[ad_1]

US Stock Market Key Points:

- The S&P 500, Dow Jones and Nasdaq 100 posed a bounce after the release of FOMC minutes, which tempered into the close.

- Mixed corporate earnings and mixed economic data raised questions about the health of the economy.

- FOMC minutes suggested further interest rate hikes will continue until inflation is subdued.

Most Read:US Dollar Forecast: DXY Index, USD/JPY Slip After July FOMC Minutes

The major US indices reversed a portion of early-session losses after the release of FOMC minutes from the July rate decision. The indices still finished in the red after opening the session with weakness. A major driver continues to be recessionary fears, and the meeting minutes highlighted a Federal Reserve that doesn’t look to be near a policy pivot.

The Dow Jones lost 171.69 points and closed 0.50% lower, while the S&P 500 ended with a loss of 0.72%.Nearly every sector in the S&P 500 posted declines, except for Energy, after US government data showed a large drawdown in crude inventories, pushing the price of crude oil higher.

The negative tone in stocks was driven by Target after they missed earnings expectations by a wide margin ahead of the open. And as looked at yesterday, the S&P 500 had just found resistance at the 200 day moving average, which continued to hold through today’s session. On the other hand, there was a more positive tone from Lowes, as they reported profits that outpaced analyst projections.

Meanwhile, the Nasdaq 100 index came under further pressure closing 1.21% lower, at 13,470.86 points. US multinational semiconductor company, Analog Devices led the decline despite beating corporate earnings expectations because the company warned that economic uncertainty is beginning to affect bookings.

S&P 500 and 200 Day SMA- Daily Chart Prepared using TradingView

On the economic front, and in-line with yesterday’s disappointing Housing Starts numbers, mortgage applications for the week ending on August 12th fell to its lowest level in twenty-two years. According to the Mortgage Bankers Association, data showed that both home purchases and refinance applications declined despite a slight decrease in interest rates amid uncertainty surrounding the US economy. The 30-year mortgage stood at 5.45% vs a 5.99% high seen in June, yet data remained dim.

Surprisingly enough, retail sales data added to the debate as to whether the economy is on solid footing. According to the latest release of the US Census Bureau, the pace of the sales at US retailers was unchanged last month. After rising 0.8% in June, retail sales were flat in July amid a drop of auto and gas station sales. However, compared to twelve months ago, overall retail sales rose 10.3% y/y (vs 8.5% in June) as consumers shifted to online spending.

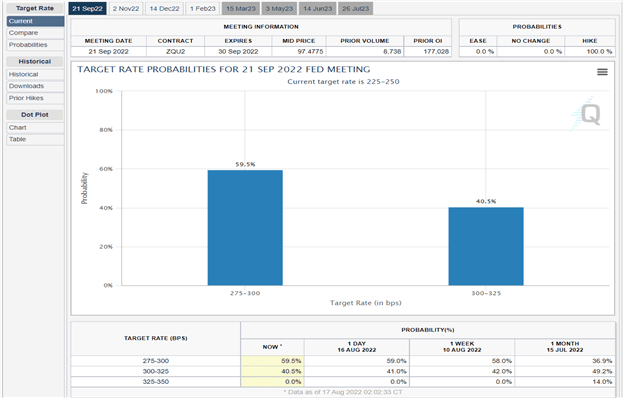

Such mixed data and still-elevated inflation may contribute to the FOMC’s decision to continue raising interest rates (without explicitly hinting a pace) until further signs of easing are visible. The market is currently pricing-in a 59.5% chance of a 50-basis point rate hike in September.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Cecilia Sanchez-Corona, Research Team, DailyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.