[ad_1]

Dow Jones, S&P 500, Bank Earnings, Netflix, Tesla – Talking Points

- Dow Jones continues advance away from support at 30,000

- S&P 500 breaks through 3950, resistance at 4000 coming into view

- Netflix pops as subscriber loss not as bad as originally feared

Equities pushed higher once again on Thursday as traders remained positive as we head into corporate earnings season. Sentiment has been strong following bank earnings last week, while Netflix’s quarterly report on Tuesday saw shares jump as subscriber losses came in under estimates. All eyes will now shift to Tesla, which is set to report after the closing bell today. The week has been quiet on the data front for US market participants, as traders eagerly await next week’s FOMC meeting. Prior to that, tomorrow’s ECB meeting could further bolster a buoyant Euro, which may aid additional equity gains.

After putting in a test of the 30,000 zone in June, the Dow Jones index has slowly pulled away from the major psychological threshold. The Dow has been under significant pressure of late as the growth-sensitive value names have retreated as recession fears grow. This has brought back Nasdaq outperformance, as investors digest whether rates may move lower in the near-term. Having broken through the 50-day moving average during yesterday’s rally, the Dow may look to fill a lingering gap from June. Beyond that, sustained momentum may bring a test of the 100-day MA at 32,827. If this bear market rally is faded, support at 30,800 may represent the first line of defense.

Dow Jones Daily Chart

Chart created by TradingView

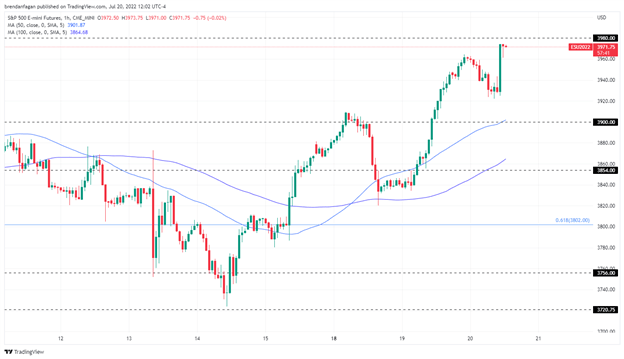

The S&P 500 has roared back to life over the last few sessions, with the recent dip to 3720 catching a very significant bid. Whether this represents the market searching for a bottom or if it is just a bear market rally remains to be seen. Earnings remain front of mind for ES traders, with the index passing the first test after Netflix hurdled over what was an extremely low bar. Tesla earnings now take centerstage, with Elon Musk already in the spotlight for his legal battle with Twitter. The king of all risk events looms next week, with the FOMC set to raise interest rates by another 75 basis points. Until then, ES remains penned in by resistance at 3980. If this area can break with a degree of momentum, price may look to revisit prior support at 4080.

S&P 500 Futures (ES) 1 Hour Chart

Chart created with TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.