[ad_1]

The short answer is YES! YES! YES! You should totally invest in down markets.

However, there is a saying that every time you touch your portfolio, you potentially damage it like a soap of bar being used over and over. Potentially is the keyword and there are definitely risks of meddling with your portfolio at the wrong time, but there can also be opportunities.

In my case, I see touching my portfolio as optimizing it. One of the best time to optimize is when markets are down.

I am fully aware of the buy and hold concept, and I have a good number of those companies. Seven stocks in my portfolio have been present for over 10 years. That includes Microsoft with an amazing 22% annual rate of return excluding the exchange rate !!! Three more stocks in my RRSP have been around for over 5 years.

My core portfolio is pretty consistent and represent 56% of my portfolio. From here, I am trying to find my next holdings to add to the core . I have a few candidates getting closer but in reality it’s not easy to find great consistent winners.

I aim high for my returns. The Canadian banks, utilities and telecoms are the minimum I will accept.

There are really 3 situations to consider trading in a down market and one of them can be wrong but the others are good.

1. New Money To Invest

This one is simple. If you have new money to invest, you want to invest when stocks on are sales.

Now, be careful, not all stocks are on sales, but a lot of them are. Be careful about averaging down as you want to make sure you are averaging down in a solid business.

It’s not about how low the stock is, but where can it go from here when the markets bounce back up.

2. Better Opportunities

This one is tricky, but a springboard to higher returns.

I did that when I sold Algonquin Power & Utilitties Corp and bought Scotia Bank. I explained my reasoning in this post.

It was my first portfolio optimization transaction during this economic downturn. Some investors are pretty negative about ScotiaBank, their Latin American business, and the new CEO but many investors are just ambivalent about it all. It’s a Canadian bank afterall and it’s trading way out of norm. My question to you is how long will a big bank be in the dog house?

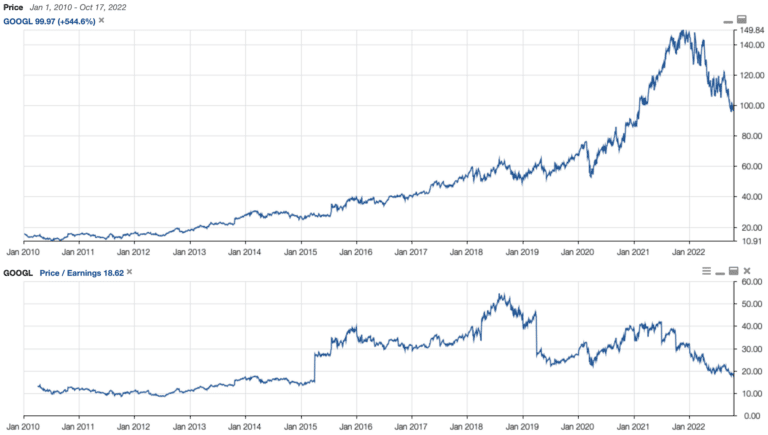

Another example of a trade optimization is my purchase of this giant communication services company; GOOGL. Yup, my telecom sector is up 🙂 I just could not pass on it. The price is just too attractive with a low P/E approaching the 2015 numbers.

I sold Disney. While I love their streaming and brands, the Netflix effect is gone in my opinion. Too many streaming subscription models for customers to buy, I expect someone to start consolidating them under other subscriptions like cable and internet providers (I see this with Telus). As a side note, the Apple One subscription is pretty smart in terms of bundling with Apple TV+, Apple Music, iCloud, and more.

Since GOOGL is trading at a discount, I wanted more exposure to GOOGL. I also sold my Visa in my TFSA account to add GOOGL. Again, both are down and it’s about where to go from here.

While I completely sold my position in Disney, I only reduced my overall VISA position. I still have over 6% of my portfolio exposed to the credit card industry between both Visa and Master Card.

For the record, the Canadian ruling on Visa fees has nothing to do with any of this. That ruling will probably have no impact to VISA and their financials. The impact I forecast is going to be around the points program which were technically funded by the fees. Less fees, less programs. You can expect some changes in the points program world in Canada. Quebec already had a limit imposed by law.

The question I ask myself is where is my money better invested to serve me from here. That’s portfolio optimization and you can do this at any point.

3. Selling Because I Don’t Want To Lose More

This one is tricky. Obviously, you invest for a reason, and it shouldn’t be for a short term loan repayment …

Selling to avoid seeing your portfolio going lower is an emotional action and one you don’t want to do. Trading on emotions is bad … You’ll also be tempted to wait until the down market is over before you invest which is market timing.

In reality, you’ll probably be the last to know when the down market is over and miss part of the recovery. Not only did you lose money, you lost part of the recovery too. That’s a double loss.

There is nothing wrong with selling a loser. The challenge is identifying the loser and you have to validate your investing thesis against the company’s business.

Remember, you don’t invest in a company because of P/E or a dividend yield, you invest in a business because you believe in their future of doing business. If you don’t want to spend time building an investment thesis, buy index ETFs and call it a day.

[ad_2]

Image and article originally from dividendearner.com. Read the original article here.