[ad_1]

Meta Platforms saw unusual put activity over the last two weeks

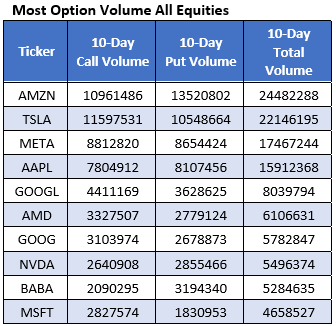

Social media giant Meta Platforms Inc (NASDAQ:META) is making headlines today, after a report from The Wall Street Journal showed the company is preparing to make large-scale layoffs that could impact thousands of employees. But even prior to the news, put traders have been targeting META with unusual fervor. The equity landed on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of 10 stocks that saw the heaviest weekly options volume during the past 10 trading days, which can be seen below.

Per White’s data, Meta Platforms stock saw 8.812,820 calls and 17,467,244 puts exchanged in the last two weeks. This flood of bearish options activity followed a massive earnings miss from the Big Tech staple. However, while put traders became more vocal, the most popular contract by far was the weekly 11/4 100-strike call, followed by the 100-strike call in the weekly 10/28 series.

At midday today, more than 247,000 calls have been exchanged, which is double the intraday average volume. New positions are being opened at the top three contracts, the 100-, 95-, and 96-strike calls, all from the weekly 11/11 series.

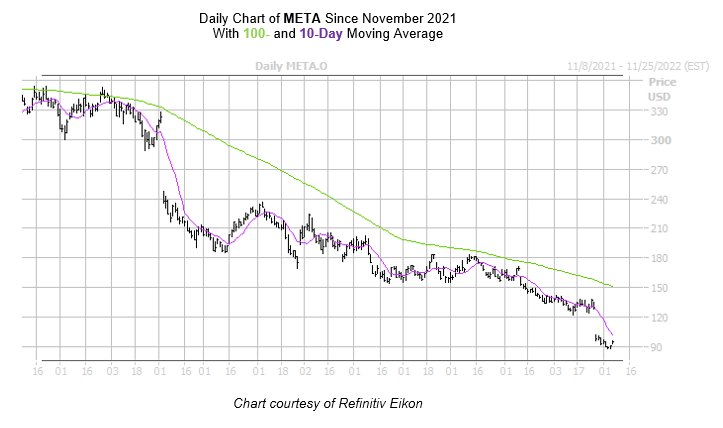

Though META was last seen up 4.9% at $95.24, the positive price action is doing little to help an equity that underperformed for the last 12 months. META sports a 72% year-over-year deficit, with pressure from the 100-day moving average steering the shares lower. More recently, that post-earnings bear gap from late October has the shares’ 10-day trendline in focus.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.