[ad_1]

Companies that grow dividends tend to have better financial health and produce sustained earnings and revenue growth. Dividends help identify well-managed companies; every dividend declaration represents a promise by management and a vote of confidence by the board of directors in the company’s leadership. Companies that consistently raise their dividend payouts also raise the bar on their own performance expectations. These dividend increases show the longstanding commitment of returning capital to shareholders for these companies. These increases also provide evidence that companies are executing on their long-term business strategies.

Shares of dividend-paying companies possess built-in value that makes them generally more resilient in down markets, with solid appreciation potential during earnings-driven market upturns — with less price volatility.

I follow the list of dividend increases weekly as part of my dividend investing strategy. I try to approach investing from different points of view, in order to ensure that I can see emerging dividend success stories and monitor existing holdings.

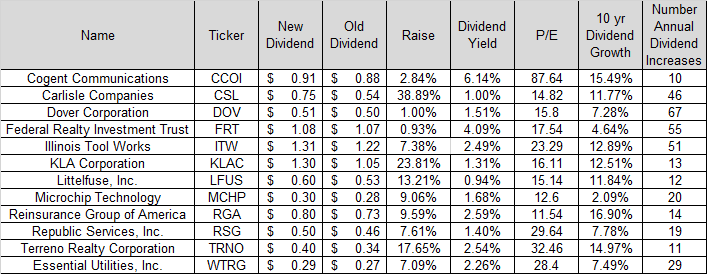

Over the past week, there were several companies that raised their dividends to shareholders. I am listing below the ones which have managed to grow dividends over the past week and also have at least a ten year track record of annual dividend increases. The companies include:

This should be followed by reviewing the trends in dividend payout ratios, in order to check the health of dividend payments. A rising payout ratio over time shows that future dividend growth may be in jeopardy. There is a natural limit to dividends increasing if earnings are stagnant or if dividends grow faster than earnings.

Obtaining an understanding behind the company’s business is helpful, in order to determine how defensible the dividend will be during the next recession. Certain companies are more immune to any downside, while others follow very closely the rise and fall in the economic cycle.

Of course, valuation is important, but it is more art than science. P/E ratios are not created equal. A stock with a P/E of 10 may turn out to be more expensive than a stock with a P/E of 30, if the latter is growing earnings and the former isn’t. Plus, the low P/E stock may be in a cyclical industry whose earnings will decline during the next recession, increasing the odds of a dividend cut. The high P/E company may be in an industry where earnings are somewhat recession resistant, which means that the likelihood of dividend cuts during the next recession is lower.

Relevant Articles:

[ad_2]

Image and article originally from www.dividendgrowthinvestor.com. Read the original article here.