[ad_1]

Euro Outlook:

- The Euro hasn’t been able to stage a meaningful rally in some time, with each of the three major EUR-crosses showing signs of technical vulnerability.

- The European Central Bank continues to carefully balance raising interest rates and preventing fragmentation in bond markets, for now.

- Per the IG Client Sentiment Index, EUR/GBP rates have a bullish bias, EUR/JPY rates have a mixed bias, and EUR/USD rates have a bearish bias.

Problems at Bay, but Still Lurking

The European Central Bank’s difficult balancing act of raising interest rates to combat multi-decade highs in price pressures while preventing fragmentation of sovereign bond markets (preventing peripheral debt yields from widening out relative to their core counterparts) has proven successful thus far, preventing more considerable downside in the EUR-crosses.

But growth concerns continue to mount, as Eurozone energy inventories remain depressed ahead of the winter months. It’s looking increasingly likely that the ECB will only be able to hike rates a few more times before the pendulum swings towards a greater focus on avoiding a significant economic downturn. The Euro’s problems have been kept at bay, but they continue to lurk, posing a risk for the single currency.

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (August 2021 to August 2022) (CHART 1)

EUR/USD rates appeared to be breaking out higher last week only to fail immediately, losing the uptrend from the July low and early-August swing low. Momentum is starting to turn lower, with EUR/USD rates below their daily 5-, 8-, 13-, and 21-EMA envelope, which is aligning in bearish sequential order. Daily MACD is nearing a bearish crossover below its signal line while daily Slow Stochastics are moving below their median line. The US Dollar lacking a significant bullish catalyst in the near-term may be helping insulate EUR/USD rates from a more substantial pullback, however. Rangebound trading conditions may prevail for the next few weeks.

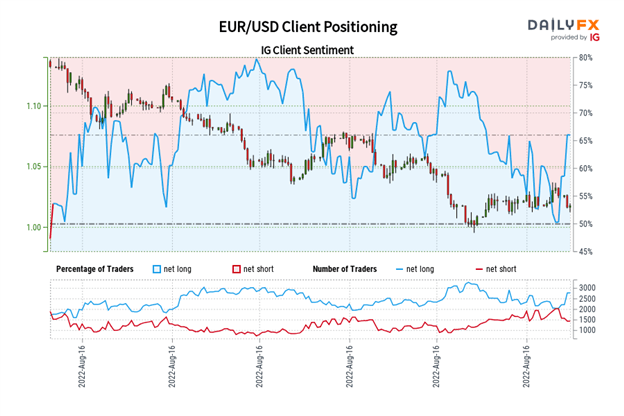

IG Client Sentiment Index: EUR/USD Rate Forecast (August 16, 2022) (Chart 2)

EUR/USD: Retail trader data shows 64.51% of traders are net-long with the ratio of traders long to short at 1.82 to 1. The number of traders net-long is 7.79% higher than yesterday and 25.35% higher from last week, while the number of traders net-short is 3.52% lower than yesterday and 27.26% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

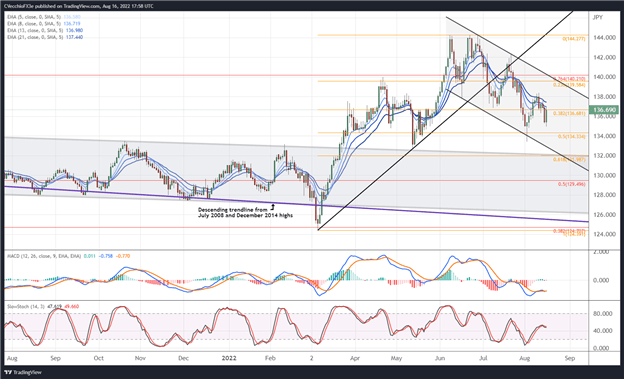

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (August 2021 to August 2022) (CHART 3)

EUR/JPY rates have remain in a descending parallel channel for the past two months, with lower highs and lower lows carved out along the way. Choppy trading conditions have sapped momentum, with daily MACD starting to trend higher while below its signal line and daily Slow Stochastics lingering just above their median line. The daily EMA envelope remains in bearish sequential order, but EUR/JPY rates are back above their daily 5-EMA. Like EUR/USD rates, EUR/JPY rates may be entering a period of rangebound trading conditions during the final weeks of the summer.

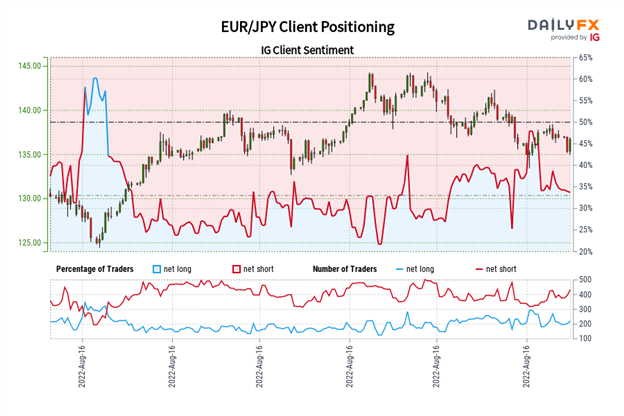

IG Client Sentiment Index: EUR/JPY Rate Forecast (August 16, 2022) (Chart 4)

EUR/JPY: Retail trader data shows 34.17% of traders are net-long with the ratio of traders short to long at 1.93 to 1. The number of traders net-long is 1.49% higher than yesterday and 21.76% lower from last week, while the number of traders net-short is 3.66% lower than yesterday and 10.43% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

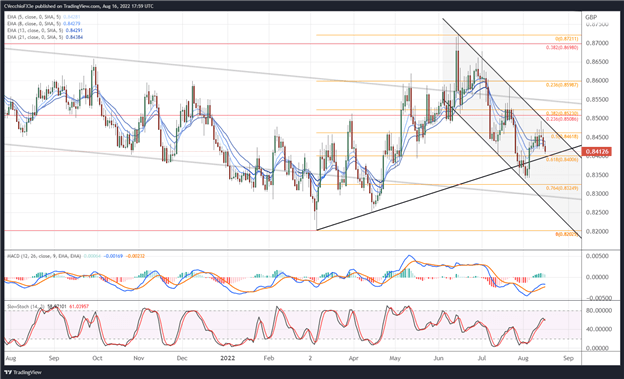

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (February 2021 to August 2022) (CHART 5)

Like EUR/JPY rates, EUR/GBP rates have been trading in a descending parallel channel since June. The early-August attempt to break below the rising trendline from the March and April swing lows was rebuffed, although the pair is quickly returning back to the trendline in recent days. Momentum is starting to turn lower, with the pair below its daily EMA envelope, which is in bearish sequential order. Daily MACD’s ascent below its signal line is starting to fail, while daily Slow Stochastics have begun to turn lower after failing to reach overbought territory. Another swing lower may soon transpire, but a breach of the August low at 0.8340 seems unlikely in the near-term.

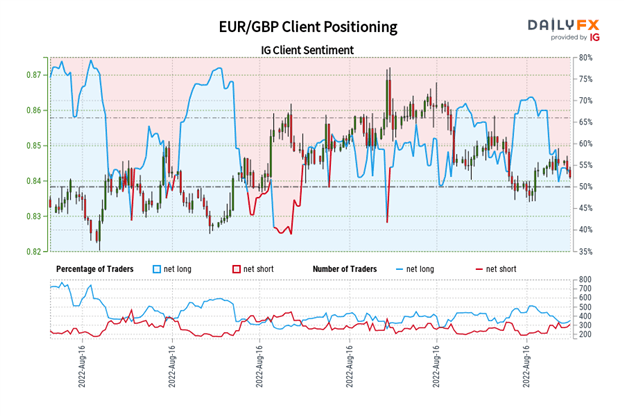

IG Client Sentiment Index: EUR/GBP Rate Forecast (August 16, 2022) (Chart 6)

EUR/GBP: Retail trader data shows 49.51% of traders are net-long with the ratio of traders short to long at 1.02 to 1. The number of traders net-long is 5.33% higher than yesterday and 21.06% lower from last week, while the number of traders net-short is 8.68% higher than yesterday and 26.04% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

Read more: Central Bank Watch: BOE & ECB Interest Rate Expectations Update

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.