[ad_1]

ISM MANUFACTURING KEY POINTS:

- September ISM manufacturing falls to 50.9 from 52.8 in August, missing expectations for a more modest decline to 52.2

- The slowdown in factory activity suggests the U.S. economy may be teetering on the edge of a recession, undermined by higher interest rates

- New orders and the employment index plummet, while the production gauge remains somewhat steady

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Crude Oil Price Rallies as Traders Mull Sizeable OPEC+ Cuts This Week

A gauge of U.S. factory activity grew for the 28th consecutive month in September, but decelerated markedly at the end of the third quarter, narrowly averting contraction territory, a sign that the economic outlook continues to deteriorate, undermined by rising interest rates aimed at curbing rampant inflation.

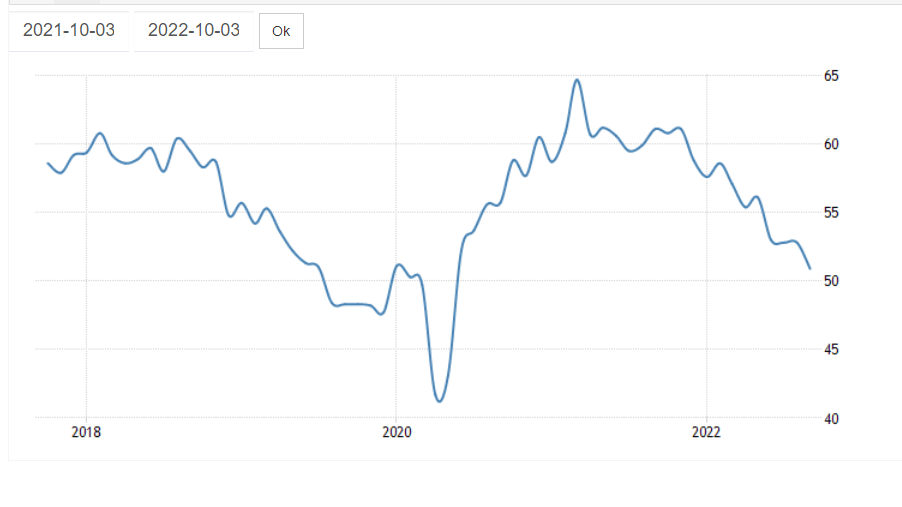

According to the Institute for Supply Management (ISM), manufacturing PMI slumped to 50.9 from 52.8 last month, hitting its lowest level since May 2020 when the COVID-19 pandemic brought the economy to a standstill, and missing expectations for a more modest decline to 52.2. For context, any figure above 50 indicates growth, while values below that level signify contraction in the sector.

ISM DATA AT A GLANCE

Source: DailyFX Economic Calendar

Looking under the hood, the goods producing sector was hampered by a steep drop in the forward-looking new orders index, which plunged to 47.1 from 51.3. Employment also contributed to the poor performance after falling to 48.7 from 54.2, indicating that the labor market may be losing strength amid tighter financial conditions.

Last but not least, the prices paid index continued to moderate, retreating to 51.7 from 52.5 in August, the lowest reading since June 2020. Softening cost burdens for manufacturers, if sustained, could help ease inflationary pressures in the economy, paving the way for less forceful monetary policy tightening over the forecast horizon.

Recommended by Diego Colman

Get Your Free Equities Forecast

ISM MANUFACTURING CHART

Source: TradingEconomics

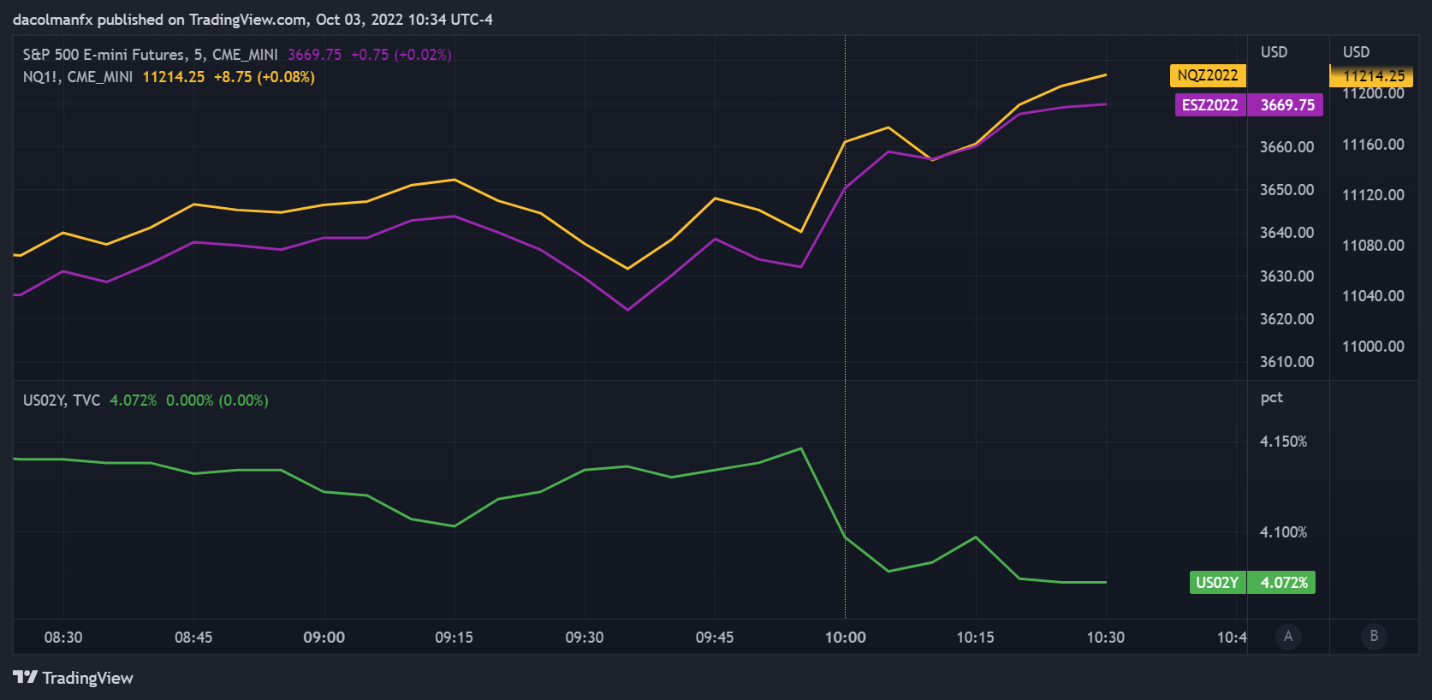

Immediately following the release of the ISM results, U.S. Treasury yields plunged, boosting stocks and allowing the S&P 500 and Nasdaq 100 to extend their daily gains. While the weak report does not bode well for the economy, traders are betting that the sharp slowdown may induce the Fed to adopt a less aggressive hiking bias, a scenario that could prevent a more substantial economic downshift in the future. In this context, bad data may be good news for stocks in the coming days. That said, the next key event to follow is Friday’s NFP report.

S&P 500, NASDAQ 100 AND TREASURY YIELDS

Source: TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.