[ad_1]

Tracxn Technologies IPO Review: Tracxn Technologies Limited Ltd is coming up with its Initial Public Offering. The IPO will open for subscription on October 10th, 2022, and close on October 12th, 2022. It is looking to raise Rs. 309.38 Crores. In this article, we will look at the Tracxn Technologies IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Tracxn Technologies IPO Review – About The Company

Tracxn Technologies Ltd is the leading global market intelligence provider for private companies. The company allows its customers to source and track companies across sectors and geographies to address their requirements through its extensive worldwide database and customized solutions and features

The company was founded in 2013 and today it is among the top five players globally in terms of the number of companies profiled offering data on private market companies across sectors and geographies.

The company runs on an asset-light business model and operates a Software as a Service (“SaaS”)- a based platform called Tracxn.

As of May 31, 2021, this platform has scanned over 662 million web domains and profiled over 1.84 million entities across 2,003 feeds which are categorized across sectors, sub-sectors, industries, geographies, affiliations, and networks globally

As of June 30, 2022, the company has acquired 3,271 users across 1,139 Customer Accounts in over 58 countries. The customer base includes several Fortune 500 companies and their affiliates.

Services provided by the company:

Through its Tracxn platform, the business makes private corporate data available to its clients for a variety of purposes, including deal sourcing, target identification for M&A transactions, deal diligence, analysis, and tracking new market and industry trends.

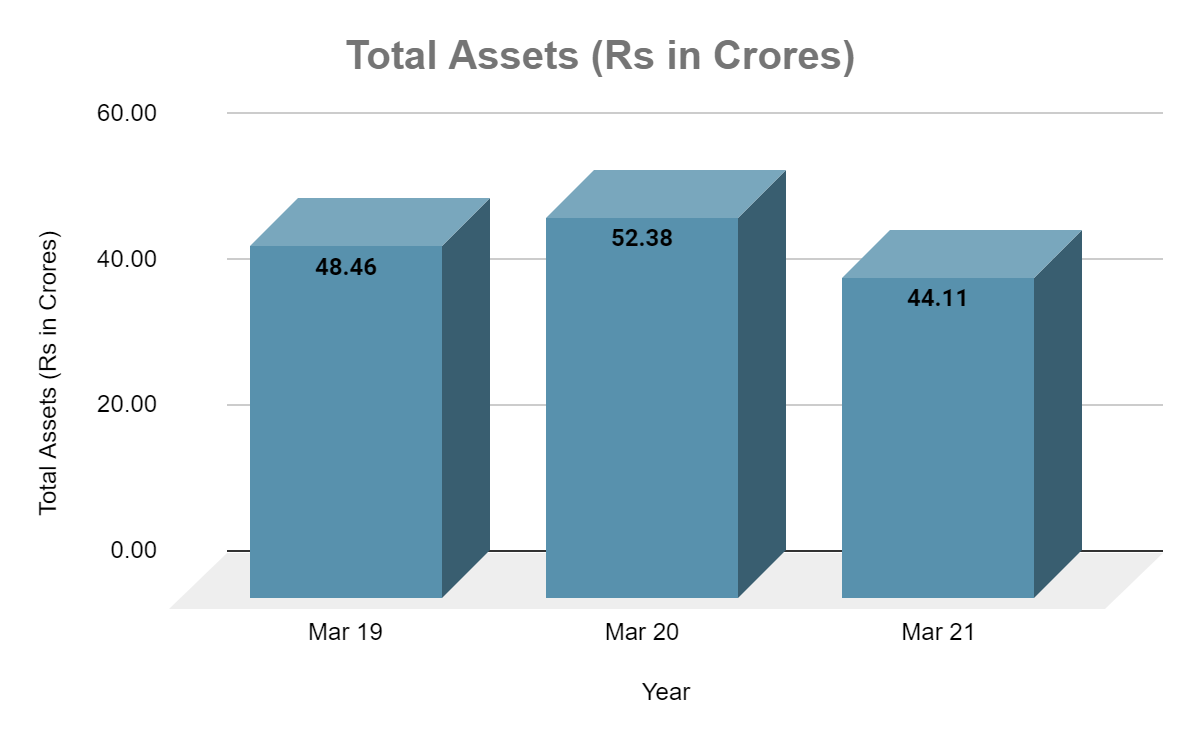

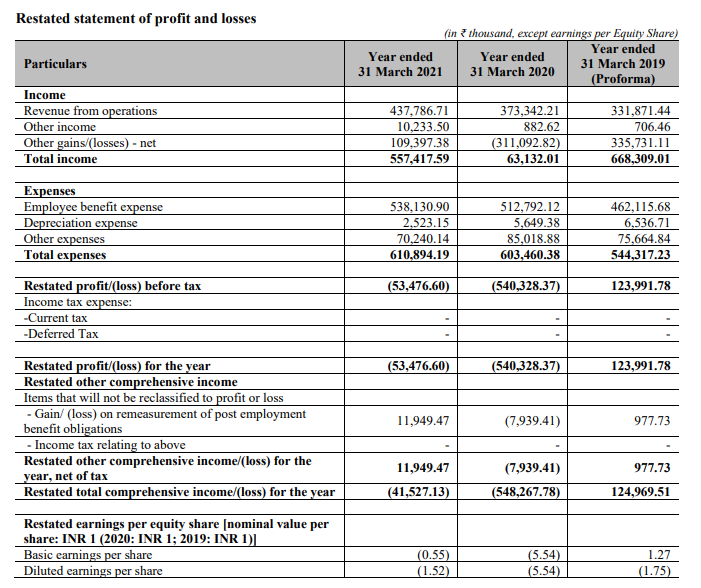

Tracxn Technologies IPO Review – Financial Highlights

(Source: DRHP of the company)

Tracxn Technologies IPO Review – Industry Overview

According to forecasts from Frost & Sullivan, the worldwide B2B information services industry, which was close to USD 140 billion in 2020 is expected to increase to USD 190 billion in 2025 at a compound annual growth rate of about 6.16%.

The total market size for private market data services is expected to increase at a rate of 6.79%. The number of PE, VC, and other investment firms, large corporations, and other entities that will be willing to invest in private enterprises is expected to increase and have a major impact on the market’s growth.

Strengths of the Company

- leading global provider of distinctive private market data and intelligence

- Longstanding, diverse, and growing global customer base

- The company has a cutting-edge platform that has been developed with continuous research

- The company has a cost advantage as most of the company’s workforce is based in India

Weaknesses of the Company

- The company is relatively new to the industry

- The company has lesser play in areas like North America

Tracxn Technologies IPO Review –Key IPO Information

| Particulars | Details |

| IPO Size | ₹309.38 Cr |

| Fresh Issue | – |

| Offer for Sale (OFS) | ₹309.38 Cr |

| Opening date | Oct 10, 2022 |

| Closing date | Oct 12, 2022 |

| Face Value | ₹ 1 per share |

| Price Band | ₹75 to ₹80 per share |

| Lot Size | 185 Shares |

| Minimum Lot Size | 1(185) |

| Maximum Lot Size | 13(2405) |

| Listing Date | Oct 20, 2022 |

Promoters: Neha Singh and Abhishek Goyal

Book Running Lead Manager: IIFL Securities Limited

Registrar to the Offer: Link Intime India Private Limited

The Objective of the Issue

The net proceeds from this issue will be utilized for the following purposes:

- To receive the benefits of listing the equity shares on the stock exchanges

- To provide liquidity to the existing shareholders of the company and enhance the company’s brand name

- To provide a public market for the company’s equity shares in India

In Closing

In this article, we looked at the details of Tracxn Technologies Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favourite stocks.

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.