[ad_1]

(Bloomberg) — Former Treasury Secretary Lawrence Summers said that the dollar has further scope for appreciation given an array of fundamentals behind it, and expressed skepticism about the effectiveness of any Japanese intervention to turn the tide for the yen.

Most Read from Bloomberg

“It’s remarkable that people were saying the dollar’s day was past not very long ago given its current strength,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “My guess is that there’s room for this to continue.”

Summers highlighted that the US has a “huge advantage” in not being dependent on “egregiously expensive foreign energy.” Washington also mounted a stronger macroeconomic response to the pandemic, and the Federal Reserve is now moving faster to tighten monetary policy than its peers, he also noted.

“All of those various factors are making us a safe haven, a mecca for capital — and that’s causing resources to flow into the dollar,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television.

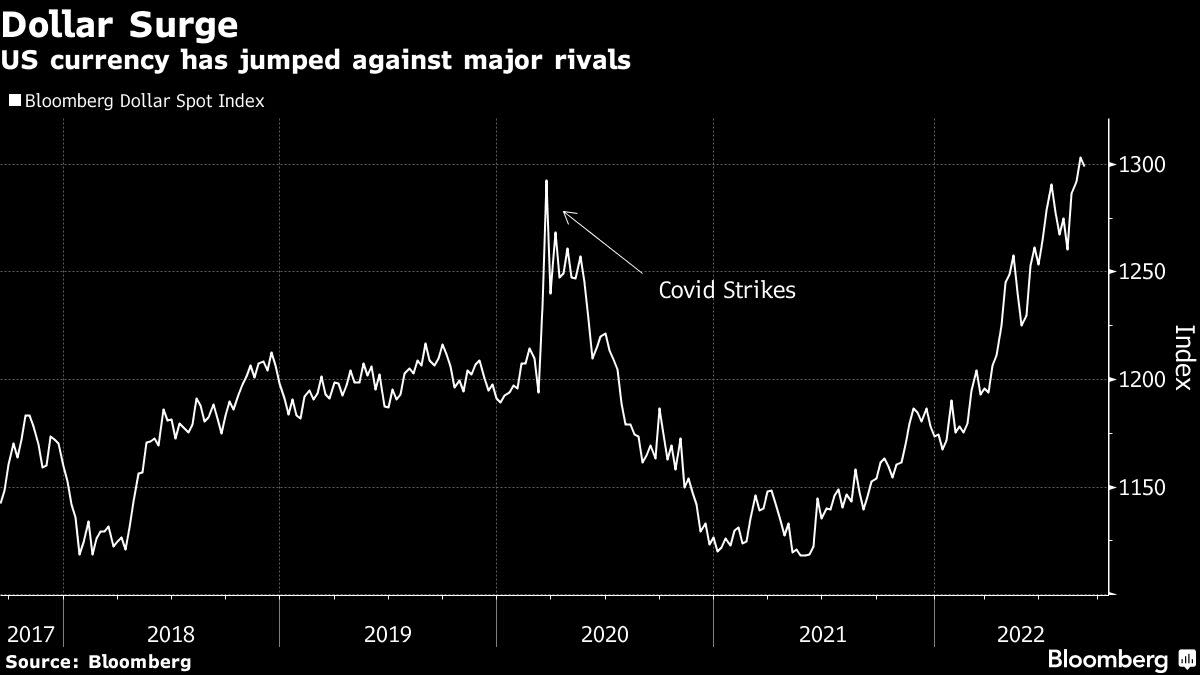

The Bloomberg Dollar Spot Index is up about 11% since the start of the year, and hit a record high this week. On Tuesday, the dollar hit the highest since 2002 against the euro, at 0.9864, while on Wednesday it reached the strongest since 1998 versus Japan’s currency, at 144.99 yen.

The euro remains above its lows from more than two decades ago, when it slid below 83 US cents.

“In some ways the relative fundamentals of the United States compared to Europe are even stronger now than they were then,” Summers said.

Japan’s currency has depreciated even more rapidly than the euro, leaving it down more than 19% against the dollar so far this year. That’s spurred escalating warnings from Japanese officials, with Bank of Japan Governor Haruhiko Kuroda holding a meeting with Prime Minister Fumio Kishida on Friday as the latest sign of concern.

Japanese officials haven’t ruled out any options, amid discussion among market participants about the chances of intervention to buy yen and sell dollars. Japan hasn’t done that since 1998, when it teamed up with the US — at a time when Summers was serving as deputy Treasury secretary — to help arrest a yen slump.

“I tend to be skeptical that intervention can have sustained impacts,” Summers said. “The capital markets are just so big, even relative to the resources that the authorities have, that I would be surprised in today’s world that interventions could have large, sustained impacts on maintaining the value of the yen.”

For its part, the US Treasury on Wednesday stuck by its reluctance to support any potential intervention into currency markets to halt the yen’s depreciation.

Read More: Yen Plunge Fails to Shift US Treasury Stance on FX Intervention

Summers highlighted that the more fundamental issue for the yen is Japan’s interest-rate settings — both short and longer-term. The BOJ has kept its negative short-term policy rate, along with a 0.25% cap on 10-year yields.

Raising those rates “is not a simple proposition, given the magnitude of debts in Japan,” Summers said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Image and article originally from finance.yahoo.com. Read the original article here.