[ad_1]

GOLD OUTLOOK & ANALYSIS

- 20-year highs for DXY restrict gold upside.

- Powell’s address sees rates stretch move higher.

- 1700.00 retest highly probable.

XAU/USD FUNDAMENTAL BACKDROP

Spot gold extended its move lower this Monday now looking at testing July swing lows. The USD hit fresh 20-year highs pressing negatively on the yellow metal. The rates market has overshadowed all other variables at this point and will likely remain in focus pending another fundamental catalyst (see economic calendar below).

U.S. real yields (see 10-year below) shot up after the Jackson Hole Economic Symposium expectedly confirmed a hawkish Federal Reserve thus increasing the opportunity cost of holding bullion – traditionally an inverse relationship.

U.S. 10-YEAR REAL YIELD

Source: Refinitiv

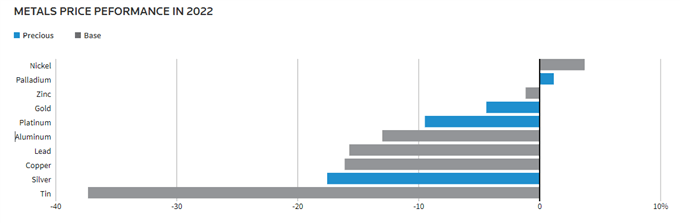

The broader metals complex shows gold standing up relatively well against its peers (see comparison below) with golds safe-haven attribute helping during periods of demand destruction this year as geopolitical tensions and recessionary fears linger. Gold tends to do well in times of systemic risk however, recession fears and geopolitical tensions remain largely isolated to certain regions. Should these factors spread on a more global scale, gold could benefit from the contagion effect.

GLOBAL METALS PRICES YTD (2022)

Source: Reuters

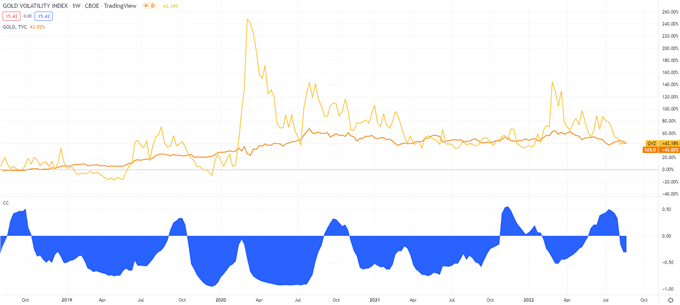

Gold has an interesting positive relationship with volatility while other asset classes such as equities tend to move inversely. The Gold Volatility Index (GVZ) is an estimate of the expected 30-day volatility of returns on the SPDR Gold Shares ETF (GLD) – Source: CBOE. The overlay shown in the graphic below outlines the above and the recent decline in the GVZ index reflects the corresponding downside in spot gold prices. Couple this with a stronger U.S. dollar post-Powell last week Friday, further downside cannot be ruled out.

GOLD VOLATILITY INDEX (GVZ)

Source: TradingView

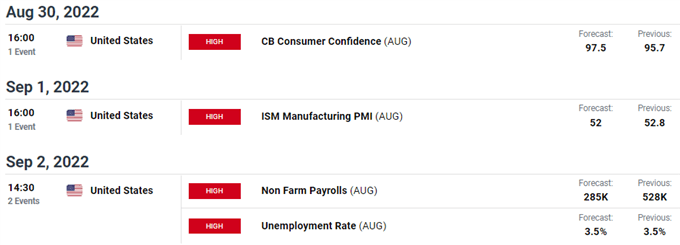

ECONOMIC CALENDAR

Today holds nothing of importance for spot gold but upcoming events may provide some interesting data on the U.S. economy. Markets will be looking forward to these releases to benchmark them against Fed Chair Powell’s speech on Friday and how these new data points fit into the Fed’s aggressive narrative.

Source: DailyFX Economic Calendar

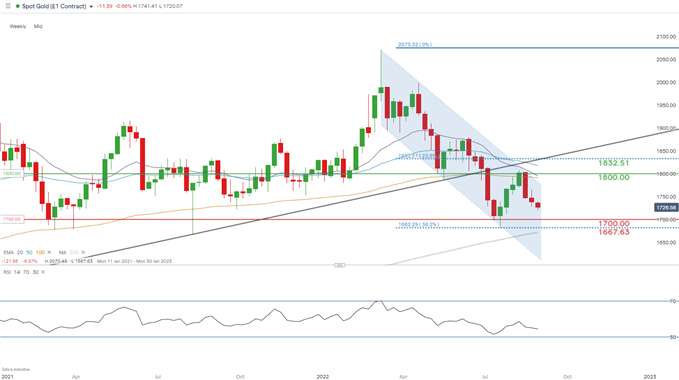

TECHNICAL ANALYSIS

GOLD PRICE WEEKLY CHART

Chart prepared by Warren Venketas, IG

Weekly price action on the spot gold chart above shows markets keeping XAU/USD within the confines of the medium-term downward sloping channel; (blue). The psychological 1700.00 support zone has yet to be pierced since 2020 with bears testing the region 5x since then. While there is still downside potential, the fact that markets are well aware of the Fed’s viewpoint (priced in) anything slightly dovish will likely result in significant declines in the Dollar Index (DXY) giving a boost to gold. The Relative Strength Index (RSI) also shows gold approaching oversold territory which may coincide with the 1700.00/200-day SMA (grey). A confirmed break below may bring substantial downside risk and invalidate the upside reversal call towards 1800.00.

Resistance levels:

Support levels:

- 1700.00

- 1667.63

- 200-day SMA

CAUTIOUS IG CLIENT SENTIMENT

IGCS shows retail traders are currently distinctly LONG on gold, with 83% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning a mixed bias is preferred.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.