[ad_1]

Flight cancellations during the Christmas holiday due to rough winter weather throughout the United States and parts of Europe was a short-term setback for airline stocks but overall travel demand is expected to rise in 2023.

With many airline stocks still trading near their pre-pandemic lows, now may be a good opportunity to buy these equities as they continue their post-pandemic recovery.

Here are two airline stocks investors may want to consider buying for 2023 and beyond.

United Airlines UAL

United Airlines stock currently sports a Zacks Rank #1 (Strong Buy) with earnings estimate revisions on the rise. United is now the largest domestic airline carrier in terms of the number of destinations served.

As the holding company for United Airlines and Continental Airlines domestic revenues (U.S. and Canada) accounted for 68.4% of total revenues in 2021. Atlantic, Pacific, and Latin American regions accounted for 13.9%, 6.12%, and 11.6% respectively in 2021.

Earnings are now expected at $2.18 per share in 2022, climbing from an adjusted loss of -$13.94 a share in 2021. Fiscal 2023 earnings are forecasted to climb 197% to $6.48 per share. Even better, earnings estimates are largely up for both FY22 and FY23 over the last 90 days.

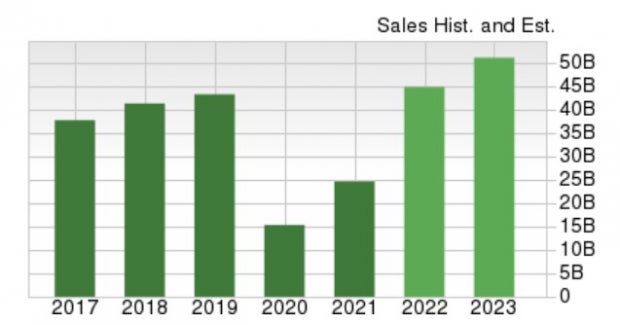

Image Source: Zacks Investment Research

Sales are expected to jump 82% this year and rise another 14% in FY23 to $51.09 billion. More importantly, FY23 would represent 18% growth from pre-pandemic levels with 2019 sales at $43.25 billion.

Image Source: Zacks Investment Research

The top-line recovery certainly justifies buying United stock for 2023 and beyond. Despite UAL being down -13% year to date, it has outperformed the S&P 500’s -22% and the Transportation-Airline Markets -24%. Over the last decade, UAL stock is up +47% to underperform the benchmark but outperformed its Zacks Subindustry’s +10%.

Image Source: Zacks Investment Research

We can also see from the decade chart that United stock was outperforming the benchmark before the Covid-19 pandemic. Trading 38% off its 52-week highs at $37 a share, UAL has a forward P/E of 17.1X. This is slightly above the industry average of 14.1X but well below its decade-high of 747.2X and closer to the median of 8.8X. With rising earnings estimates also supporting United’s valuation, the average Zacks Price Target suggests 40% upside from current levels.

Delta Air Lines DAL

Another airline stock investors may want to consider going into the new year is Delta Air Lines. Controlling roughly 17% of the domestic travel market Delta is also the second-largest global airline in terms of passengers carried and has the highest revenue of any airline in the world.

Delta stock currently lands a Zacks Rank #2 (Buy) with earnings estimates trending higher for fiscal 2022. Earnings are now projected to be $3 a share this year, up from a loss of -$4.08 per share in 2021. Fiscal 2023 earnings are expected to climb 67% to $5.01 a share but earnings estimates have trended down over the last quarter.

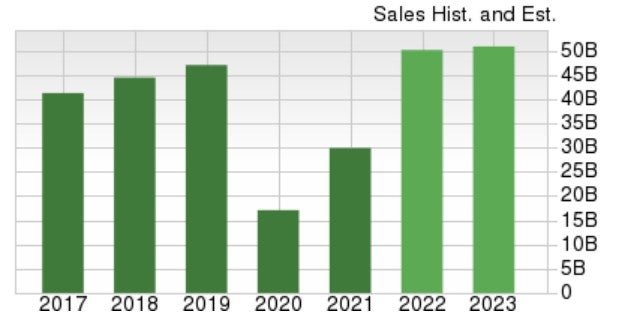

Sales are forecasted to climb 59% in FY22 and jump another 16% in FY23 to $55.29 billion. Plus, FY23 would represent 17% growth from pre-pandemic levels with 2019 sales at $47 billion.

Image Source: Zacks Investment Research

Delta stock is down -17% year to date to slightly top the S&P 500 and its Zacks Subindustry. Over the last decade, DAL’s +150% performance has crushed the Transportation-Airline Markets +10% and is competitive with the benchmark.

Image Source: Zacks Investment Research

Trading roughly 30% from its highs, this year’s decline could be a nice buying opportunity looking at Delta’s historical performance. Delta currently trades at $32 a share and at just 10.6X forward earnings which is below the industry average of 14.1X. Even better, DAL shares trade well below their decade-long high of 30.6X and near the median of 9.2X. The average Zacks Price Target offers 56% upside from current levels.

Bottom Line

United and Delta may once again become the cream-of-the-crop stocks to invest in the airline industry. Despite recent weather challenges, travel demand is expected to be robust in 2023 as traveling and vacationing continue to normalize post-pandemic. The Transportation-Airline Industry is currently in the top 15% of over 250 Zacks Industries and United and Delta looked poised to benefit.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.