[ad_1]

He who panicked first, panicked best? Some of the charts are just kind of funny.

By Wolf Richter for WOLF STREET.

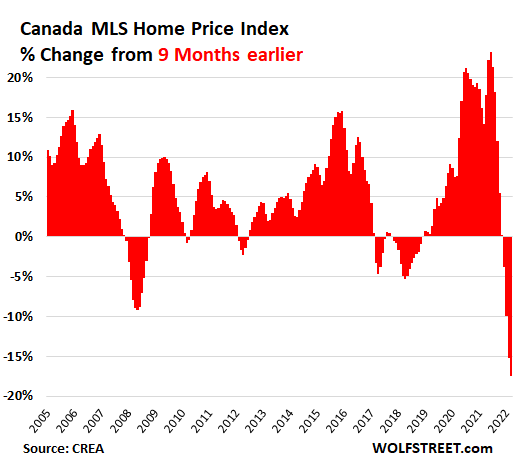

Home prices in Canada dropped 1.2% in December from November, the ninth month-to-month decline in a row, and are now down 17.4% from the peak in March 2022, and down by 7.5% from a year ago, according to the Canada MLS Home Price Index by the Canadian Real Estate Association (CREA). Sales plunged by 39% year-over-year.

In the two years from the beginning of the Bank of Canada’s money-printing binge in March 2020 to the beginning of the rate-hike cycle in March 2022, the composite benchmark price had spiked by 54%. This spectacular housing bubble, on top of an existing housing bubble, was entirely fabricated by central bank money-printing and interest rate repression. This was a global phenomenon, triggering massive global inflation. So now comes the invoice for the drunken money-printing party.

The composite benchmark price of the Canada MLS Home Price Index for all types of homes has now dropped by C$151,300 in the nine months, to C$717,000.

That 17.4% drop in the benchmark price from the peak in March was by far the largest and fastest nine-month drop in CREA’s data going back to 2005. In Canada, there wasn’t much of a housing bust during the Financial Crisis, but now the housing bust is here, and it’s real, and it’s not seasonal or whatever. Homes are being repriced on a large scale:

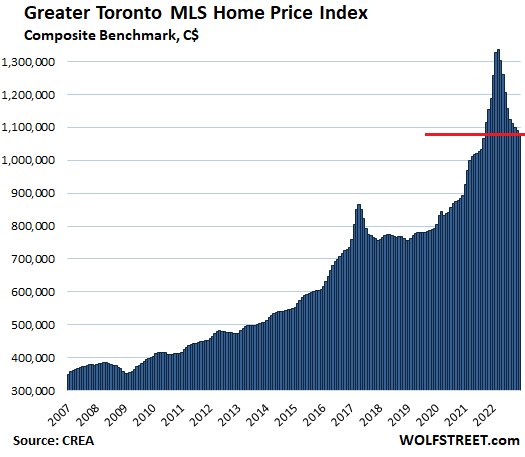

Greater Toronto Area: The MLS Home Price Index composite benchmark price dropped 0.8% for the month to C$1.08 million:

- From peak in March 2022: -19.0%

- Year-over-year: -8.9%

- Drop in 9 months from peak in March 2022: -C$253,600

- Jump in 9 months to peak in March 2022: C$313,000

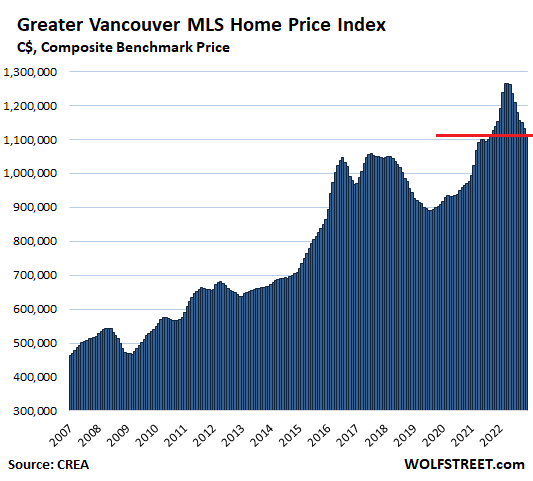

Greater Vancouver: The MLS Home Price Index composite benchmark price dropped 1.5% for the month to C$1.11 million:

- From peak in April 2022: -11.9%

- Year-over-year: -3.3%

- Drop in 8 months from peak in April 2022: -C$150,400

- Jump in 8 months to peak in April 2022: +C$163,300

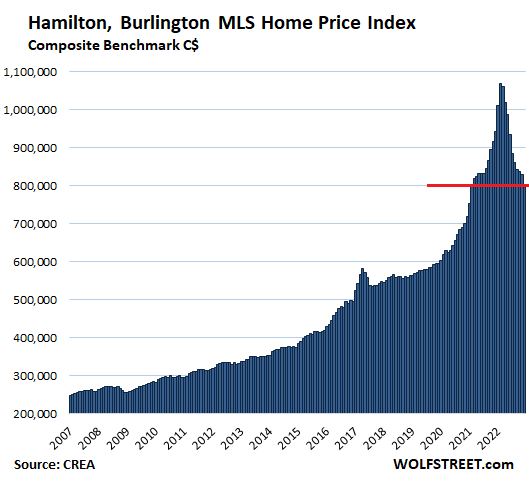

Hamilton-Burlington metro: Prices made even more spectacular moves than those in Toronto during the pandemic: From the beginning of the Bank of Canada’s money-printing binge in March 2020 to the price peak in February 2022, the composite benchmark price spiked by 70%. Now they’re heading back down even faster and more spectacularly.

The MLS Home Price Index composite benchmark price plunged another 3.3% for the month to C$803,200, the lowest since February 2021:

- From peak in February 2022: -24.9%

- Year-over-year: -14.8%

- Drop in 10 months from peak in February 2022: -C$265,600 – going down faster than up.

- Jump in 10 months to peak in February 2022: +C$244,400

Charts like this are just kind of funny:

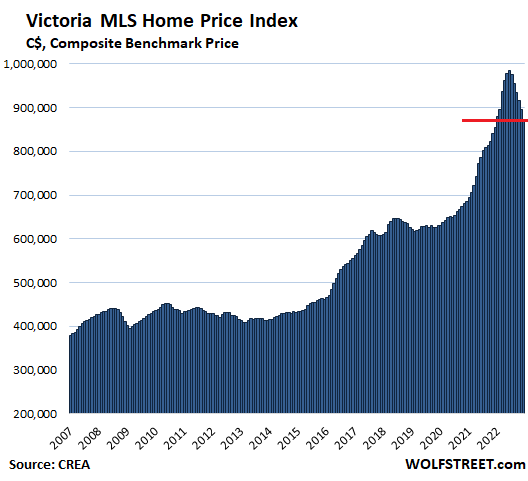

Victoria: The composite benchmark price dropped another 2.4% for the month to C$872,700:

- From peak in June 2022: -11.4%

- Year-over-year: +2.3%

- Drop in 6 months from peak in June 2022: -C$112,800

- Jump in 6 months to peak in June 2022: +C$132,200

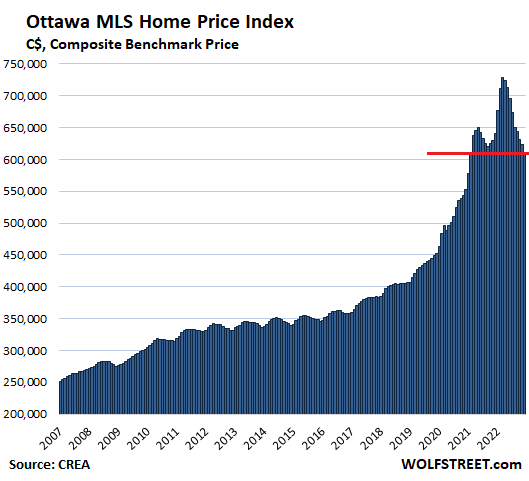

Ottawa: The composite benchmark price dropped 2.0% for the month to C$610,800:

- From peak in March 2022: -16.1%

- Year-over-year: -4.6%

- Drop in 9 months from peak in March 2022: -C$117,400 – going down far faster than up

- Jump in 9 months to peak in March 2022: +C$85,500.

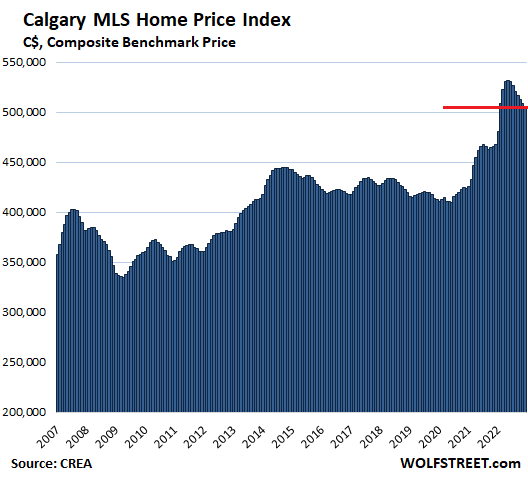

Calgary: Despite the oil boom, home prices are now falling in Canada’s oil capital. The composite benchmark price dropped 0.6% for the month, the seventh month in a row of declines, to C$506,400:

- From peak in May 2022: -4.8%

- Year-over-year: +8.1%

- Drop in 7 months from peak in May 2022: -C$25,800

- Jump in 7 months to peak in May 2022: +C$67,200:

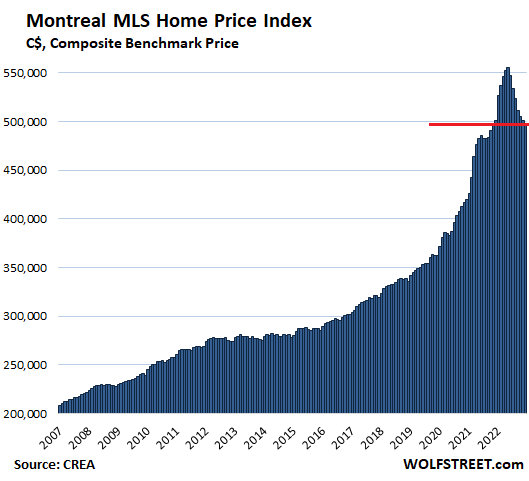

Montreal: The composite benchmark price dropped 0.6% for the month to C$497,800:

- From peak in May 2022: -10.4%

- Year-over-year: -0.7%

- Drop in 7 months from peak in May 2022: -C$57,800

- Jump in 7 months to peak in May 2022: +C$64,600:

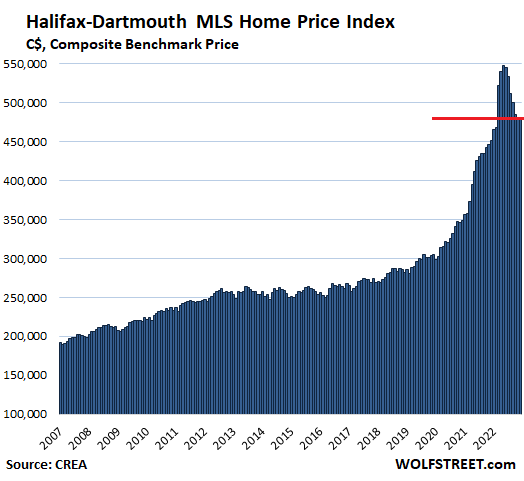

Halifax-Dartmouth: After years of housing sanity, the money-printing bug turned buyers’ brains to mush. From February 2020 to the peak in May 2022, the benchmark price spiked by 81%.

The composite benchmark price, after huge plunges in the prior months, ticked up a hair in December (+0.2%), to C$480,600:

- From peak in May: -12.3%

- Year-over-year: +6.3%

- Drop in 7 months since peak in May: -C$67,200

- Jump in 7 months to peak in May: +C$105,200:

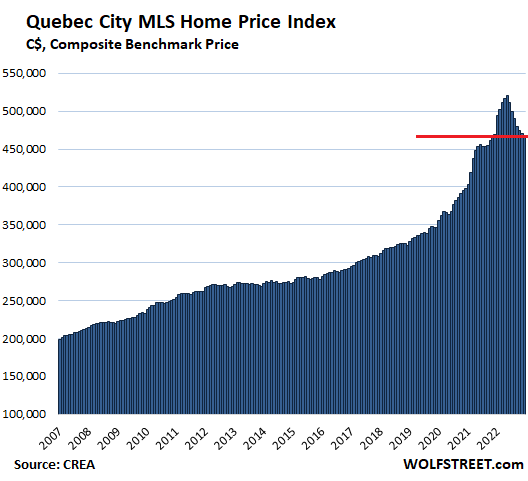

Quebec City: The composite benchmark price dropped 0.6% for the month to C$468,100:

- From peak in May: -10.0%

- Year-over-year: -0.3%

- Drop in 7 months since peak in May: -C$52,200

- Jump in 7 months to peak in May: +C$59,400:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Image and article originally from wolfstreet.com. Read the original article here.