[ad_1]

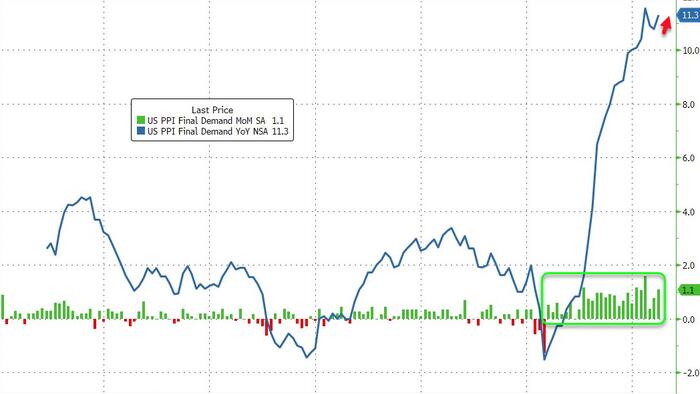

Following yesterday’s CPI scare, analysts were hoping that Producer Prices will decelerate modestly. They were wrong, very wrong. PPI printed 11.3% YoY in June (nback up near record highs and well above the +10.8% expected)

Source: Bloomberg

This is the 27th straight month of MoM increases in producer prices.

Notably, opposite to CPI, we are seeing Goods PPI soaring while Services PPI slowing…

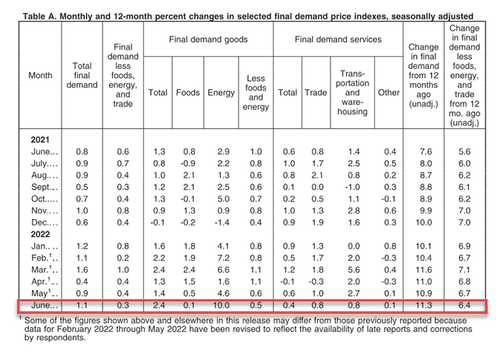

Final demand goods:

The index for final demand goods moved up 2.4 percent in June, the sixth consecutive rise. Nearly 90 percent of the June increase can be traced to a 10.0-percent jump in prices for final demand energy. The indexes for final demand goods less foods and energy and for final demand foods advanced 0.5 percent and 0.1 percent, respectively

Over half of the June increase in the index for final demand goods is attributable to gasoline prices, which jumped 18.5 percent. The indexes for diesel fuel, electric power, residential natural gas, motor vehicles and equipment, and processed young chickens also moved higher. In contrast, prices for chicken eggs dropped 30.2 percent. The indexes for iron and steel scrap and for jet fuel also decreased.

Final demand services:

The index for final demand services rose 0.4 percent in June after climbing 0.6 percent in May. Two-thirds of the broad-based advance in June can be traced to a 0.8-percent increase in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services also moved higher, 0.1 percent and 0.8 percent, respectively.

Over 30 percent of the June advance in the index for final demand services can be traced to margins for food and alcohol retailing, which rose 3.8 percent. The indexes for machinery and equipment wholesaling, outpatient care (partial), transportation of passengers (partial), guestroom rental, and hospital inpatient care also increased. Conversely, prices for portfolio management declined 2.7 percent. The indexes for automobile retailing (partial) and for long-distance motor carrying also moved lower

The pipeline of price increases remains horrible for The Fed with intermediate demand goods inflation re-accelerating in June…

Finally, margin pressure continues to weigh on American corporates with PPI dominating CPI for the 18th straight month…

…get back to work Mr.Powell

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.