[ad_1]

Volatility has started dropping but is still elevated compared to a “normal” market. In high volatility environments, option premiums increase.

Higher volatility means a 15 delta put is now further away from the stock price than it was last week.

Selling options further away from the stock price gives us a greater margin for error when trading option strategies such as an iron condor.

Today, we are using Option Omega to look at a backtest on SPX iron condors.

An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received, while the maximum potential loss is also capped.

To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Traders should have a neutral outlook on the stock and ideally look to enter when the stock has a high implied volatility percentile.

Let’s work through the backtest parameters.

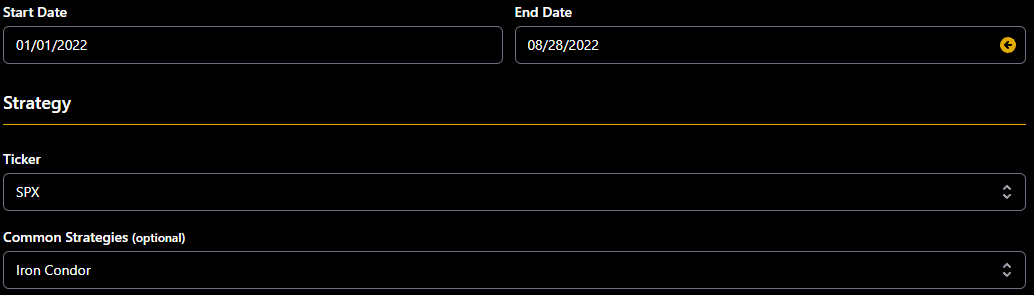

The first step is to pick our start dates.

For this backtest, we will use January 1st, 2022, to August 28th, 2022.

Then we select our ticker (SPX) and strategy (Iron Condor):

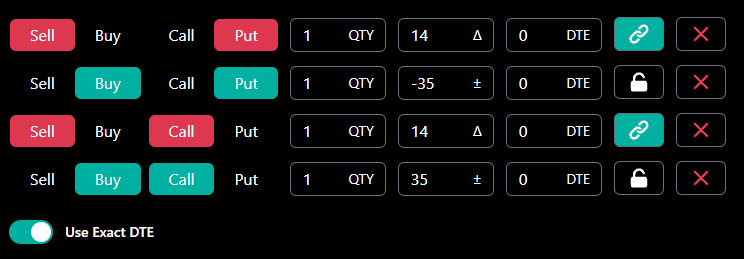

Step 2 is to select our delta.

For this test, we will sell the 14 delta put and call and place the long leg 35 points away.

We’re also going to be looking at a 0 DTE Condor, which has exploded in popularity in recent years.

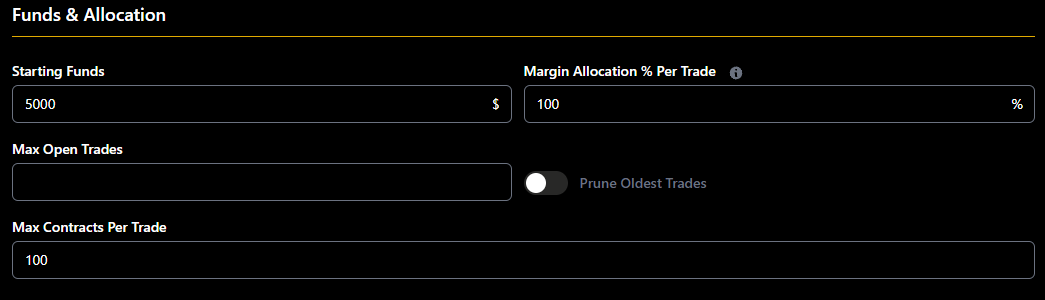

We will start with a low balance of $5,000 but allow 100% allocation to any trade.

It’s not typically a good idea to allocate all of your capital to one trade, but it’s fine for this backtest.

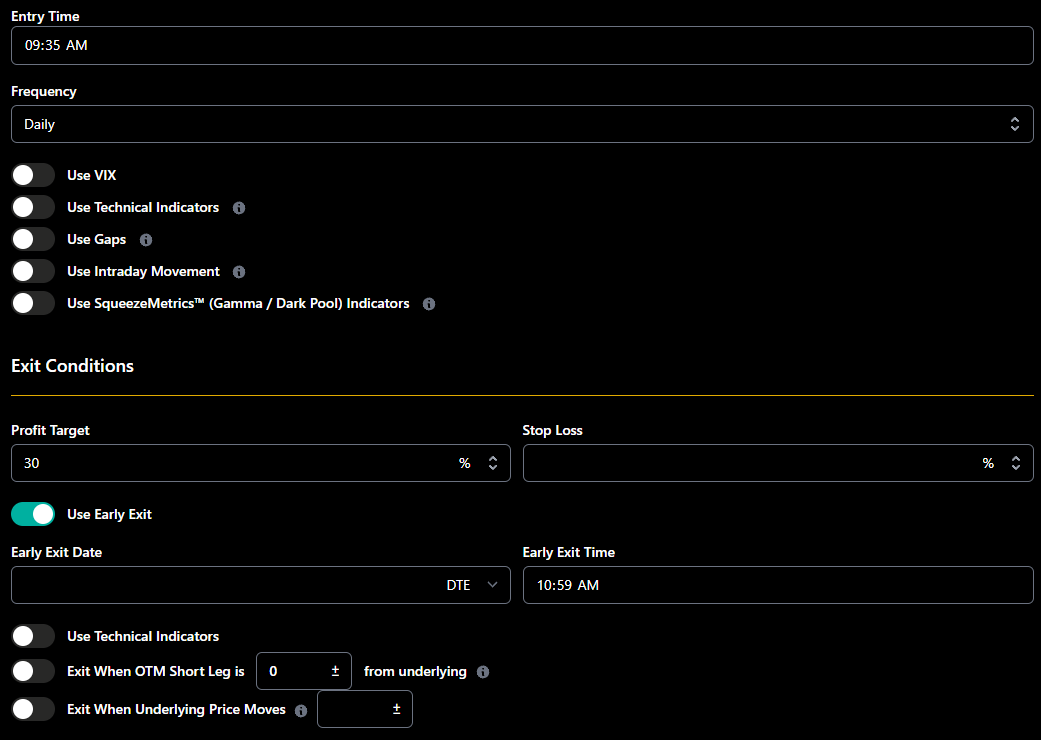

For this backtest, we open the trade at 9:35am, have a 30% profit target, and a timed exit of 10:59am.

* Advertising disclosure: All opinions expressed are our own. We may receive compensation from some of our partner brands in this article. However, we only promote brands we trust and have personally used.

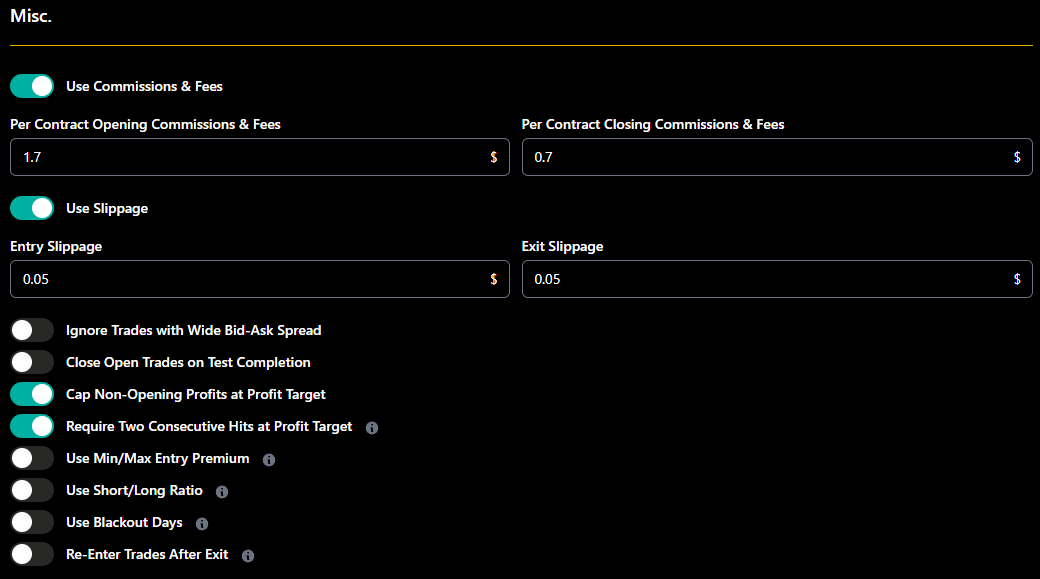

An important aspect of any backtest is making it as realistic as possible, so using the software, we can add in commissions and slippage.

We estimate $1.70 per contract for trade opening and $0.70 for closing.

Most trades will not get filled at the exact mid-point of a spread, so we will assume a $0.05 slippage on entry and exit.

Now that we have all our parameters in place let’s evaluate the results.

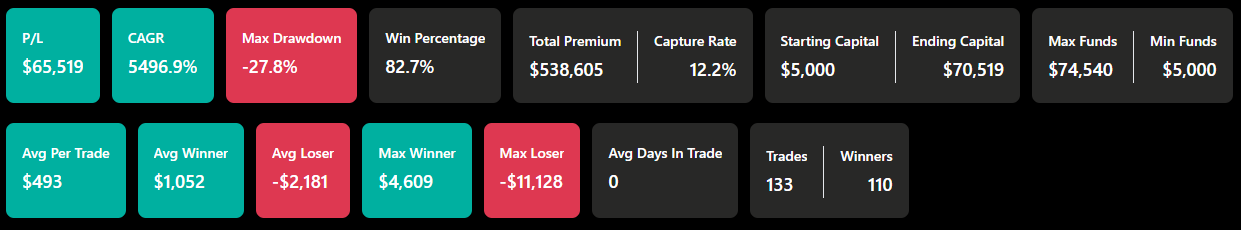

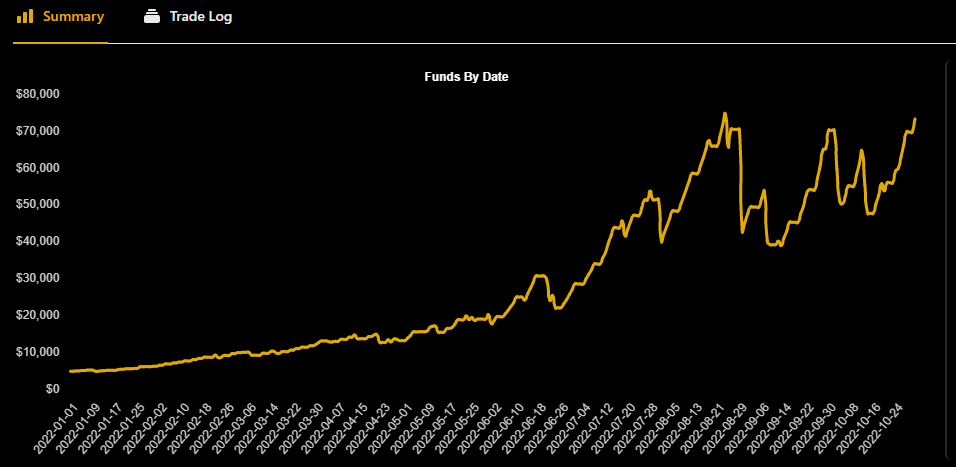

The test took around 15 seconds to run and showed overall positive results.

Out of 133 trades, there were 100 winners for a win rate of 82.7%.

Pretty impressive so far!

The average winning trade was $1,052, and the average losing trade was -$2,181, with a max drawdown of -27.8%.

The overall CAGR is an impressive 5496.9%, so this trade seems to work very well.

This is also during a period that regularly saw VIX spikes up to the 32-28 range.

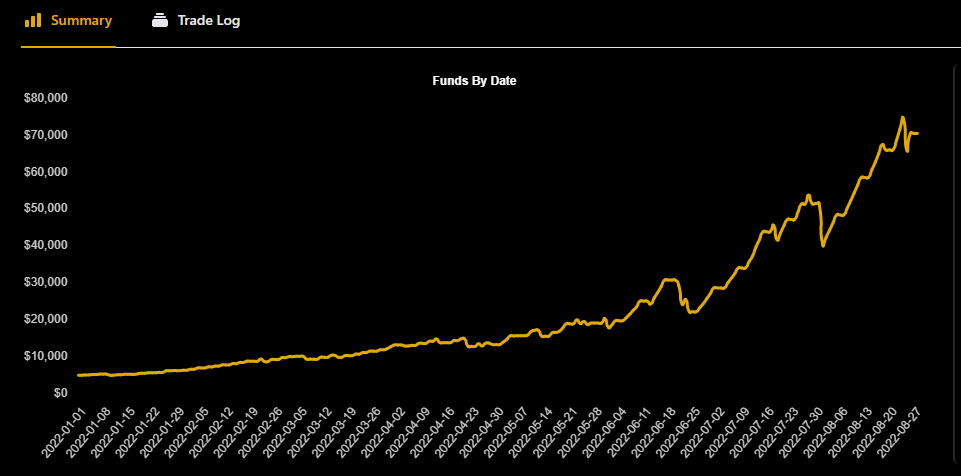

With this strategy, profits are re-invested, resulting in a larger trade size towards the end of the test period.

This can be both a good and a bad thing.

The overall equity curve is fantastic, but the losses in dollar terms become much larger as the trade progresses, with the biggest losing trade being -$11,128.

That loss came at the start of August.

That being said, the gains get bigger as well, with the biggest winning trade being the very last trade on August 26th.

Perhaps when trading this type of strategy, it might be worth taking some profit out of the account and putting it into dividend stocks, paying down the mortgage, or even taking a nice holiday!

The full trade log can be viewed within the platform and can even be exported to Excel if you want to drill into the data in more detail.

Here is a copy of the Excel trade log for ease of use.

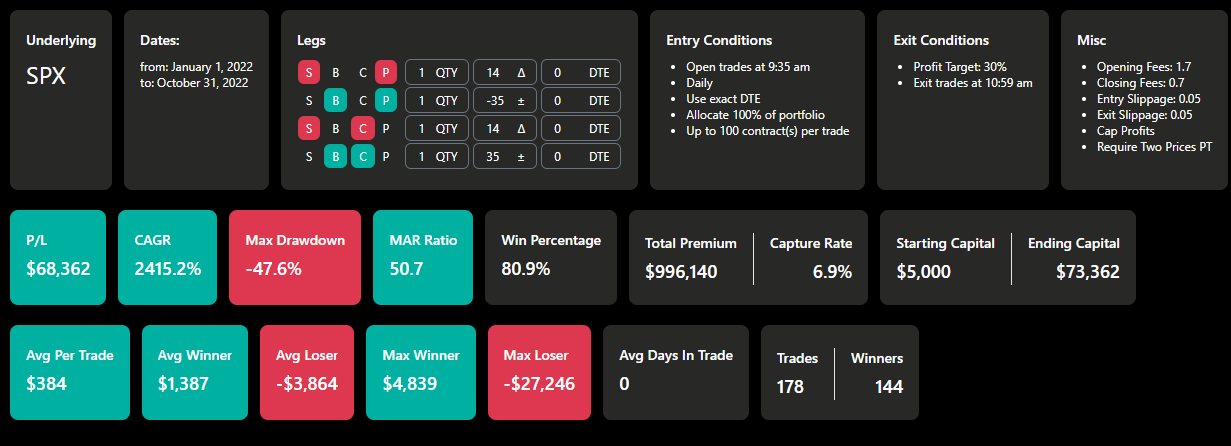

Here are the updated details on the backtest including the August to October period.

The strategy did not perform as well during this period. Max drawdown is larger, but the strategy has recovered to around its high water mark by the end of October.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

This trading strategy would require a lot of active management, with trades being opened and closed almost every day.

If you have questions about this strategy, please let us know.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

* Advertising disclosure: All opinions expressed are our own. We may receive compensation from some of our partner brands in this article. However, we only promote brands we trust and have personally used.

[ad_2]

Image and article originally from optionstradingiq.com. Read the original article here.