[ad_1]

Short-term options traders are overwhelmingly bearish on SIG

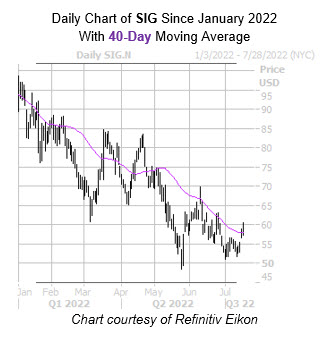

Signet Jewelers Ltd. (NYSE:SIG) is surging, last seen up 5.8% to trade at $59.89. Though there was no clear catalyst for today’s positive price action, it is possible the security is enjoying broader market tailwinds after a strong batch of earnings reports. While shares are still running into resistance at the $60 level, which has been in place since June, SIG is now eyeing its third-straight win, as well as its first close above the 40-day moving average in over one month.

Short sellers are already running for the exits, with short interest down 12% in the most recent reporting period. However, the 7.15 million shares sold short still make up 15.8% of Signet Jeweler stock’s available float, or over one week’s worth of pent-up buying power.

Meanwhile, short-term options traders are overwhelmingly bearish. This is per SIG’s Schaeffer’s put/call volume ratio (SOIR) of 4.30, which ranks higher than all readings from the past year. In simpler terms, these traders have never been more put-biased.

Digging deeper, Signet Jewelers stock continues to trade at an extremely low forward price-earnings ratio of 4.26, and a price-sales ratio of 0.41. SIG also offers a dividend yield of 1.4%, with a forward dividend of 80 cents. Moreover, the fine jewelry company maintains a manageable balance sheet with $940.5 million in cash and $1.45 billion in total debt.

Although its trailing 12-month revenues have increased 2% since its 2022 report, its trailing 12-month net income is already down a massive 29%, making Signet Jewelers stock a massive short- and long-term risk. In general, this diamond business presents too many uncertainties for the profit potential to be worth the possible losses.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.