[ad_1]

AUD/USD ANALYSIS &TALKING POINTS

- RBA summary.

- Risk aversion and growth concerns hurt Aussie.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar extends its losing streak against the greenback this week with markets focusing on the broader macro complex. Poor global economic data has been reigniting the recession narrative which has hurt pro-growth currencies like the AUD. This includes China (major importer of Australian commodities) resulting in an overall negative for the Aussie. Earlier this morning the RBA’s Meeting Minutes were released with the following points highlighted in the statement:

- Acknowledgement of high inflationary pressures.

- Strong labor market – lowest unemployment level in 50 years.

- Global risks include China, Russia/Ukraine and monetary tightening.

- The route to normalizing monetary policy is uncertain.

There is clearly a watchful approach being applied by the Reserve Bank of Australia (RBA) and rightfully so with so many moving parts at play but with no strict hawkish bias, the AUD was left vulnerable to outside influences.

From a strictly Australian economic perspective, the country has been comparatively well navigated through 2022 thus far but commodity exports are a concern as demand-side factors continue to deteriorate as economic growth concerns gain traction.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

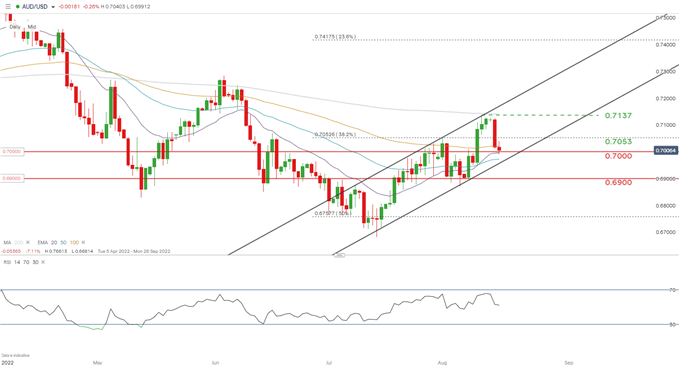

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

AUD/USD price action looks to retest the psychological 0.7000 support zone ahead of key U.S. data tomorrow. The Relative Strength Index (RSI) currently reads around the 50 level which is indicative of indecision and in favor of neither bullish or bearish momentum, echoing the wait and see approach before tomorrow’s releases.

Key resistance levels:

- 0.7053

- 100-day EMA (yellow)

- 0.7000

Key support levels:

- 20-day EMA (purple)

- 50-day EMA (blue)

- 0.6900

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on AUD/USD, with 54% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term bearish disposition.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.