[ad_1]

The apparel retailer earned an upgrade from Williams Trading to “hold” from “sell”

Canada Goose Holdings Inc (NYSE:GOOS) is seeing an influx of bearish options activity today, despite the apparel retailer earning an upgrade from Williams Trading to “hold” from “sell.” So far, 12,000 puts have been exchanged — 29 times the volume that is typically seen at this point. Most popular by far is the weekly 10/7 15-strike put, where new positions are being opened.

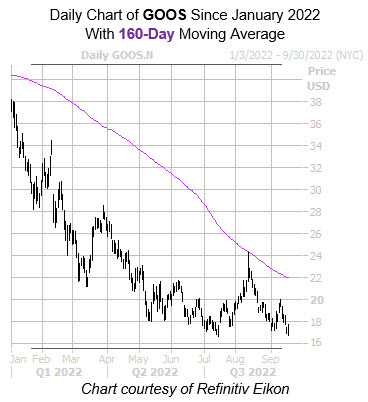

Although last seen up 0.6% to trade at $17.34, the $20 level rejected the shares just last week. The security is also sitting near its annual low of $16.65, and remains down 52.7% year-to-date. Plus, overhead pressure at the 160-day moving average — or $24 level — capped the security’s mid-August rally.

While short sellers have been hitting the exits of late, they still rule the rooster. The 6.45 million shares sold short account for 12% of the equity’s available float, or nearly seven days’ worth of pent-up buying power.

Now looks like an affordable time to speculate on the security’s next move with options. Canada Goose stock’s Schaeffer’s Volatility Index (SVI) of 57% sits higher than just 19% of readings in its annual range, suggesting these options players are pricing in relatively low volatility expectations at the moment.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.