[ad_1]

News of the Albertsons ACI and Kroger KR merger took up a lot of headlines in October. After all, the deal would merge two of the nation’s largest supermarket chains and create the fifth-largest retail pharmacy operator in the U.S.

Let’s see if it’s time to buy shares of either grocery retailer as we progress through 2023.

Merger Scrutiny

Pending litigation and arbitration, the merger will see Kroger acquire Albertsons for $34.10 per share in a deal valued at $25 billion. Both Albertsons and Kroger have argued that their merger will actually lower consumer prices and give them the ability to compete with the likes of Walmart WMT and Amazon AMZN.

Still, eyeing the individual prospects of both Kroger and Albertsons is very much ideal as there is much scrutiny surrounding the proposed merger.

-Store closures and layoffs are a concern with such a large number of stores being combined and many overlapping each other in proximity.

-Regulators and the Biden administration have stated they will scrutinize these types of mega deals across industries due to the effect they have on the economy, including labor markets.

-Consumer price spikes are also a concern as Kroger and Albertsons are already the largest and second-largest grocery operators in the U.S., on top of already higher inflation.

-Lawsuits filed by three states and the District of Columbia attorneys general led to a county court in Washington state pausing Albertsons planned $4 billion dividend payment as part of acquisition terms to its shareholders.

Recent Performance & Valuation

Kroger stock is only down -4% in the last year to largely outperform Albertsons -30% and the S&P 500’s -21% drop. However, when including dividends, Albertsons total return over the last two years is +66% to beat Kroger’s +44% and the benchmark.

Image Source: Zacks Investment Research

Trading around $20 a share and 70% below the acquisition price, Albertsons forward P/E of 7.2X is much lower than its industry average of 15.2X. In comparison, Kroger trades at $44 per share and 10.7X forward earnings which is just below its Retail Supermarkets industry average of 11.7X.

Image Source: Zacks Investment Research

From a valuation standpoint, Albertsons shares certainly look attractive, trading 51% below its two-year high of 14.9X and at a 29% discount to the median of 10.1X. In contrast, Kroger stock trades 34% beneath its two-year long high of 16.4X and at a 15% discount to the median of 12.6X.

Growth & Outlook

As it stands without the merger, Albertsons earnings are now expected to dip -1% in fiscal 2023 and be virtually flat in FY24 at $3.01 per share. Earnings estimates are slightly up for both FY23 and FY24 over the last 90 days.

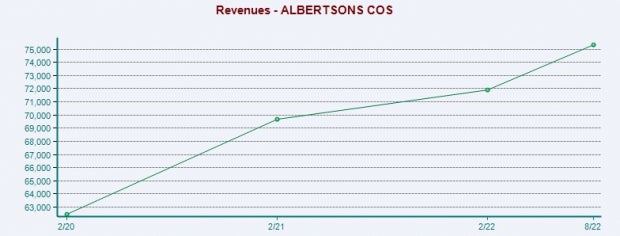

Image Source: Zacks Investment Research

Sales are projected to be up 6% in FY23 and rise another 2% in FY24 to $78.01 billion. Fiscal 2024 would represent 29% growth from pre-pandemic levels with 2019 sales at $60.53 billion.

Turning to Kroger, earnings are forecasted to jump 12% in fiscal 2023 and rise another 1% in FY24 to $4.19 per share. Earnings estimates have gone up for FY23 over the last 60 days and remained unchanged for FY24 over the last quarter.

Image Source: Zacks Investment Research

On the top line, sales are projected to be up 7% in FY23 and rise another 3% in FY24 at $152.49 billion. Fiscal 2024 would be a 26% increase from pre-pandemic levels with 2019 sales at $121.16 billion.

Bottom Line

Both Albertsons (ACI) and Kroger (KR) stock land a Zacks Rank #3 (Hold) and they trade attractively relative to their past with solid top line growth expected. While operating and supply costs may be challenging in the current market environment, the top line growth shows Albertsons and Kroger should have the ability to sustain their bottom lines.

In the event the companies are allowed to merge, holding on to shares could also pay off for long-term investors. This could especially be the case for ACI shareholders with the stock still trading well below the acquisition price of $34.10 per share. With that being said the completion of the merger still wouldn’t be expected until 2024, which makes it important to monitor Albertsons and Kroger’s growth and valuation separately.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

The Kroger Co. (KR) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.