[ad_1]

- What happened to “Balance the Budget”?

- Mountains of money cause inflation. $15 trillion in recent spending is a mountain of money

- Inflation causes increases in interest rates, lowering bond prices, unless the Fed intervenes by printing more money — a paradox

- Increases in interest rates cause reductions in stock values because earnings are discounted at a higher rate

In case you hadn’t noticed, the recent $2.8 trillion spending package brings spending over the past decade to $15 trillion, which is a mountain of money. Inflation cannot be controlled when the money supply gushes into the economy. The Fed cannot control inflation when it is complicit in creating it.

How much is the $15 trillion in recent spending

Here are a couple ways to put $15 trillion into perspective.

According to CNBC just one trillion is a lot of money:

- If you paid out $1 per second, to settle a $1 million debt would take less than 12 days. To pay off $1 billion would take 32 years. Paying off $1 trillion at a dollar per second? 32,000 years.

- A trillion is a 1 followed by 12 zeros, like this: 1,000,000,000,000.

- A trillion square miles would cover the surface of 5,000 planet Earths.

- A trillion people would be 10 times more than have ever lived (based on the Population Reference Bureau’s very rough estimate of 108 billion humans ever).

- A trillion dollars is enough to give $3,195 to every man, woman and child in the United States. (Author’s comment: we actually got this helicopter money doled out in bigger checks)

- For a typical U.S. household making $50,000 per year to earn enough to pay off a $1 trillion debt would take 20 million years.

$15 trillion is substantially more than we’ve spent on our recent very expensive wars:

Money printing and inflation

Our government is creating new money, spending future tax payments, and generating “Cost-Push Inflation” where there’s too much money chasing too few goods. Current inflation is mostly “Demand-Pull” caused by supply shortages, so expect more ahead from Cost-Push Inflation.

The government doesn’t actually run the printing presses to create all this new money. The Treasury issues bonds. Note that your relief check says “US Treasury.” Under normal circumstances there are plenty of buyers for these bonds, including foreign governments like China and Japan, but these are not normal times, so the Federal Reserve is buying most of the Treasury’s new bonds. Yes, the Fed is complicit in creating inflation.

Modern Monetary Theory (MMT) argues that the government can solve economic problems by printing money until it causes inflation, at which time taxes need to increase to rein in that money. Quantitative Easing (QE) did not bring inflation as measured by the Consumer Price Index (CPI), so that experiment has been declared a success, but the reality is that QE did inflate stock and bond prices, so there was inflation but not in the usual metric. This has created a super bubble in the US stock market that has only begun to burst.

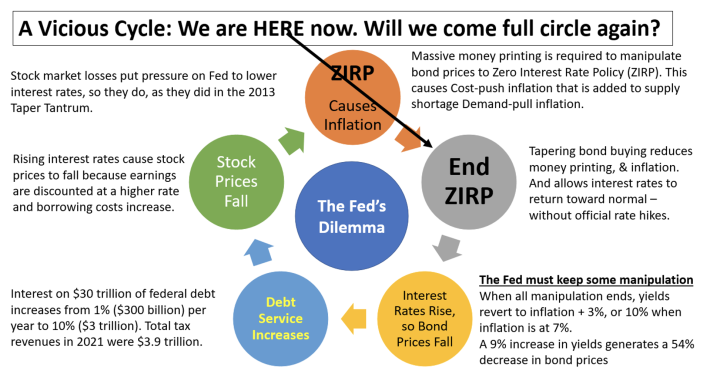

The inflation bear has been poked viciously by recent spending, and there’s no sign that taxes will remedy the problem. The Fed is just pretending to control inflation, as shown in the following diagram:

The falling dominoes

Rising interest rates reduce the values of both stocks and bonds. Stock prices decline because future earnings are discounted at a higher rate of interest. Growth stocks are most affected. Bond prices decline because that’s how they produce a higher yield on their coupon.

Protection from inflation and bursting bubbles

In normal situations, investors can protect themselves from bursting stock and bond bubbles by moving to the safety of cash, but inflation fears argue against this move. “Safe” in these conditions is hedged against inflation, like the following investments:

Inflation protections

- Precious metals, especially gold

- Cryptocurrencies like bitcoin

- TIPS: Treasury Inflation-Protected Securities

- Inflation hedged stocks like materials & staples

- Commodities, including energy & food

- Some real estate, like farmland

- Some foreign stocks

Conclusion

Unconventional times require unconventional thinking.

Paper money is called “fiat currency” because it only works if we all agree it works – by fiat. Recent interest in alternative money like gold and cryptocurrencies is evidence that some are losing confidence in fiat money. Inflation is becoming a big concern.

The advice in the Talmud is worthy of consideration, namely: Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.

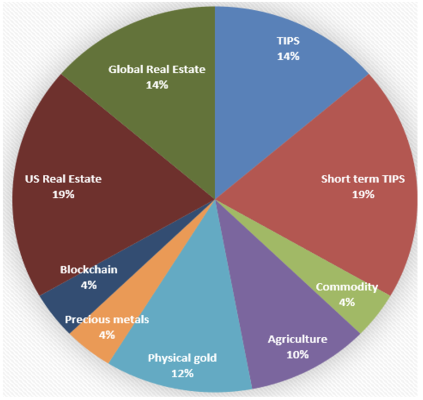

With the current inflationary threats, Talmud-based allocations could look something like the following, where the real estate allocations include your home.

Source: the Talmud and the Boomer Investing Show

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.