[ad_1]

- The Perth Mint sold 79,305 troy ounces (oz) of gold and 2,465,513oz of silver in minted product form during July.

- The Perth Mint depository’s total gold holdings decreased slightly by -0.14%; silver declined by just -0.1% during the month.

- Holdings in The Perth Mint listed ETF, ASX:PMGOLD decreased for the month by -1.54%.

Gold and silver prices experienced similar trading patterns in July with substantial declines followed by healthy retracements.

Starting the month at USD 1,807/oz, gold failed to find any traction as it slipped to USD 1,697/oz by 21 July, its lowest level in 15 months. With a falling dollar and lower yields, however, gold’s comeback was marked by a 50% retracement to USD 1,753 at month’s end (-3.08%).

Gold in Australian dollars traded in a similar pattern with the price finishing July at just above AUD 2,512 (-4.92%).

Silver faced a similar mid-month struggle. Starting the month just above USD 20.24 before retreating, it ended July impressively having recouped 100% of its decline and more (+0.36%).

The gold silver ratio ended July at just under 87.

Minted products

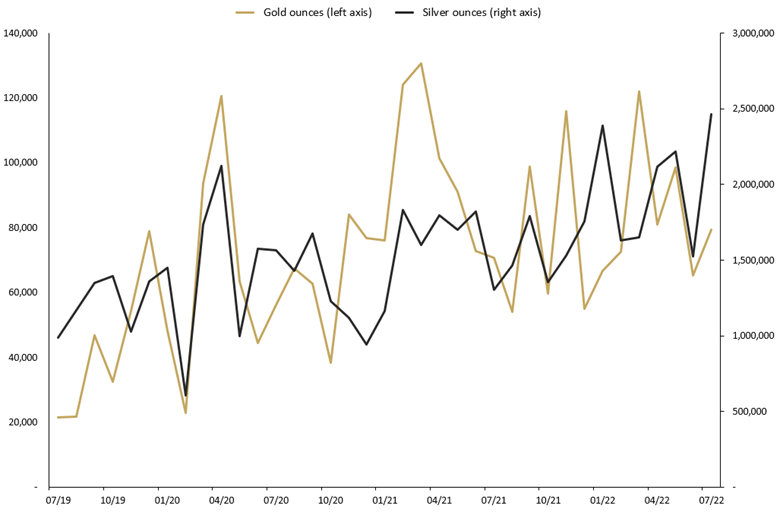

The Perth Mint sold 79,305oz of gold and 2,465,513oz of silver in minted product form during July.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid-2012.

CURRENT MONTH SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS TROY OUNCES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS

july 2019 to july 2022

General Manager Minted Products, Neil Vance, said the start of the new financial year was characterised by strong interest in Australian gold bullion products.

“Rebounding demand was especially noticeable out of North America, which compensated for the slowdown in the German market we noted in June,” he said.

“We continued to experience extremely strong demand for physical silver,” he added. “Even with a strong month for output, silver coins remain subject to allocation.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. For more product information visit the bullion web page.

The Perth Mint depository

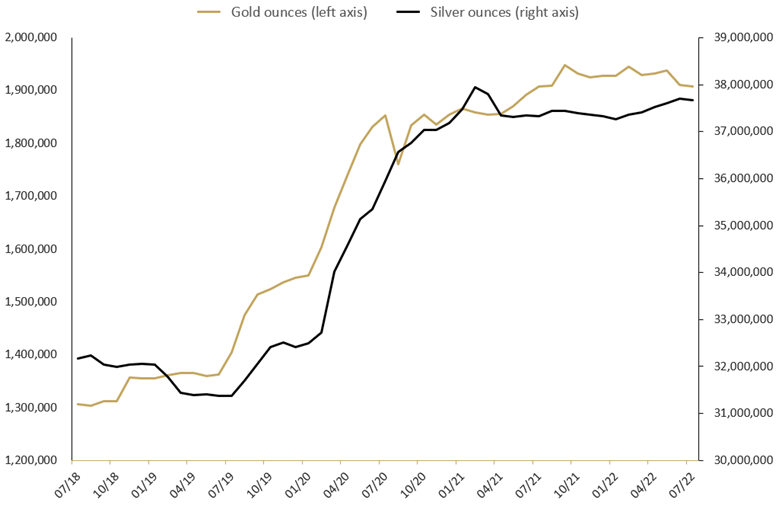

Total gold holdings in The Perth Mint depository decreased slightly by 0.14%, while silver decreased by 0.1% during July. Compared to 12 months ago, holdings of gold are virtually the same while silver holdings are up 0.88%.

Looking back to July 2019, holdings of gold have increased by approximately 36% and silver by 20%, with the strong growth evident in the chart below.

TOTAL TROY OUNCES OF GOLD AND SILVER HELD BY CLIENTS IN THE PERTH MINT DEPOSITORY July 2019 TO july 2022

The Perth Mint depository enables clients to invest in gold, silver, and platinum, with The Perth Mint storing this metal in its central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit the depository web page.

Perth Mint Gold (ASX:PMGOLD)

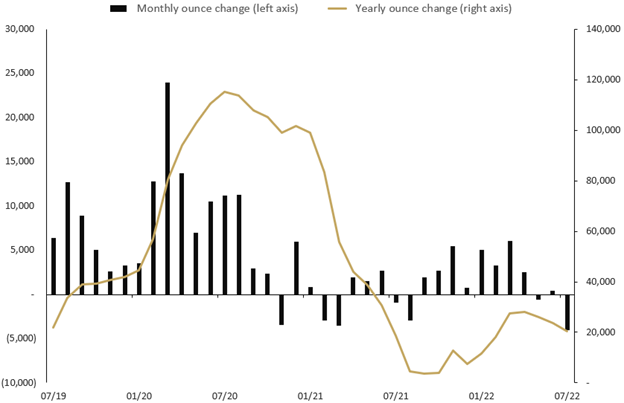

Total holdings in Perth Mint Gold (ASX:PMGOLD) decreased during July, with holdings down 4,005 (-1.54%). This brings total holdings in PMGOLD to 256,135oz (7.79 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) July 2019 TO July 2022

Source: The Perth Mint, ASX, World Gold Council

The total value of PMGOLD holdings ended July was AUD 643.5 million, with the gold price trading just above AUD 2,512/oz.

To learn more about investing in PMGOLD, visit the PMGOLD page.

[ad_2]

Image and article originally from www.perthmint.com. Read the original article here.