[ad_1]

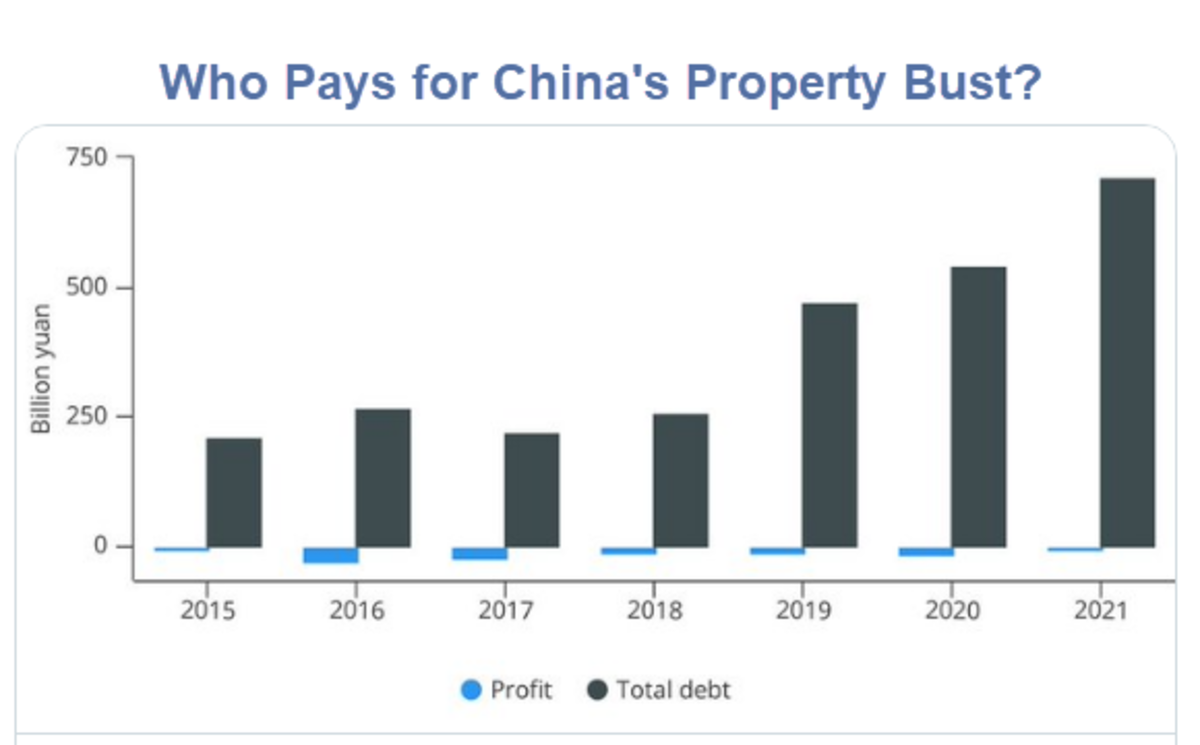

With a major property bust underway, China will not be a global leader in growth.

Bailouts will not help explains Michael Pettis at China Financial Markets.

Shifting Debt Doesn’t Solve Problems

- Good piece by Houze Song on why the property bailout plans being proposed in Zhengzhou and elsewhere are likely to fail. The authorities are simply shifting debt around rather than resolving it.

- I’d add that existence of large amounts of bad debt and overvalued assets means by definition that the recorded collective “wealth” of the system exceeds the real wealth. The gap between the two can be thought of as “bezzle”

- That means that “resolving” a debt problem isn’t a matter of shifting it around or extending liquidity. Ultimately it requires writing down the debt and allocating the associated loss, so that recorded wealth in the overall economy is reduced by the full amount of bezzle.

- In that process and for that reasons someone’s wealth must decline, whether workers, household savers, businesses, local governments, the central government, importers, or anyone else. That is why resolving debt is politically so difficult: someone must take the loss.

- Trying to resolve losses and debt in the property sector by shifting debt around from one entity to another without anyone having to take a loss can never be a solution. All it can do is extend the amount of time during which to resolve the problem.

Payback in the US

Payback in the US for extreme property valuations will come in the form of much lower growth going forward.

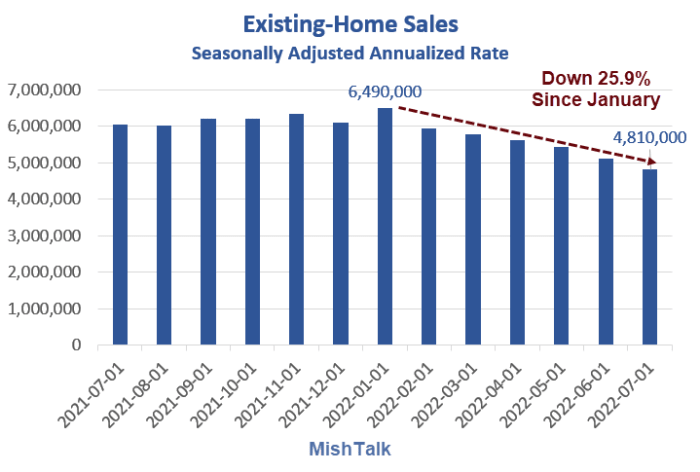

Existing-Home Sales Fall 5.9 Percent, Down Sixth Consecutive Month

Yesterday, I noted Existing-Home Sales Fall 5.9 Percent, Down Sixth Consecutive Month

Key Existing-Home Sales Points

- Existing-home sales fell for the sixth consecutive month to a seasonally adjusted annual rate of 4.81 million.

- Sales were down 5.9% from June and 20.2% from one year ago.

- The median existing-home sales price climbed 10.8% from one year ago to $403,800.

- The median price is down $10,000, however, from last month’s record high of $413,800.

- The inventory of unsold existing homes rose to 1.31 million by the end of July, or the equivalent of 3.3 months at the current monthly sales pace.

- The median existing-home price for all housing types in July was $403,800, up 10.8% from July 2021 ($364,600), as prices increased in all regions. This marks 125 consecutive months of year-over-year increases, the longest-running streak on record.

- Properties typically remained on the market for 14 days in July, the same as in June and down from 17 days in July 2021. The 14 days on market are the fewest since NAR began tracking it in May 2011. Eighty-two percent of homes sold in July 2022 were on the market for less than a month.

- First-time buyers were responsible for 29% of sales in July, down from 30% in June and also in July 2021.

- All-cash sales accounted for 24% of transactions in July, down from 25% in June, but up from 23% in July 2021.

- Individual investors or second-home buyers, who make up many cash sales, purchased 14% of homes in July, down from 16% in June and 15% in July 2021.

The details are instructive.

There were 125 consecutive months of year-over-year increases, the longest-running streak on record.

Scroll to Continue

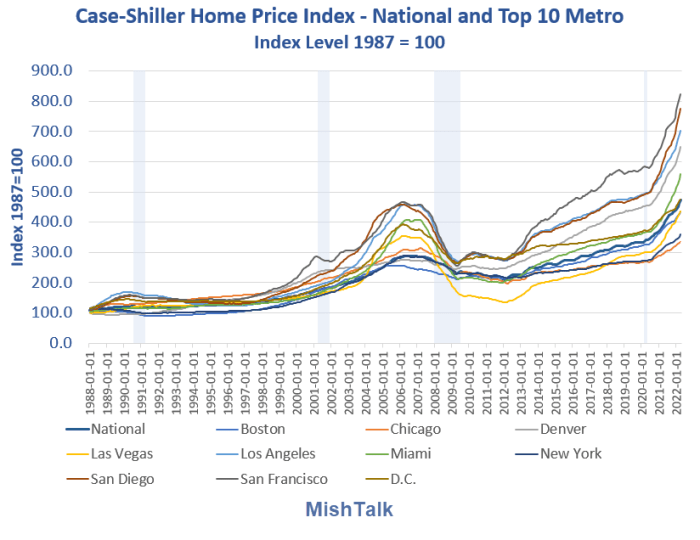

Case Shiller Home Prices

Housing Starts Drop 9.6 Percent, Now Below Pre-Pandemic Level, Led By Single Family

Also note Housing Starts Drop 9.6 Percent, Now Below Pre-Pandemic Level, Led By Single Family

Home prices will either crash or bleed slowly for a long time. A crash would be better.

Because the longer prices stay high, the weaker the housing market will be.

This is a problem of the Fed’s making.

Free money from Congress exacerbated the problem, but absurdly low interest rates by the Fed for over a decade created the housing bubble.

This post originated on MishTalk.Com.

Thanks for Tuning In!

Please Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as they happen. Read the ones you like and you can unsubscribe at any time.

If you have subscribed and do not get email alerts, please check your spam folder.

Mish

[ad_2]

Image and article originally from mishtalk.com. Read the original article here.