long. Traders know that and will be anticipating a bounce well before it comes, meaning that next year may not be as bad for MU as the news last night may make you think.

* In addition to contributing here, Martin Tillier works as Head of Research at the crypto platform SmartFI.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.