[ad_1]

POUND STERLING ANALYSIS & TALKING POINTS

GBP/USD FUNDAMENTAL BACKDROP

Input prices have soared globally and this is no different within the UK as manufacturers felt the pinch. Manufacturing PMI’s headed into contractionary territory for the first time since May 2020 but saw minimal downside reaction from GBP with services data marginally outperforming estimates. The reaction function from sterling makes logical sense as roughly 80% of UK GDP is generated from the services sector, hence cable finding some bids. This being said, the composite figure (50.9) remains marginally within the expansionary domain highlighting the declining state of the UK economy which does not bode well for the pound should this trajectory continue.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Leading up to today’s UK PMI data, we have seen misses on key economic metrics including retail sales, consumer confidence and the labor market. These less than favorable releases for the pound come under the cloak of rampant inflation on both core and headline components, making the Bank of England’s (BoE) job much more tricky to navigate as higher interest rates will surely aggravate consumer concerns. The energy landscape remains bleak and with Europe edging closer to the winter months, the potential for rising energy prices are high. What this means for sterling against the greenback is significant headwinds and consequently downside risk as the U.S. and UK economies look to diverge – favoring a safe-haven USD.

TECHNICAL ANALYSIS

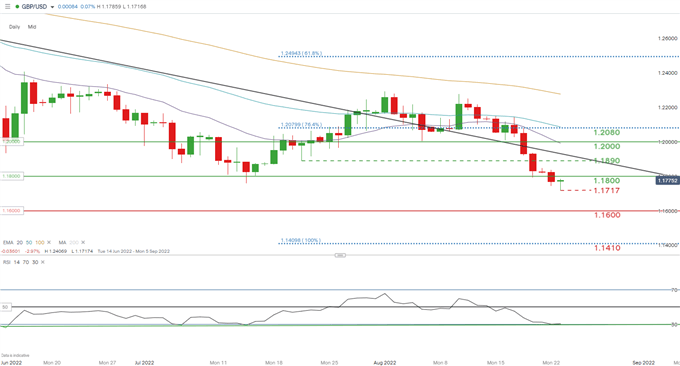

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action post-PMI has services data preferred over the significant manufacturing miss. The resultant move has uncovered a lower long wick on today’s daily candle and may point to consequent upside ahead of the Jackson Hole Economic Symposium later this week. Profit taking may also be on the cards after the sharp fall in cable however, the hawkish expectations around Jackson Hole may see a resumption in the downward trend towards subsequent support zones.

Key resistance levels:

Key support levels:

MIXED IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 80% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a cautious bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.