[ad_1]

US Dollar, DXY, Market Sentiment, CPI, China, Technical Outlook – Talking Points

- Asia-Pacific markets set for higher open as traders look to extend gains on USD weakness

- China’s Covid lockdowns pose a threat to recovering market sentiment if restrictions grow

- The DXY Index accelerated lower on Friday, and prices may fall more if a key SMA gives way

Recommended by Thomas Westwater

Introduction to Forex News Trading

Monday’s Asia-Pacific Outlook

Asia-Pacific markets are set to open higher as traders look to extend gains from last week when a softer US Dollar encouraged traders to buy stocks and other risk assets. The Greenback fell despite rate traders increasing their bets for a 75-basis point hike at the September FOMC meeting. The driving narrative sees the Fed slowing its pace of tightening after the next meeting, which should slow the exodus from Treasuries and help temper the rise in yields.

China, however, poses a risk to market sentiment. The country is enduring its broadest lockdown measures to date as policymakers attempt to stamp out virus flare-ups. A highly-transmissible strain and an under-vaccinated population, especially among the elderly, are hardly inspiring confidence in a quick resolution. Moreover, the upcoming National Congress in October, when President Xi is expected to secure a precedent-setting third term in office, makes a government policy shift all the more unlikely.

Recommended by Thomas Westwater

The Fundamentals of Breakout Trading

China’s consumer price index missed estimates last week, thanks in large part to falling pork prices. That could give the People’s Bank of China (PBOC) more policy space, but a Yuan near the 7 level poses its own challenges for the central bank. Last week, China cut the number of reserves that most banks must hold by 2%, but the impact was negligible.

The Japanese Yen is closer to a potential market intervention after the Bank of Japan Governor Haruhiko Kuroda and Prime Minister Fumio Kishida met to discuss the currency’s extraordinary weakness. The island nation’s ultra-loose monetary policy, extended debt levels, and high energy costs are weighing on the Yen. The US remains opposed to a Japanese intervention in the foreign exchange market. Nonetheless, the Yen caught a bid as traders speculated on the tail-risk chance. Still, if Japan decides to intervene in the currency, it could backfire and cause a flood of capital outflows even with its sizable reserves.

Starts in:

Live now:

Sep 13

( 02:09 GMT )

Recommended by Thomas Westwater

Weekly Commodities Trading Prep

US Dollar Technical Outlook

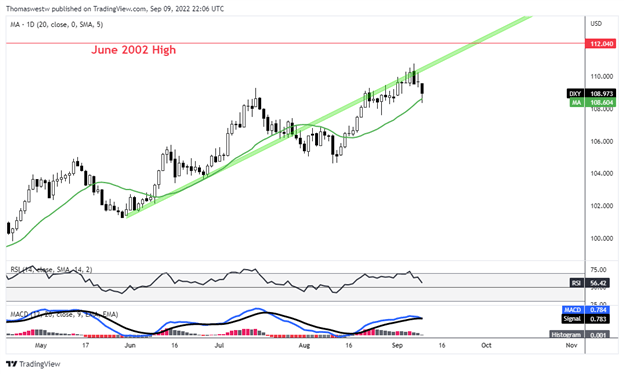

The US Dollar accelerate lower on Friday, breaking a three-week win streak. While prices hit a fresh 2022 high early in the week, bulls had trouble clearing a trendline from May. The Relative Strength Index (RSI) fell below the 70 overbought level and is tracking toward its midpoint, which may encourage more selling. Prices failed to hold below the 20-day Simple Moving Average on Friday, but a break lower would potentially threaten the August swing low.

DXY Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.