[ad_1]

AUGUST JOBS REPORT KEY POINTS:

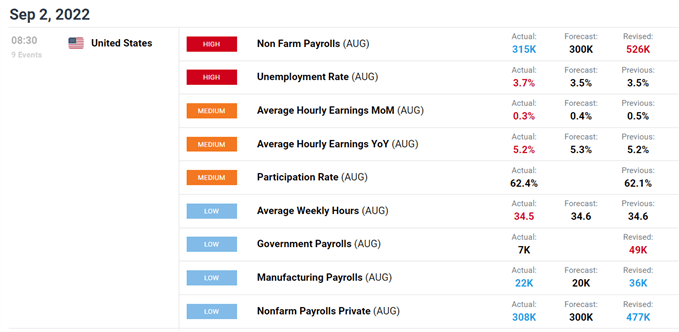

- U.S. employers add 315,000 payrolls in August, slightly above expectations of a gain of 300,000 jobs. The unemployment rate rises to 3.7% from 3.5%, disappointing forecasts

- Average hourly earnings climb 0.3% month-over-month, prompting the annual rate to remain unchanged at 5.2%

- Healthy employment growth by historical standards reduces the probability of a monetary policy pivot by the Federal Reserve

Most Read: US Manufacturing Activity Data Beats Expectations in Sign of Economic Resilience

Update at 9:05 am ET

The U.S. dollar, as measured by the DXY index, maintained a slightly bearish bias after the NFP report crossed the wires despite the U.S. Treasury yields’ attempt to perk up. However, the greenback could resume its ascent soon as the employment data is not likely to alter the Fed’s tightening plans in the near-term. While wages may be growing at a slower pace, the extremely tight labor market will prevent the type of demand destruction needed to bring inflation back to the 2% target rapidly. Having said that, the FOMC may deliver another 75 basis points interest rate increase at its September gathering, in line with current market pricing. In addition, more monetary policy tightening should be expected at subsequent meetings later in the year.

DXY CHART VS US TREASURY YIELDS

DXY Chart Prepared Using TradingView

Original post at 8:40 pm ET

U.S. employers continued to add workers at a strong and remarkable pace for country navigating turbulent waters and presumably at the late stage of the business cycle, although job creation cooled noticeably compared to the start of the third quarter, when hiring activity surprised to the upside.

According to the U.S. Department of Labor, the economy generated 315,000 nonfarm payrolls (NFP) in August, versus the 300,000 expected, following a downwardly revised increase of 526,000 in July. The unemployment rate, meanwhile, rose to 3.7% from 3.5%, but the uptick was likely attributed to a jump in the participation rate which climbed to 62.4% from 62.1% (more people returning to the labor force).

Today’s results show that the labor market remains extraordinarily resilient and extremely tight, despite the various headwinds battering U.S. firms, including runaway inflation and rising interest rates. The report, which clearly defies the doom-and-gloom narrative, also suggests that widespread hiring freezes and major headcount reductions are not yet taking place, a vote of confidence in the outlook by Corporate America.

US EMPLOYMENT DATA AT A GLANCE

Source: DailyFX Economic Calendar

Related: NFP and Forex – What is NFP and How to Trade It?

Elsewhere in the NFP survey, average hourly earnings, a powerful inflation gauge closely monitored by the central bank, advanced 0.3% on a seasonally adjusted basis, one-tenth of a percent below the consensus, prompting the annual rate to hold steady at 5.2%, a sign that wage pressures continue to moderate.

The sturdy labor market should continue to support household spending, the main pillar of the consumption-driven U.S. economy, preventing a hard landing with deleterious effects for Americans. This benign scenario, however, could complicate the Fed’s efforts to quickly bring down inflationary forces via demand destruction, increasing the need for further rate hikes and reducing the probability of an early pivot in monetary policy.

In the current macroeconomic environment, the U.S. dollar is likely to retain a positive bias, aided by attractive U.S. Treasury yields, comparatively speaking. While brief corrections cannot be ruled out, the path of least resistance appears to be higher. This means that the greenback, as measured by the DXY index, could keep bullish momentum and charge towards new multi-decade highs in the coming days and weeks.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.